Peter Walker

@peterj_walker

Head of Insights @Cartainc | New data on startups out multiple times per week

ID: 1238615498754949120

https://carta.com/subscribe/data-newsletter-sign-up/ 13-03-2020 23:58:47

6,6K Tweet

12,12K Followers

430 Following

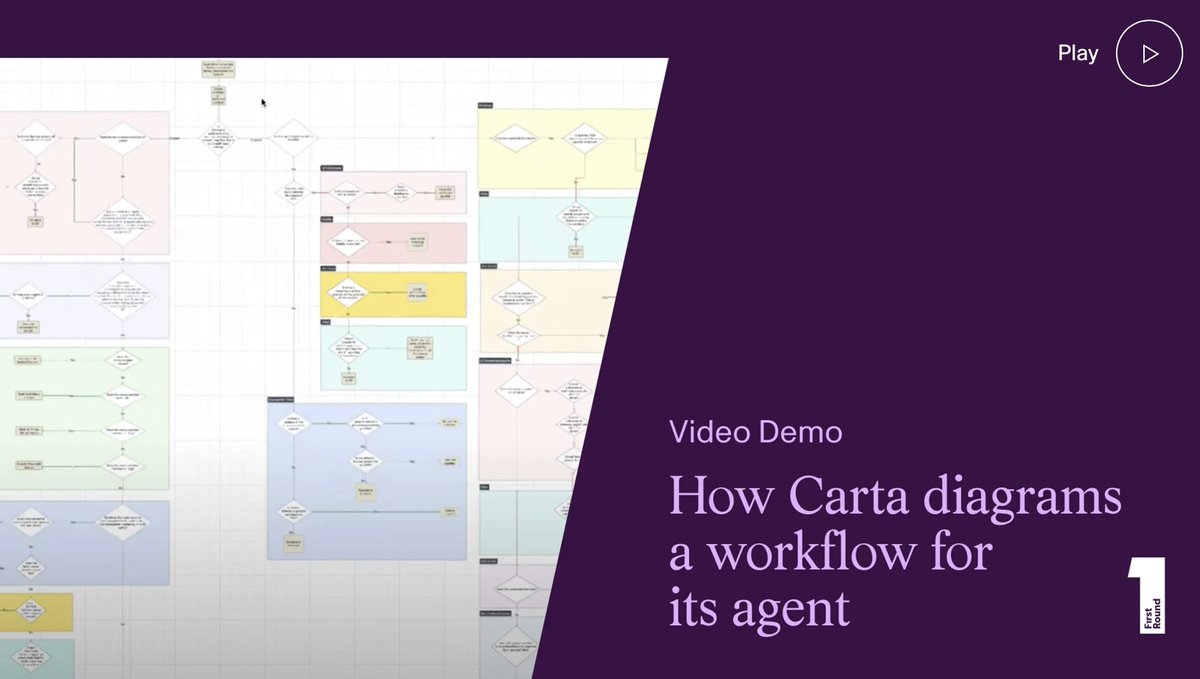

Carta saved 3,500+ hours a month with internally built AI agents. Not by automating busywork, but by scaling complex judgment. Our second essay on First Round Applied Intelligence explores exactly how they did this, in a crazy amount of detail.

I sat down with Peter Walker, Head of Insights at Carta, and the best data storyteller on the internet. This episode is filled with data-backed insights for startups. Here's what we covered: 1/ Why it's harder than ever to raise at Seed 2/ How much ARR you need for Series A