Pictet Asset Management

@pictetam

Privately-owned, multi-boutique asset manager. Here, our investment experts draw attention to developments crucial to strategic and tactical asset allocation.

ID: 3663199035

https://www.am.pictet 15-09-2015 11:11:18

2,2K Tweet

14,14K Followers

259 Following

According to Arun Sai and Mickael Benhaim, Pictet Asset Management, the simultaneous decline of US government bonds and the US #dollar earlier in April was a sell-off that ranked as the fourth most violent of the past 40 years and a warning sign for investors.

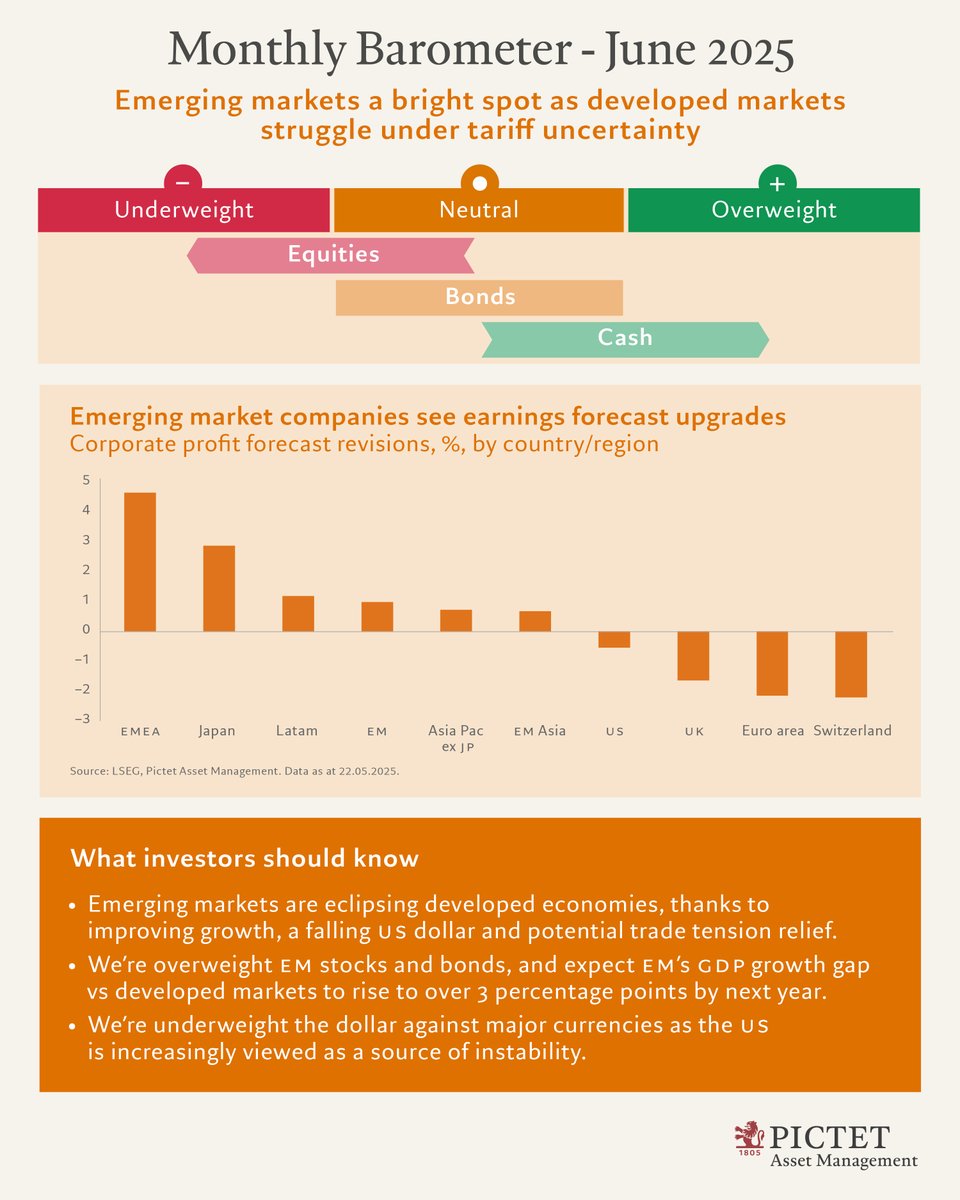

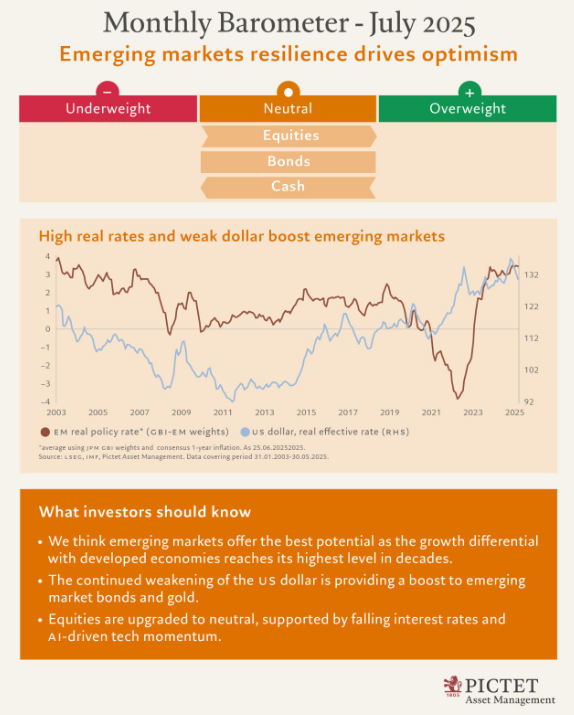

In the news this week: Emerging markets’ unexpected outperformance. Shaniel Ramjee, co-head of multi-asset strategies, Pictet Asset Management, explains why policy-induced uncertainty and fears of a US slowdown are fuelling the ‘sell America’ #trade and opening opportunities across EM’s.

In the news this week: Clean energy will be critical to scaling AI-related applications. Katie Self, Senior Investment Manager, Pictet Asset Management, looks at the interplay between AI innovations, energy supply and how climate fluctuations are causing strain on the grid.

“Liberation Day has already taken a toll on global financial assets and overall, we believe this uncertain environment warrants caution – the risks that concern us haven’t been adequately reflected in asset prices.” notes Luca Paolini, in the latest Barometer from Pictet Asset Management.

From PictetAM chief economist Patrick Zweifel

With macroeconomic and structural trends turning positive for emerging market local currency bonds, Alper Gocer, Head of Emerging Markets Fixed Income and Adriana Cristea, Senior Investment Manager, Pictet Asset Management, explain why it’s time for investors to look at the asset class again.

“The growing influence of BRICS+ will bolster emerging economies' global impact, attracting inward foreign investment and fuelling economic growth, opening up attractive investment opportunities in listed EM equities.” Anna Mulholland, Pictet Asset Management

“Credit is a well-rewarded opportunity. Misconceptions about defaults make investors wary credit, but bondholders are very well compensated for taking on that risk”, according to Ermira Marika, Head of Developed Markets Credit, Pictet Asset Management

From PictetAM senior investment manger, multi asset, Steve Donzé

In the news this week: European small and mid-caps outshine US peers. Arun Sai, senior multi-asset strategist at Pictet Asset Management, explains the drivers behind EU mid-caps outperformance vs. US peers and why they stand to benefit from a pickup in domestic growth. #InTheNews #EUEquities