Opening Bell Daily🔔

@readopeningbell

Data-driven financial news and independent analysis trusted by 190,000 investors. Get smarter about markets in 5 minutes a day👇

ID: 1769837905831247872

https://www.openingbelldailynews.com/subscribe 18-03-2024 21:27:07

1,1K Tweet

5,5K Followers

15 Following

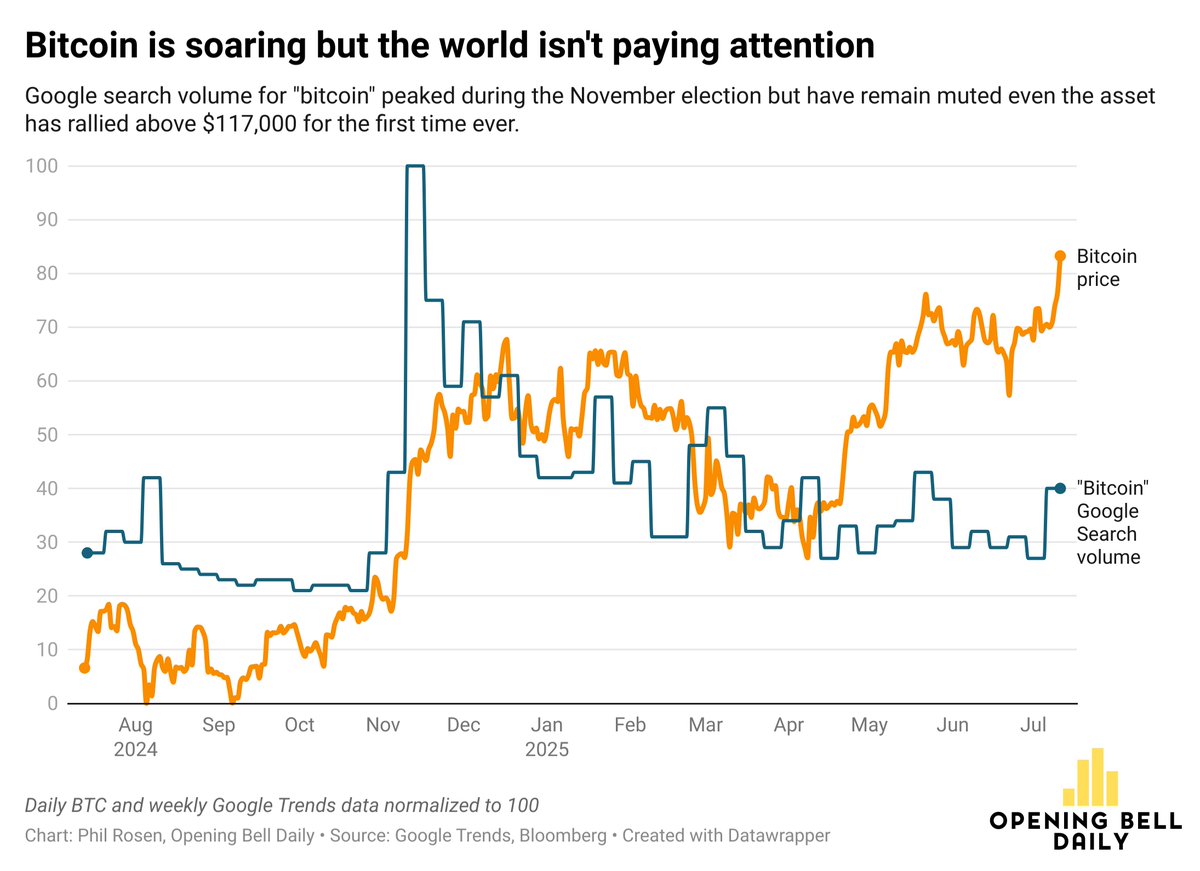

Bitcoin has crushed stocks, gold and bonds with a 29% annual return since 2018. Bitcoin's also averaged a 51% drawdown per year. Investors who held through the volatility have been rewarded. (h/t Matt Cerminaro Opening Bell Daily🔔)

President Trump's tariffs have injected more uncertainty into markets than the 2008 financial crisis, dot-com bubble, 9/11, and the fall of the Soviet Union. (h/t Capital Group)

Jerome Powell won't cut interest rates because he expects tariffs to drive inflation higher. But his track record the last 5 years is riddled with missed inflation calls and policy errors. (Chart: Opening Bell Daily🔔)

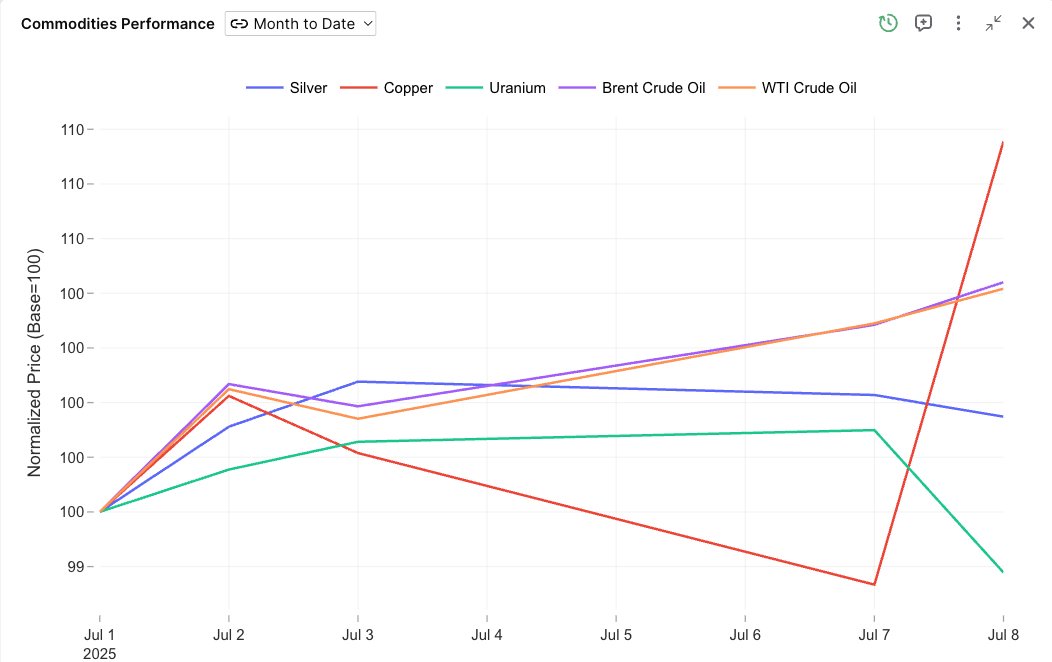

New newsletter: A key economic indicator is flashing for all the wrong reasons. Copper hit a record high after Trump announced 50% tariffs on the metal. It was the biggest 1-day gain ever, but the price distortion was specific to US markets, Mike McGlone tells me. That surge

We think its safe to say Boeing ( $BA ) has exceeded price target expectations much sooner than expected. Excerpt from the April 20th interview with Opening Bell Daily🔔 Access our free newsletter for more at LongVolReport.com

Investors are either so bullish they're ignoring tariff risks, or they don't think risks are serious enough to stop buying stocks. Equities and bitcoin are crushing records while volatility is collapsing, trade war be damned. Bulls like Ryan Detrick, CMT Sonu Varghese keep being

Thanks Phil Rosen Opening Bell Daily🔔 for including our Carson Investment Research Midyear Market Outlook!

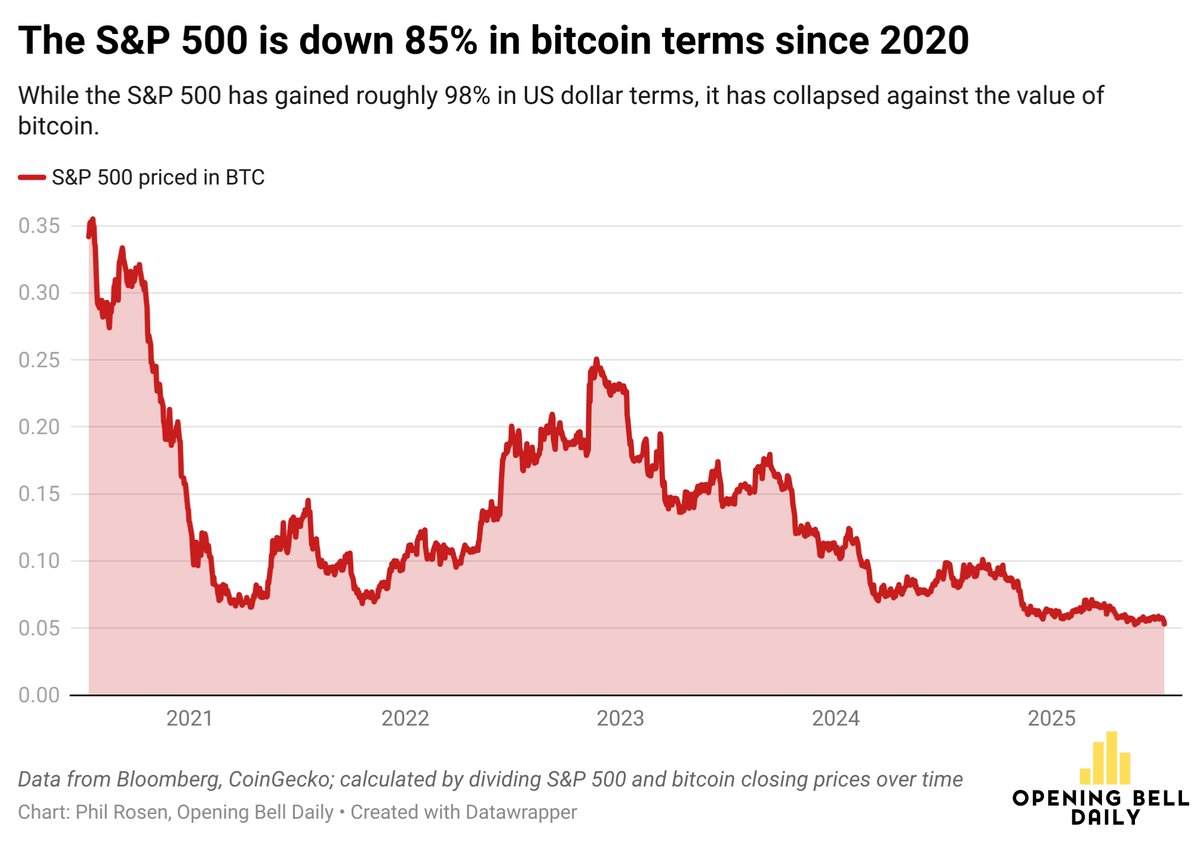

One of the wildest charts I've seen. The S&P 500 in $BTC terms is down 85% in 5 years. (h/t Opening Bell Daily🔔)

Bitcoin is above $121,000 and BlackRock's $IBIT is leading the way. It's the fastest ETF ever to $80 billion AUM in just 374 days — 5x faster than $VOO. Great chart from Eric Balchunas. $BTC

The S&P 500 is down 85% in bitcoin terms since 2020. The bitcoin rate of return for an investment is all that matters moving forward. H/t Phil Rosen