Samantha Attridge

@samattridge1

Development finance professional

ID: 1119156821774614528

https://www.odi.org/experts/1709-samantha-attridge 19-04-2019 08:32:34

71 Tweet

127 Followers

25 Following

What are the potential benefits of greater harmonisation of impact measurment among DFIs? Read C. Cali, N. Fenton European Investment Bank and M. Ripley, The Good Economy's essay 'Learning together: the case for a collaborative approach to conducting impact studies' cdn.odi.org/media/document…

Development finance institutions and the #careeconomy: opportunities for greater involvement Read Jessica Espinoza and @AnneMarieLevesq 's essay analysing the potential transformative effects of private sector investments in the care economy. Read more: cdn.odi.org/media/document…

Published today, a set of essays from experts at ODI Global | odi-global.bsky.social on how G7 summit could be made a success odi.org/en/topics/g7-s… with Alina Rocha Menocal Tom Hart Annalisa Prizzon Max Mendez Parra Sarah Colenbrander Sara Pantuliano - @sara-pantuliano.bsky.social Tim Kelsall

Read Juho Uusihakala, Gaia Consulting and others' essay on climate adaptation. You'll learn more about Finnfund's approach to capture both dimensions of #climateadaptation in its investment process. cdn.odi.org/media/document… #EDFInetwork #impactinvesting

With MPs today voting on the government's #UKAid cuts, Mark Miller debunks three myths: the cuts aren't temporary, they won't put public finances on a more sustainable footing & they aren't a fiscal necessity 👇 buff.ly/3kexpYG

bit.ly/3Bus59u Blog on some potentially damaging decisions by HM Treasury. If the cuts are really about fiscal worries, then neither SDRs, nor expected debt relief for Sudan, will be counted under 0.5, as they have *no* impact on our fiscal situation.

So wrong. Fully against counting any UK SDR reallocation against 0.5% ODA target. euan ritchie -am no expert on SDRs but does UK have to pay a small interest charge on SDR balances below its cumulative allocation and if so is this a cost? bit.ly/3f4buQm

New new CDC Group México strategy unveiled this AM. Some quick observations to come: looks like financial return expectation increased,perhaps in part to fund higher risk investment but with the expanded new geography what will this mean for riskier investment in Africa – a USP of CDC?

New This is not the CDC group strategy. Welcome focus on leveraging the city to mobilise commercial investors to cement the UK as a development finance hub. Will require quite a different approach to that in old strategy – look forward to learning more about the plan of attack!

Amid talk that Germany may look to merge its development ministry into the Federal Foreign Office, the government should heed caution from the experiences of the UK, Canada & Australia. Read Nilima Gulrajani's new ODI Global | odi-global.bsky.social blog 👇🏾 buff.ly/310CEDt

DFIs must be more strategic in their investment to increase transformational impact. New ODI Global | odi-global.bsky.social Stockholm Environment Institute (SEI) examines how DFIs align and support country plans. Room for improvement. Great to work with George Marbuah, Alberto F Lemma, Jodie Keane Dirk Willem te Velde bit.ly/3tqHTao

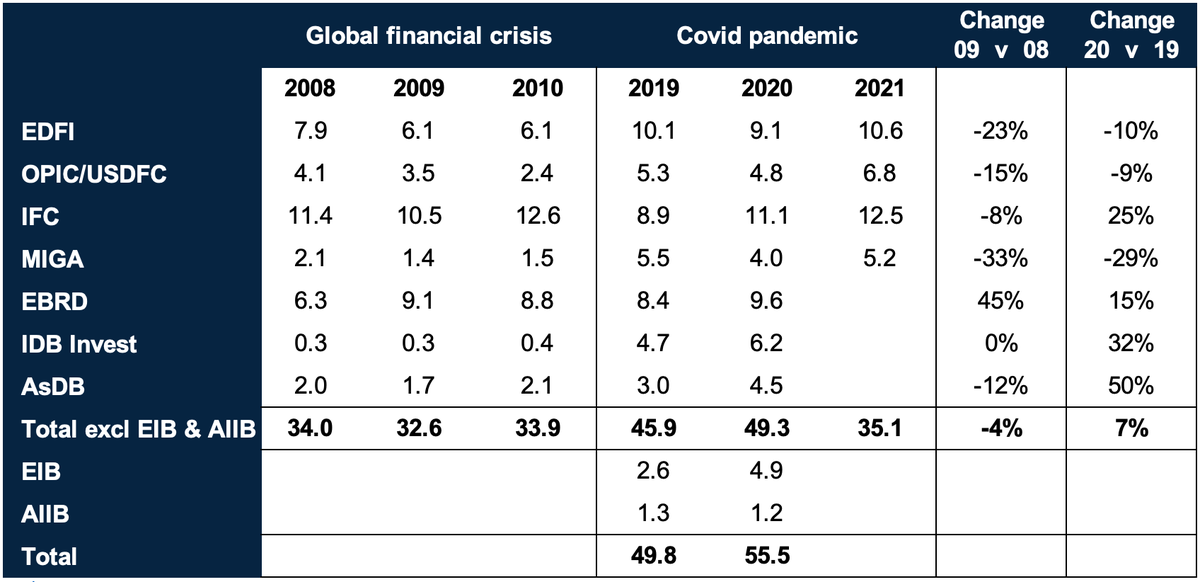

Counter-cyclical response sorely lacking by #DFIs and #MDBs in 2008. Was it different in 2020 in response to Covid? Yes, it was. My 4 obs in new ODI Global | odi-global.bsky.social blog. bit.ly/3MjjR8L