Samuel Hartzmark

@samhartzmark

Professor of Finance at Boston College Carroll School of Management. samhartzmark.com

ID: 871527205200855040

http://samhartzmark.com 05-06-2017 00:40:52

125 Tweet

1,1K Followers

175 Following

My amazing co-author David Solomon (the finance professor, not the DJ) has finally joined twitter! Give him a follow for finance knowledge and a dose of Western Aussie wit. Here he is on his paper on the unintended impact of Starbuck's bathroom policy:

Thanks to Samuel Hartzmark for kicking off this year’s Experimental Finance Conference with a great keynote! Happy to meet so many friends and colleagues again after a long time! Thanks to ECONtribute for making this possible!

We are ready to kick-off #RBFC2022 tomorrow with keynote speeches by Samuel Hartzmark Michaela Pagel and Stephan Siegel. Together with over 100 other presentations, the program looks great. RBFC.eu Looking forward to meeting everyone in Amsterdam!

Behavioral finance conference in Amsterdam. Experimental setup can help us better understanding asset prices in keynote by Samuel Hartzmark

April 27-29, 2023: UK Gatton College of Business and Economics Finance Conf! Our fab prg comm includes Michael Ewens Tony Cookson Song Ma Michaela Pagel Ed Van Wesep Zhi Da Samuel Hartzmark Jordan Nickerson Matthew Ringgenberg Yufeng Wu Nick Gantchev ⑆Luke Stein⑈ Submission deadline: Nov 18 uky.edu/financeconfere…

Does trading move the entire stock market? Yes—returns are four times higher on high dividend payment days (known weeks prior). This suggests price pressure is widespread, not an anomaly, from Samuel Hartzmark and David Solomon nber.org/papers/w30688

This one by Samuel Hartzmark and David Solomon blows up a lot of standard fundamental assumptions about financial markets too. Money flows affect stock prices independently of news. nber.org/papers/w30688

Thanks Matt Levine for the amazing write up of my new paper with Kelly Shue (Yale School of Management). Really appreciate it! papers.ssrn.com/sol3/papers.cf…

Counterproductive #SustainableInvesting: What is the impact of directing capital toward green firms & away from brown firms? Find Out More: spkl.io/60194dzG5 Subscribe for Free: spkl.io/60104dzGg S&P Global Samuel Hartzmark Chicago Booth Yale School of Management #ESG #Sustainability

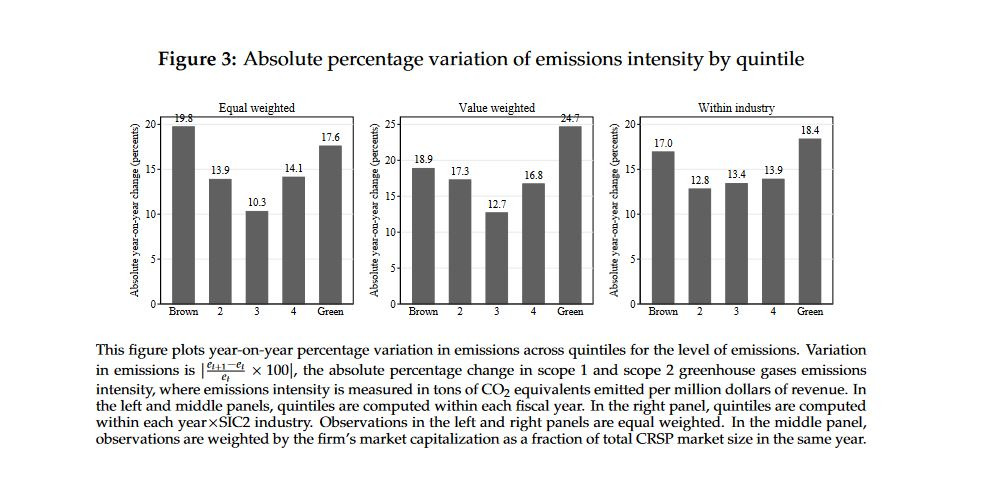

SRI is ineffective because it focuses on %, not absolute changes in emissions. Allure of Net Zero means we'd rather reduce a green firm's emissions from 1 to 0 (a 100% fall) than a brown firm's from 100 to 90 (a 10% fall). By Samuel Hartzmark and Kelly Shue. papers.ssrn.com/sol3/papers.cf…

Episode 273: Professor Samuel Hartzmark: Asset Pricing, Behavioural Finance, and Sustainability Ranking rationalreminder.ca/podcast/273

Explore the intersection of asset pricing and behavioral finance with CSOM finance professor @Samhartzmark in this recent episode of the Rational Reminder Podcast podcast. loom.ly/wODQbNM

According to the paper "The Dividend Month Premium," by Samuel Hartzmark, investors are chasing yield and inflating prices in the process. In a surprising turn of events, it turns out that dividend investors are the yield!

Professor Samuel Hartzmark has the most interesting research out there when it comes to investor behavior. Strongly recommended you check out his research website: sites.google.com/site/samhartzm…