Fabrizio Santoro

@santoro_fab

Resarch Fellow @ICTDTax, Research Lead @Digitax, based at @IDS_UK. Into public finance for development. Space Africa.

ID: 1436611720349429763

11-09-2021 08:45:13

65 Tweet

181 Followers

452 Following

"Les promesses et les limites des technologies de l’information dans la mobilisation fiscale" Lisez notre résumé de recherche par Fabrizio Santoro & Oyebola Okunogbe 👇 ictd.ac/fr/publication… CREDAF

Giulia Mascagni I'll wrap it up here - the full brief, written by a large part of the ICTD research team including Giulia Mascagni Vanessa van den Boogaard Mick Moore, Gio Occhiali, Wilson Prichard Fabrizio Santoro Celeste Scarpini is available here: 👇 ictd.ac/publication/wh…

#Mpesa processes some 70% of #Kenya’s daily financial transactions amounting to 59% of the country’s GDP. With the government eyeing up #MoMo transactions for #tax revenue, will this block some from achieving financial inclusion? Read the paper 👇 Institute of Development Studies buff.ly/3DdbglI

🚨Last chance to apply for our Research on Tax & Development Course! Over 9 months, it provides sessions on current issues, training in research methods, & mentorship for participants to develop their own research project. 🗓️Deadline tomorrow! ictd.ac/news/research-… Institute of Development Studies

Our new research study on electronic billing machines and tax compliance in Rwanda is finally out! Thanks to RRA and everyone else who made it happen. ictd.ac/publication/te… International Centre for Tax and Development

This week our Executive Director Wilson Prichard & Research Fellow Fabrizio Santoro will be speaking at the @NTOConference in Cape Town! 🇿🇦 🧑💻See our recent research on the digitalisation of tax administration in Africa here 👉 ictd.ac/publication/?_… ATAF Institute of Development Studies Secretaría Ejecutiva

Vinicius de Freitas Secretaría Ejecutiva SII SATMX @NTOConference @TaxCompact There will be an open discussion after the presentations by a panel of Mr Fabrizio Santoro of International Centre for Tax and Development; Mr Osama Samer, the Deputy Director of Digital Initiatives, Federal Board of Revenue Pakistan and Ms Louise Kalisa, the Commissioner of IT and Digital Transformation at the Rwanda Revenue Authority (RRA)

🔎#TaxTheRich: Fabrizio Santoro & Ronald Waiswa evaluate the extent to which the unit launched by Uganda Revenue Authority to monitor the tax affairs of the richest was able to improve this category's compliance. 🔗Their findings: ow.ly/6cV450SJVJ7 #TaxTwitter #TaxTheirBillions #G20Brazil

"Does technology improve tax compliance?" Very proud to see this International Centre for Tax and Development paper out, and huge merit to the lead authors Jule Tinta and Mouhamed Zerbo. There is little tax research from #BurkinaFaso and I am grateful to the national tax administration for supporting the study.

Evidence suggests that digital public infrastructure can greatly simplify tax administration & boost compliance. However, some persistent challenges must first be addressed, including poor data access. Fabrizio Santoro & Lucia Rossel write for GlobalDev Blog➡️ ow.ly/FA1o50TOvmz

Under subtheme Task Force 05 on Inclusive digital transformation, Fabrizio Santoro, Tanele Magongo & Razan Amine 's T20 South Africa Policy Brief has just been posted! It tackles the adoption of digital tax services and electronic payments ➡️ow.ly/PVTt50TvK3b #G20Brasil #TaxTwitter

🚨 Join us next week in a webinar that will explore how digitalisation is reshaping tax administration in low income countries. 🗓️ 4 December 2024 (14:00-15:00 GMT) 📍 Online 👉 Register here: ow.ly/ZhAz50Ug3RI #TaxTwitter | World Bank | GRA | Gates Foundation

📝 In this earlier blog, Ludovic Bernad and Fabrizio Santoro reflect on key lessons for African countries with regard to the rapid evolution of #digitalfinance and its profound implcations on tax systems. Read it here 👉 ow.ly/nS6m50UgNiI #TaxTwitter | 📸WorldRemit/Flickr

🤔 Where is #digtal tax administration headed? Join our conference next week to find out! Co-hosted with Rwanda Revenue Authority (RRA), the event features unmissable sessions with high profile speakers & industry experts. 🗓️ 12-13 December 👉 Register online: ow.ly/7bGk50UkFJ3 #TaxTwitter

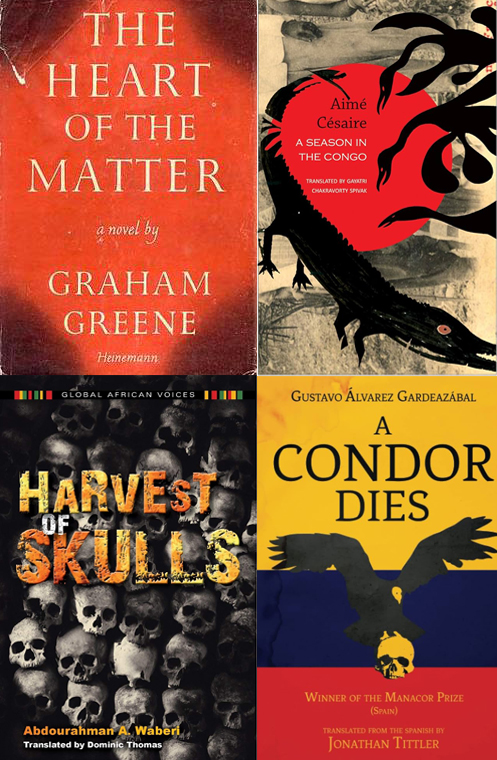

Bidding farewell to February with our monthly #BookRecommendations 📚Ready for a literary tour around the world? The books, selected by our Research Fellow Fabrizio Santoro, depict stories from Colombia, Congo, Rwanda, Sierra Leone ⬇️ #BookSpotlight #BookX #BookOfTheWeek

SESSION 1: presentation on 2 papers about Taxpayer Services; 1. The human factor in tax compliance: Taxpayers’ experiences of interaction with tax officials in Rwanda by Dr. Fabrizio Santoro, Research Fellow from International Centre for Tax and Development 2. Boosting Voluntary Tax Compliance and Revenue

Rodrigo Carril Giacomo Brusco Malka Guillot Wayne Sandholtz Julia Cage Eva Davoine Gianmarco Daniele Alessandra Moresi Barcelona School of Economics Théo Valentin and Fabrizio Santoro presents his research agenda "Digital Tax Infrastructure and Taxation" : Can digital IDs & payments boost tax capacity in Africa? Evidence points to promise—but gaps remain. DPI as a catalyst for development Barcelona School of Economics

![Journal of Development Studies (JDS) (@jdevstudies) on Twitter photo Our 6⃣th [June] issue of 2023 is up:

Featuring 8⃣ articles & 3⃣ book reviews!

* on COVID-19, taxes, gender, employment, food markets, nutrition, youth, roads & more

From 🇭🇰🇸🇬🇷🇼🇪🇨🇵🇪🇳🇬🇵🇬

Check it out 👉🏾 tandfonline.com/toc/fjds20/59/6 Our 6⃣th [June] issue of 2023 is up:

Featuring 8⃣ articles & 3⃣ book reviews!

* on COVID-19, taxes, gender, employment, food markets, nutrition, youth, roads & more

From 🇭🇰🇸🇬🇷🇼🇪🇨🇵🇪🇳🇬🇵🇬

Check it out 👉🏾 tandfonline.com/toc/fjds20/59/6](https://pbs.twimg.com/media/FxdeIHeakAADbia.png)

![Christos Kotsogiannis (@kotsogiannisc) on Twitter photo New paper on the role of #electronic #billing #machine (#EBMs) in enhancing compliance directly, through broadening the tax base, but also indirectly through making tax audits more efficient w/<a href="/LVSalvadori/">Luca Salvadori</a> <a href="/Karjon21/">John K</a> and Murasi [1/9] New paper on the role of #electronic #billing #machine (#EBMs) in enhancing compliance directly, through broadening the tax base, but also indirectly through making tax audits more efficient w/<a href="/LVSalvadori/">Luca Salvadori</a> <a href="/Karjon21/">John K</a> and Murasi [1/9]](https://pbs.twimg.com/media/F0p1RUxXgAARycF.png)