Colin Ferrian

@savingplants

student of the cannabis industry and PM @poseidoninvest

Disclaimer: bit.ly/3XWlzE2

ID: 117291929

http://poseidonassetmanagement.com 25-02-2010 04:00:00

1,1K Tweet

1,1K Followers

465 Following

Poseidon Investment Management co-founder Emily Paxhia on cannabis' journey to federal legalization:

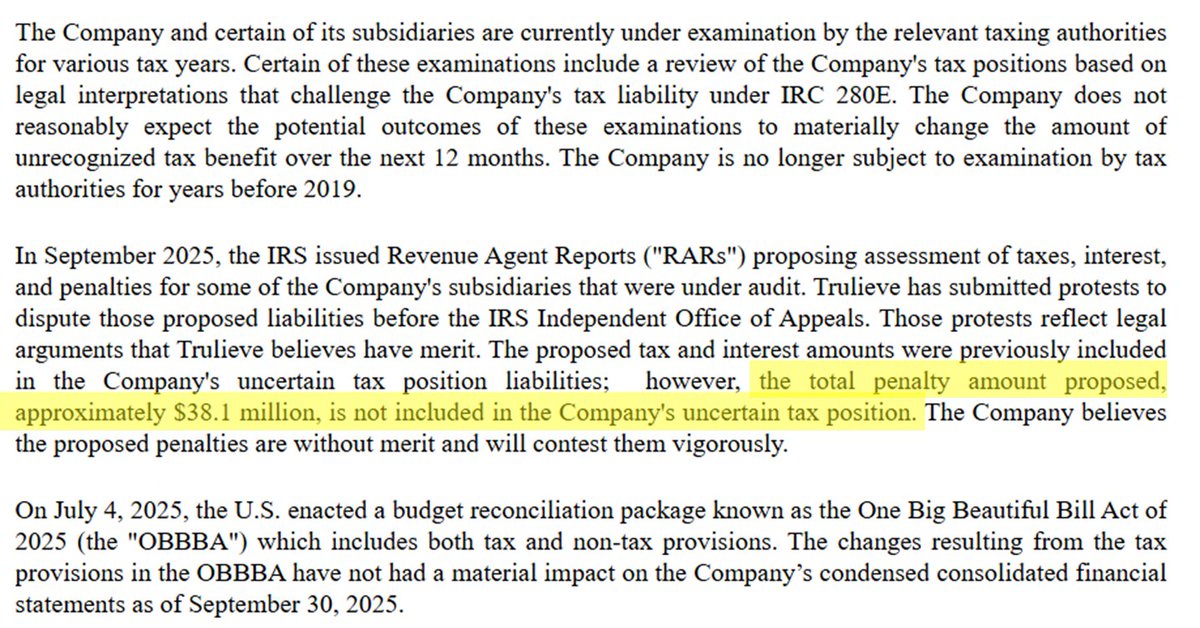

Looks like $TSNDF turned $8.4M of uncertain tax liability into an asset when the statute of limitations expired—suggesting an alternative to rescheduling for these debts, especially with the recent IRS workforce reduction. cc Keith Stauffer Jason Wild as I'm not a tax expert.

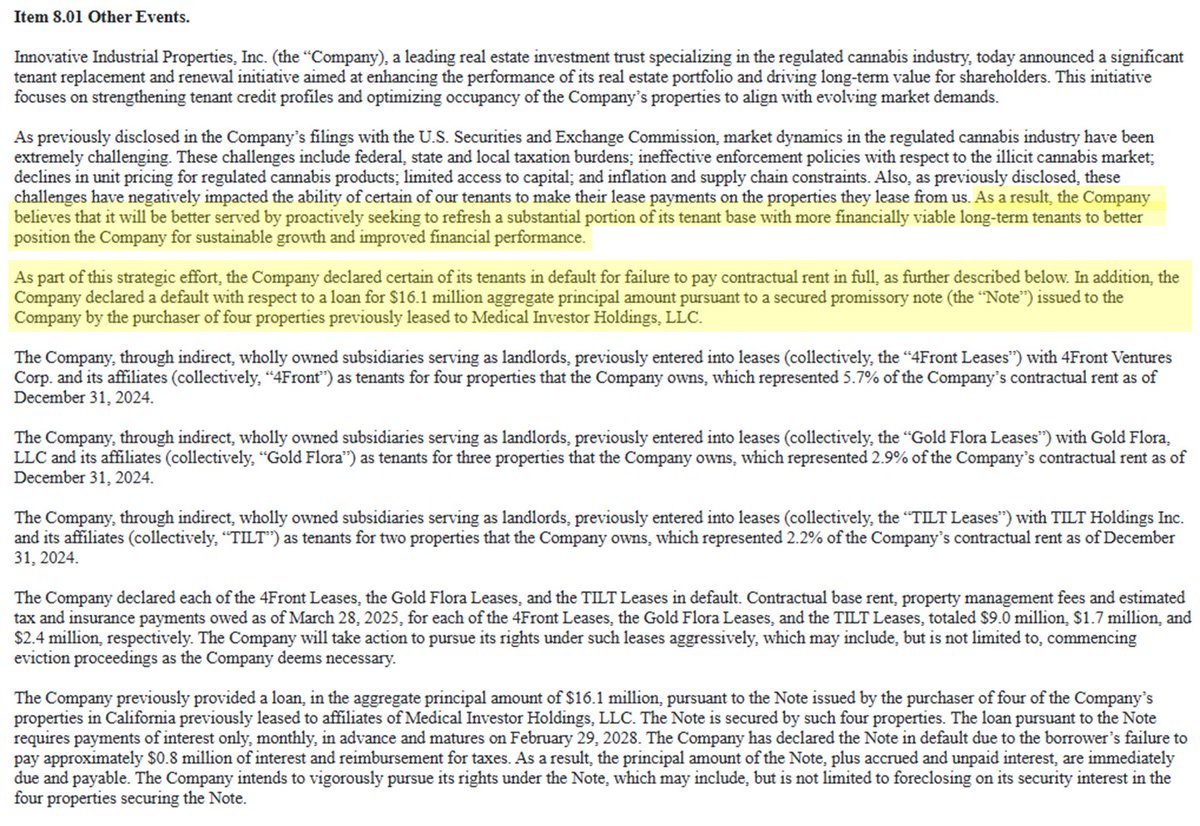

Great podcast with Colin (Colin Ferrian) from Poseidon. Especially good discussion of the risks of $IIPR (which he is short) vs. $REFI (which he and I are long) Not a big poster, but when he says something people, especially $MSOS investors, should listen.

Words chosen wisely by $iipr execs in justifying their acquisition of a private REIT founded by their chairman. Cc Dr. James V. Baker