Secha Capital

@sechacapital

Investing patient capital in Southern African "adolescent" businesses in the missing middle. Address the management gap with our Operator-Investor model.

ID: 740932266629730304

http://sechacapital.com 09-06-2016 15:43:13

495 Tweet

622 Followers

1,1K Following

Lessons from an EM in an EM (emerging fund manager in an emerging market): How (and why) to actually add value as a GP? bit.ly/EMinEM2OIandSA… Post two in a six-part series Secha Capital

We at Secha Capital are proud to announce that we have been selected to the ImpactAssets #IA50 2023! bit.ly/IA502023

This was a great panel discussion about the opportunities, paths, sizes and strategies for exits in Africa. A1: I am bullish on exits in Africa! Thank you to the impressive panellists and moderator! AfricArena Zachariah George Norrsken22 @launchafricavc Endeavor SouthAfrica Secha Capital

Very excited and proud to announce Secha Capital's investment in #FarmTrace, a South African agri-tech farm solution. FarmTrace becomes the backbone of farming operations, a vertical operating system which integrates all data and processes on the farm. bit.ly/FarmTracePress…

Secha Capital and Hassium Capital Invest in FarmTrace Secha Capital #deals #privateequity #Africa #agritech africaglobalfunds.com/news/private-e… #SouthAfrica

Five female fund managers in #SouthAfrica exemplify the range of tools #genderlens funds are deploying. Lessons from linea capital, Sweepsouth, Africa Trust Group, #Womvest, Secha Capital and Five35 Ventures. Lelemba C Phiri Maya Burney Hema Vallabh impactalpha.com/how-women-led-…

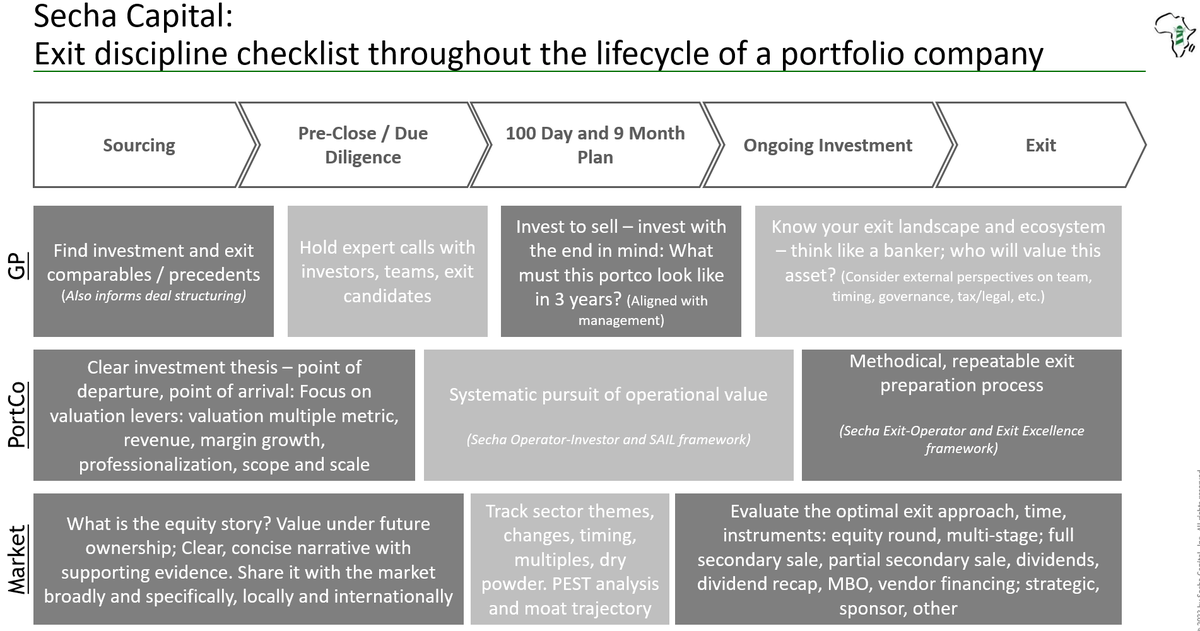

We believe that a value-add team that supports the portfolio company with a systematic pursuit of operational value also unlocks a methodical, repeatable exit preparation process, leading to more exit opportunities for the fund and management team. Here’s Secha Capital's guide:

.Secha Capital inks $15.8 million for second fund to back South Africa’s growing businesses. “We’ve identified a gap in the market,” says Secha’s Rushil Vallabh. impactalpha.com/secha-capital-…

News via bne IntelliNews: South African Venture Fund Secha Capital Raises $16 Million from Blue-Chip Investors: bit.ly/3taxq6u Secha Capital 27four SA SME Fund @cleocapital #SMEs #SmallBusiness #SocialImpact #ImpactInvesting #impinv #SouthAfrica

Thank you for hosting us, YALDAfrica *@BrendanJMullen

. Secha Capital is formally launching its Junior Operator-Investor Network (JOIN). This program will imbue the JOIN cohort with the capabilities and skills to create an arsenal of Operator-Investors in Africa! shorturl.at/h4TuH

Secha Capital has announced its recent hire of Nina Verder as principal and operator-investor.🌍🤝 Read the article on our FREE for download app or here: africaprivateequitynews.com

It's #TechTidesTuesday! 🌍 "The standard VC playbook often overlooks critical African contextual factors" - Rushil Vallabh 📰 Andile Masuku's column features Vallabh & Masedi Madisha on Secha Capital's operator-investor model challenging VC norms. africantechroundup.com/secha-capitals…

“The Opportunity for Alpha in Africa”. Secha Capital is delighted to share our contribution to the esteemable Evercore Private Funds Group's annual State of the Market publication. linkedin.com/posts/secha-ca…