Stefano Battiston

@stefbattiston

#Finance #Sustainability #Climate #Complex #Networks #Policy. FINEXUS Center - Prof Sustainable Finance - UZH, Prof Economics - Univ. Venice Ca Foscari

ID: 306211107

http://www.bf.uzh.ch/cms/de/battiston.stefano.html 27-05-2011 13:49:16

1,1K Tweet

2,2K Followers

890 Following

For those interested in financial risk nature reviewed how research in complex networks helped financial supervisors with tools to monitor and assess systemic financial risk. And why more research by supervisors is needed go.nature.com/41BQhmM Stefano Battiston Guido Caldarelli 贵多

Definitely Stefano Battiston + co-authors have left a major mark on the field of evaluating #systemicrisks in #financial #networks. The #DebtRank, in its various forms, has now been pretty much mainstreamed in central banks. So it is great that #Nature is highlighting these

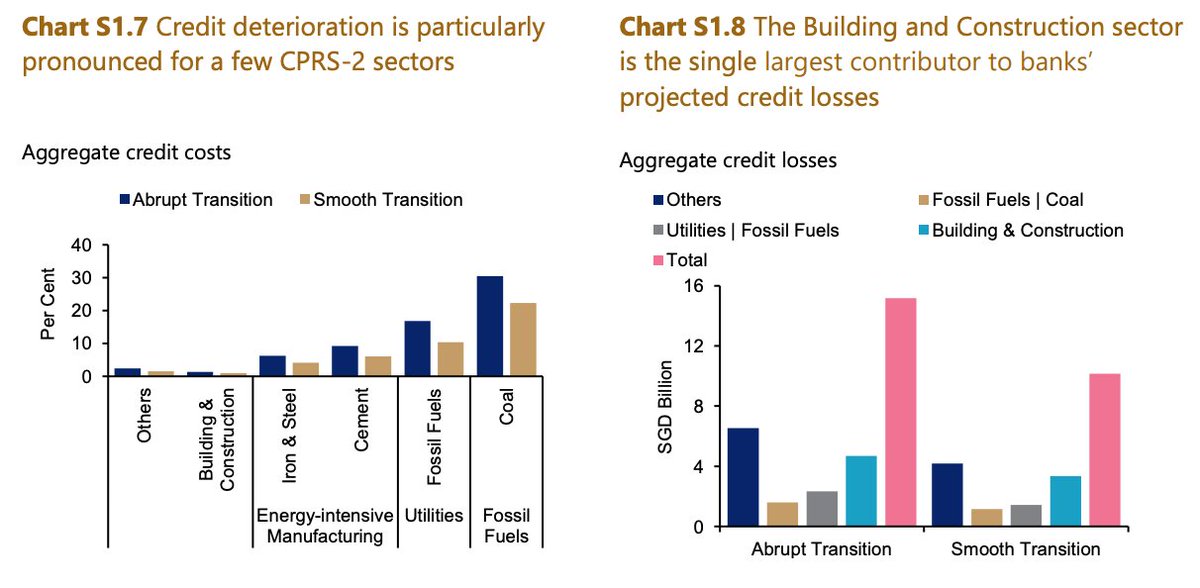

In VoxEU we discuss how climate policy uncertainty affects investors' expectations, hindering capital reallocation and risk management in the transition. We find welfare-enhancing if policy changes follow a predictable longer-term path Stefano Battiston Charlotte Gardes-Landolfini @Nepo_Dunz

@aless_maresca Stefano Battiston Indeed the problem is that most people still do not understand that process-based IAM are not like DICE style aggregate IAM. There is literature out there explaining the differences and why they matter for climate econ and finance, no real excuse....

Day 2: 1st European Sustainable Finance PhD Workshop at U.S.E. concludes. Naciye Sekerci Irene Monasterolo Jeroen Derwall (ECCE/UM Sustainable Finance) Nick Gantchev @YasminevStraten Stefano Battiston Rens van Tilburg @SFL_nl Matilde Faralli

Alaa Al Khourdajie 🇪🇺 And you did great. Unbelievable that in 2023, after so much knowledge, there are still *environmental* or *climate* economists arguing about optimal warming. Yet it gives a good indication of where the problem of missing mitigation may stand...Stefano Battiston

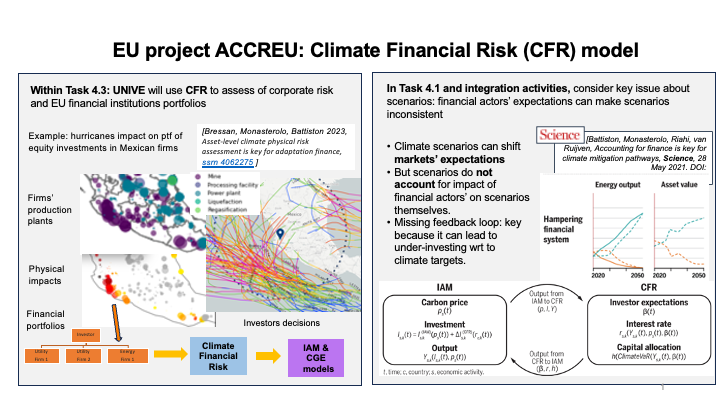

Job opening on "Modelling climate finance physical risk" Ca' Foscari Economia in Venice. - Deadline Nov 9th *noon* - Join EU project ACCREU and work on high-impact publications with Prof. Stefano Battiston (UNIVE&UZH). Details: linkedin.com/hiring/jobs/37…

Nature and biodiversity losses can be financially relevant even in the short term: our new report develops a biodiversity stress-test for the loans portfolios of UK banks, building on intermediate biodiversity loss scenarios: rb.gy/q6wmje Stefano Battiston Nicola Ranger 🔃