Stefano Giglio

@stefanogiglioec

Financial Economist @YaleSOM

ID: 1110599372889354240

https://som.yale.edu/faculty/stefano-giglio 26-03-2019 17:48:19

104 Tweet

3,3K Followers

337 Following

This recently published paper by Stefano Giglio and Dacheng Xiu seems like a big deal. It proposes a way to estimate risk premium of non-traded factors, e.g., intermediary capital, aggregate liquidity, ESG(?), without having a fully correctly specified factor model of returns.

Check out more from Xiao Xu and Andy Reed in collaboration with Matteo Maggiori @stroebel_econ Stefano Giglio corporate.vanguard.com/content/corpor… 2/2

My new Nature Energy article: how do climate risk & financial markets affect energy companies in different ways, with @stroebel_econ Stefano Giglio Ed Crooks from Wood Mackenzie and Eugenie Schwob from BlackRock #climatefinance #climaterisk #energy whr.tn/3eHxJyz

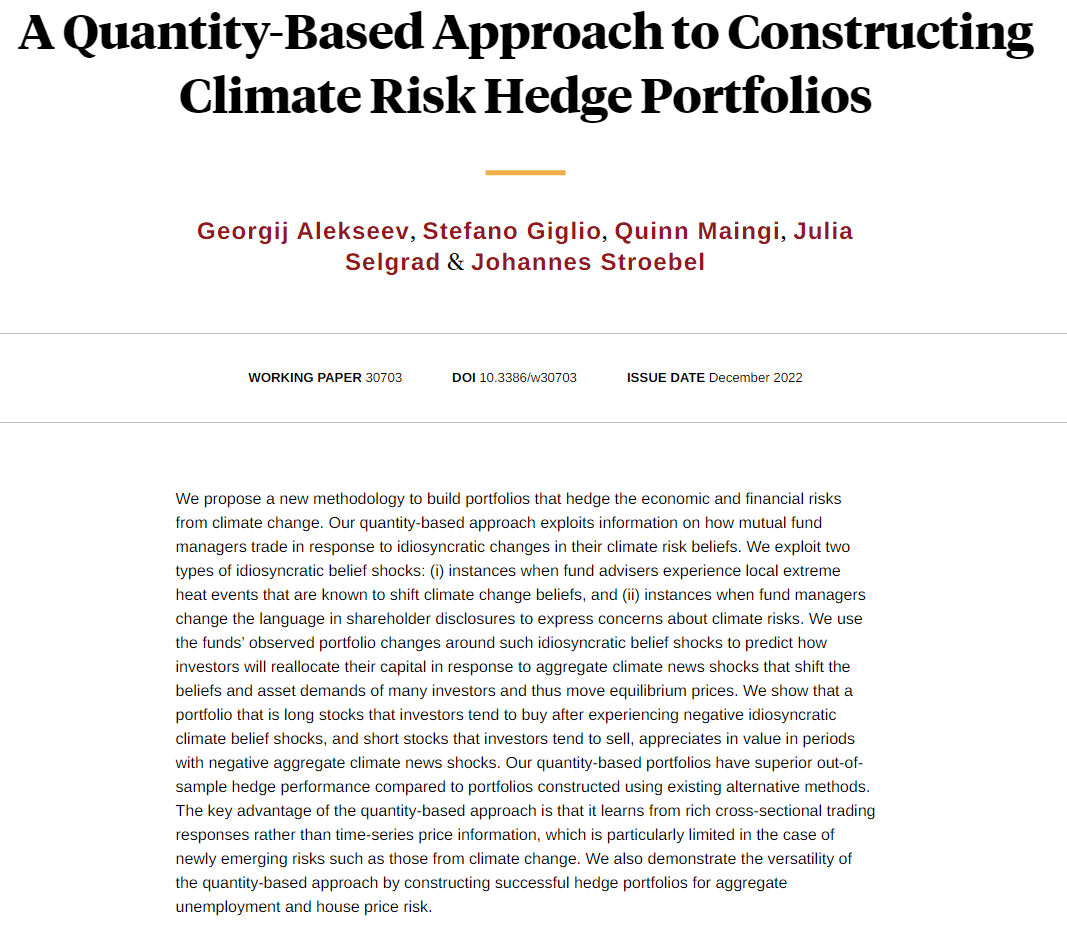

Building successful hedge portfolios for climate risks by studying how mutual funds trade in response to idiosyncratic shocks to their climate beliefs, from Georgij Alekseev, Stefano Giglio, Quinn Maingi, Julia Selgrad, and @stroebel_econ nber.org/papers/w30703

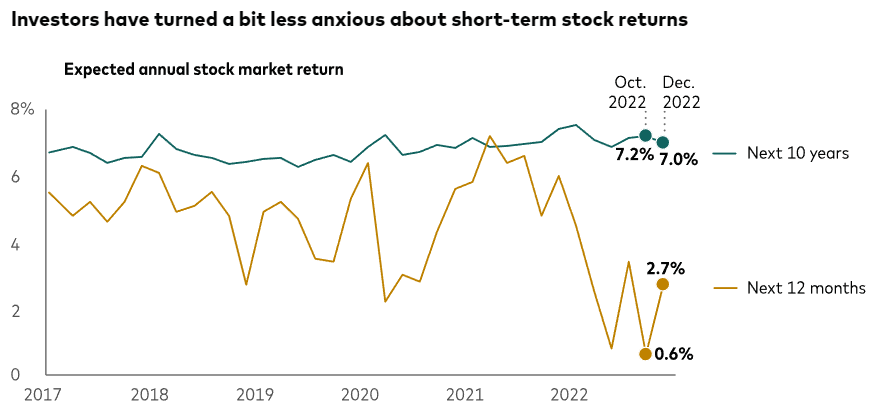

In Dec 2022 investor expectations of stock market returns (2.7% in next yr) improved from a 5-yr low in Oct. Expectations of GDP growth over next 3 yrs also ticked up. Long run expectations remained strong. cc Andy Reed Xiao Xu Matteo Maggiori @stroebel_econ Stefano Giglio

The issue of discounting--how much you would pay today to receive a future benefit--is both important and fascinating. Take this creative paper by Stefano Giglio Matteo Maggiori @stroebel_econ which use 99 to 999 (!!!) year leases to estimate it. …eomaggiori.s3.us-east-2.amazonaws.com/GMS_Very_Long_…

Estimates of equity term structures on a large set of portfolios from the cross section of stock returns. These synthetic term structures provide new moments for macro-finance models, from Stefano Giglio Bryan T. Kelly, and Serhiy Kozak nber.org/papers/w31119

An introduction of a new high-frequency measure of biodiversity risk, and measures of firms’ exposures to this risk. Biodiversity risk appears to be partially priced in equity markets, from Stefano Giglio Theresa Kuchler, @stroebel_econ, and Xuran Zeng nber.org/papers/w31137

⭐ VoxTalks Climate Finance NEW EPISODE ⭐ VoxTalks Climate Finance Ep1! What problems can climate finance solve & how do we solve them? Alissa Kleinnijenhuis & Tim Phillips Talk Normal talk to Viral Acharya NYU Stern Patrick Bolton Imperial Business School Stefano Giglio Yale School of Management

Examining if historically negative returns on equity index options can be explained by investors' crash aversion or by intermediaries demanding a premium for hedging risk in respect to return on synthetic options, from Dew-Becker and Stefano Giglio nber.org/papers/w31833

New CEPR Discussion Paper - DP18626 Biodiversity Risk Stefano Giglio Stefano Giglio Yale School of Management, Theresa Kuchler NYU Stern, Johannes Stroebel @stroebel_econ NYU Stern, Xuran Zeng NYU Stern ow.ly/uXlx50QfpHs #CEPR_AP

I am organizing a #SITE session on "Climate Finance and Banking" Stanford Economics Aug 19-20 with Stefano Giglio, Lars Hansen, and Monika Piazzesi. The submission link is here: docs.google.com/forms/d/e/1FAI… Deadline is April 15. All papers in climate/finance/banking welcome.

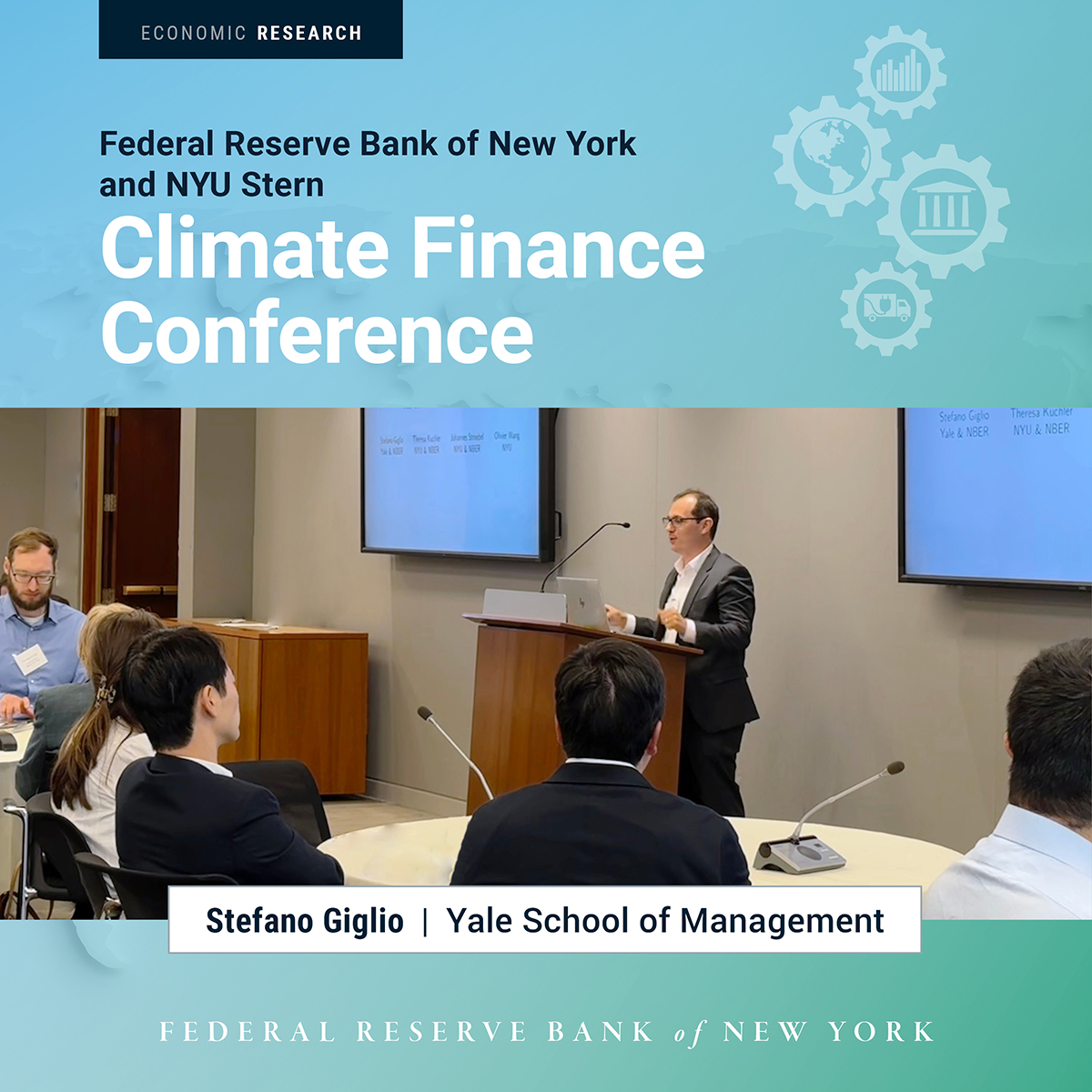

Prof. Stefano Giglio of Yale School of Management delivered a keynote on the economic consequences of #biodiversity loss—referring to the variety of life on earth: of genes, of species, of ecosystems. His paper focuses on the diversity of #species. #ClimateFinance: nyfed.org/3wO5ZkU

New CEPR Discussion Paper - DP19277 The #Economics of #Biodiversity Loss Stefano Giglio Yale School of Management, Theresa Kuchler NYU Stern, @stroebel_econ NYU Stern, Olivier Wang NYU Stern ow.ly/fnlM50SHW4Q #CEPR_MG #CEPR_PE #CEPR_AP #CEPR_CCE

Interested in Biodiversity Finance❓ It's today at 6:00pm! Don’t miss this unique opportunity to explore the financial implications of #biodiversity risk and its impact on markets and economic activities with Stefano Giglio Yale University To register👉 edhec.edu/en/form/speake…

Joshua Rauh Stefano Giglio and I are organizing the Cavalcade conference May 19-22, just across the river from NYC. 6 days left to submit a paper at conftool.com/sfs-cavalcade-…