TARC

@tarc2013

Tax Administration Research Centre (TARC), an ESRC Research Centre, hosted by the University of Exeter Business School

ID: 1361848362

http://tarc.exeter.ac.uk/ 18-04-2013 12:58:59

547 Tweet

744 Followers

352 Following

How exactly should carbon border adjustment mechanisms be structured? Christos Kotsogiannis and I look into this--a question that has received much less attention than you might think cesifo.org/en/publication… CESifo EU Tax & Customs 🇪🇺 Institute for Fiscal Studies TARC @OECDTax

The advice that tax authorities should do more “desk audits” & less “comprehensive” requires qualification. See this paper ⬇️ for the why! Enjoyed working on this project and learned a lot from Luca Salvadori John K @Theo68933256 and colleagues at Rwanda Revenue Authority (RRA) Dr. Innocente Tagadenis

Big thanks to Secretaría Ejecutiva for hosting TARC at the 58th General Assembly dedicated to the“prevention & resolution of tax conflicts”. Looking forward to 3 days of productive discussions and to sharing TARC’s work on the theme! Christos Kotsogiannis

Principles for Pareto Efficient Border Carbon Adjustment | Michael Keen Christos Kotsogiannis #EconTwitter cesifo.org/en/publication…

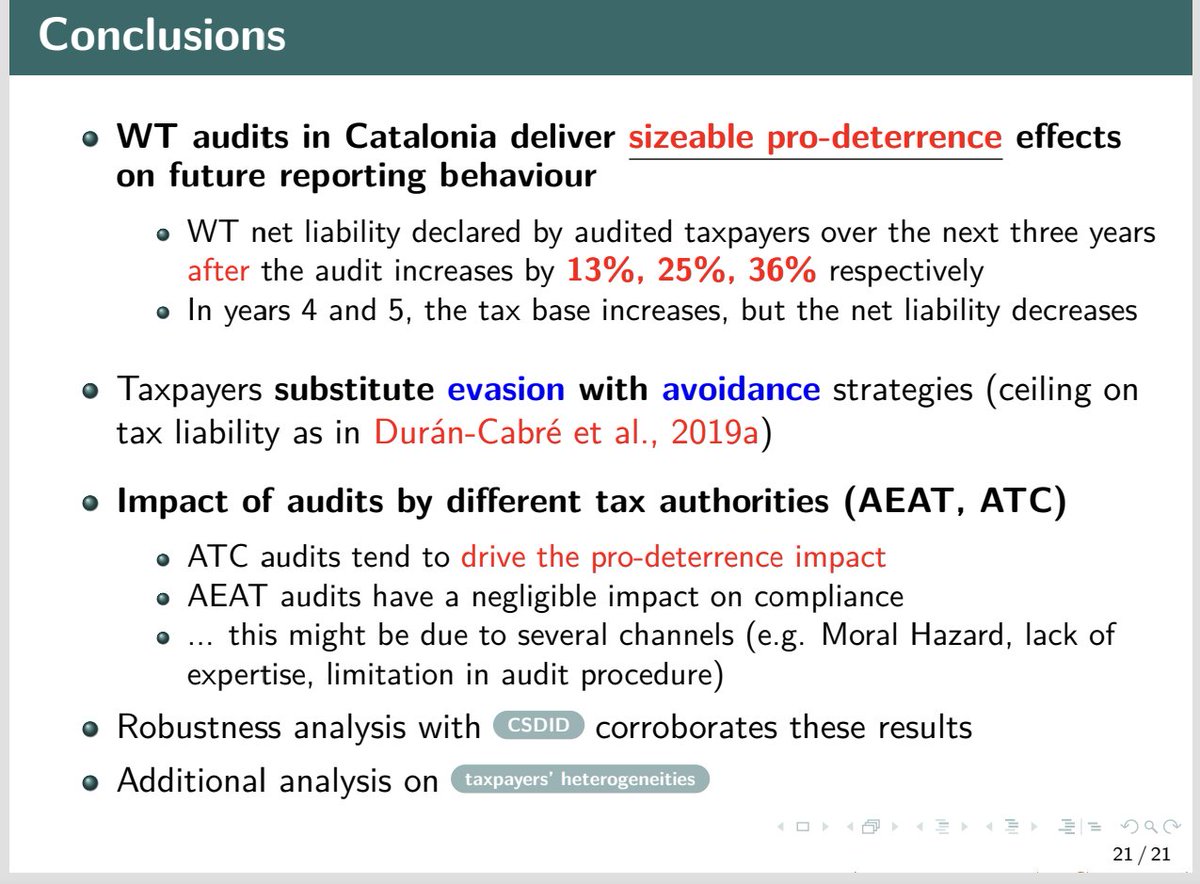

Many thanks to the organizers of the Encuentros Economía Pública for having me presenting our paper on #Wealth #TaxAudits (with #JMDuran Alejandro Esteller Moré Christos Kotsogiannis) to the discussant (#JValles) and all the participants for the fruitful & productive debate Barcelona School of Economics IEB TARC

A new TARC publication available open access. Link below ⬇️ Thanks to the Economic and Social Research Council and the University of Exeter Business School for supporting TARC’s research and impact!

E-invoicing, Tax Audits and VAT Compliance Barcelona School of Economics Working Paper by Christos Kotsogiannis, Luca Salvadori, John Karangwa and Innocente Murasi #bseResearch #EconTwitter TARC Universitat Autònoma de Barcelona IEB Rwanda Revenue Authority (RRA) bse.eu/research/worki…

Thank you IOTA and the State Tax Service of the Republic of Azerbaijan for inviting TARC to the International Forum on Carbon Pricing! Excited to collaborate on driving global climate solutions. #ClimateAction Economic and Social Research Council University of Exeter Business School University of Exeter Christos Kotsogiannis

Thank you Secretaría Ejecutiva for inviting TARC to participate in the Technical Conference! I thoroughly enjoyed the discussion on GAARs. This is an important instrument but with its challenges too. Looking forward to discussing more design issues over the next 2 days. University of Exeter Business School

A new TARC publication, in collaboration with Rwanda Revenue Authority (RRA), on the introduction of e-invoicing in Rwanda. University of Exeter News University of Exeter Business School Christos Kotsogiannis

.Elizabeth Morton blogs about her recent paper, "Understanding Non-Fungible Tokens and the Income Tax Consequences", co-authored by Michael Curran & published in the latest issue of JOTA, on the TARC blog, here: sites.exeter.ac.uk/tarc/2024/12/0… Christos Kotsogiannis

JUST PUBLISHED: Vincent Ooi 's blog post about his paper, "The Case for Stronger Scrutiny of the Deductibility of Crypto Losses", which was published in the latest issue of JOTA, is live on the TARC blog: sites.exeter.ac.uk/tarc/2024/12/0… Christos Kotsogiannis

Just published on the @tarc2013 blog: "Taxing Bitcoin: A New Source of Revenue", by Andreas Thiemann, discussing his recently published article in JOTA, "Cryptocurrencies: An Empirical View from a Tax Perspective": sites.exeter.ac.uk/tarc/2024/12/0… Christos Kotsogiannis

Thanks to all authors who contributed to this symposium! Amedeo Piolatto @AntoineZerbini #EMunozSobrado Paweł Doligalski Luis E. Rojas Sebastian Castillo #VLeyaro Ezekiel Swema #OHaule #OTuyishimire #BFMurorunkwere TARC

Thank you to the Asian Development Bank (Asian Development Bank) and the DET Network for giving TARC the opportunity to share our experience with the global community on the impact of digital transformation of tax authorities on tax compliance. Economic and Social Research Council University of Exeter Business School Christos Kotsogiannis

Thank you Secretaría Ejecutiva and #SII for inviting TARC to the 59th General Assembly 2025. It was a pleasure to share our work & engage in such productive dialogue with colleagues across the many countries that participated. Christos Kotsogiannis Economic and Social Research Council University of Exeter Business School

JOTAJournal relies on the dedication and goodwill of its reviewers, and we are grateful for the outstanding service Dr. Mayya Konovalova has provided. Congratulations to her for being awarded Reviewer of the Year! CIOT TARC Uni of Birmingham