Babak 🇺🇦 🌻

@tn

Whatever the opposite of 'laser eyes' is...

ID: 1188301

14-03-2007 22:53:13

18,18K Tweet

9,9K Followers

124 Following

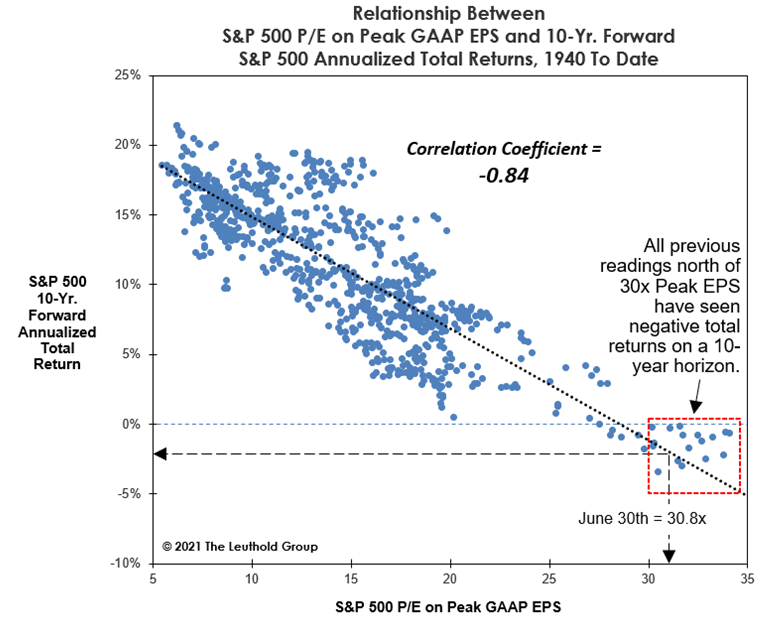

S&P 500's June 2021 peak PE at 30.8 (99th %tile, below Dec 1999's 35.8 an all time record which would put $SPX +5000) such high #valuation corresponds to poor long term returns - a slightly negative 10 year annualized total return! chart via The Leuthold Group