Otavio (Tavi) Costa

@tavicosta

Crescat Capital macro strategist. Native of Sao Paulo, Brazil 🇧instagram.com/tavicostamacro

ID: 2584103654

http://crescat.net/disclosures 23-06-2014 14:35:18

10,10K Tweet

251,251K Followers

2,2K Following

If US gold reserves today covered as much of the national debt as they did in 1971, gold would have to hit $23,000/oz! Check out this eye-opening chart (credit to my buddy Otavio (Tavi) Costa) Is a gold-backed dollar a relic of the past, or the comeback of the decade? 🥇💸 Find out

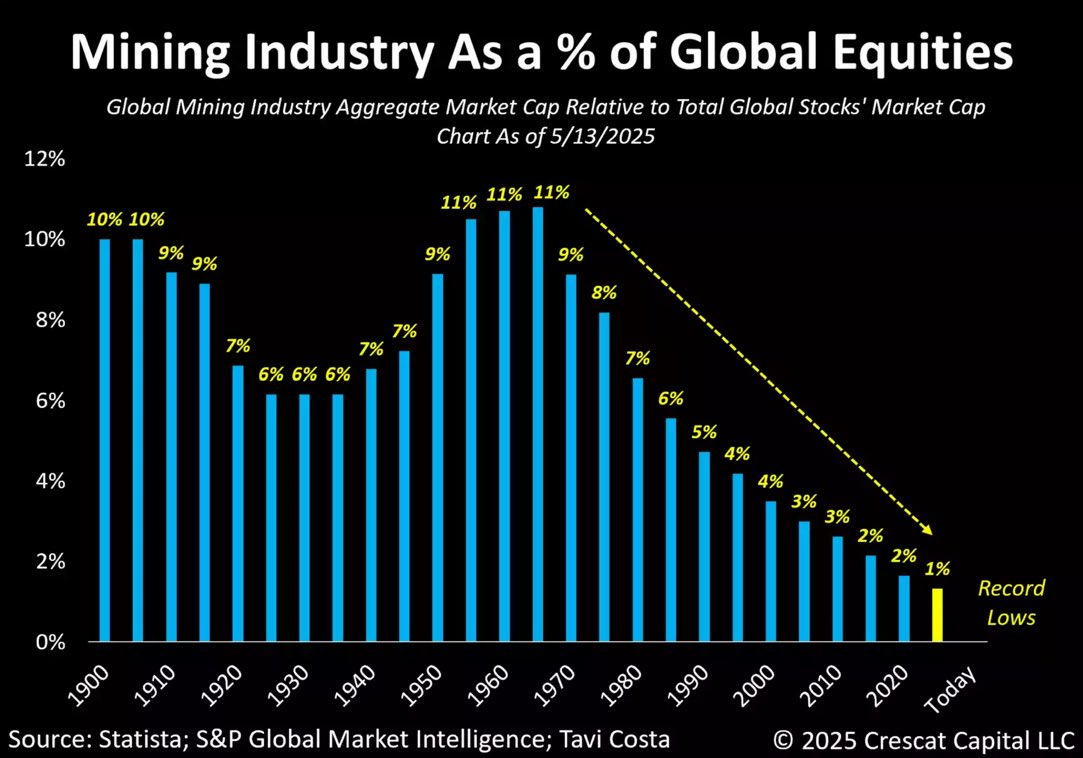

3/5 🥱 On the flip side, not every sector has attracted investors’ attention. 📉 The next chart by Otavio (Tavi) Costa shows that mining companies have never been so undervalued relative to the broad stock market! #MiningStocks #MeanReversion