Tax Foundation

@taxfoundation

Leading nonpartisan tax policy research and analysis

ID: 16686673

https://taxfoundation.org/tax-newsletter 10-10-2008 18:13:37

56,56K Tweet

61,61K Followers

865 Following

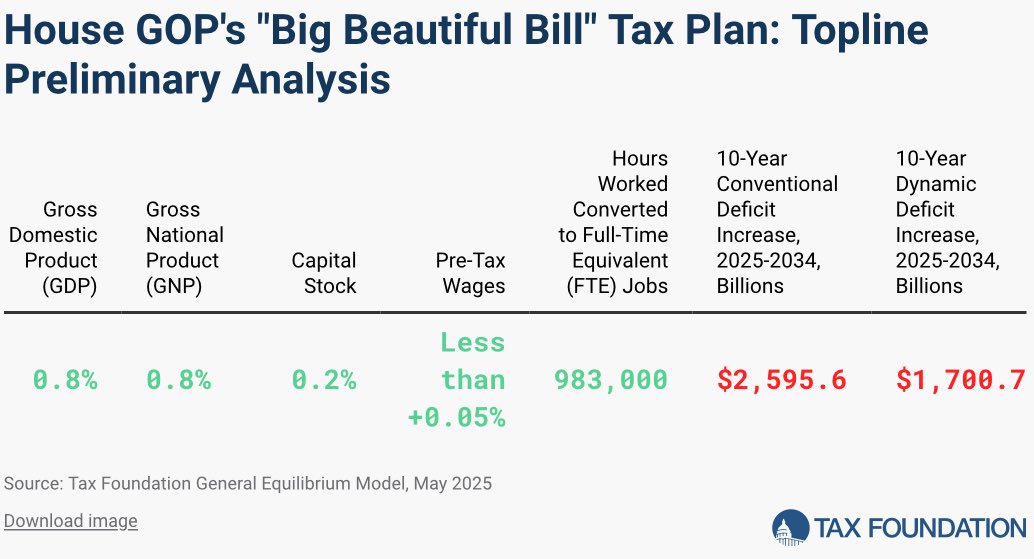

We did the math right at Tax Foundation, including producing a dynamic score of the tax provisions. The House bill as written unambiguously increases deficits.

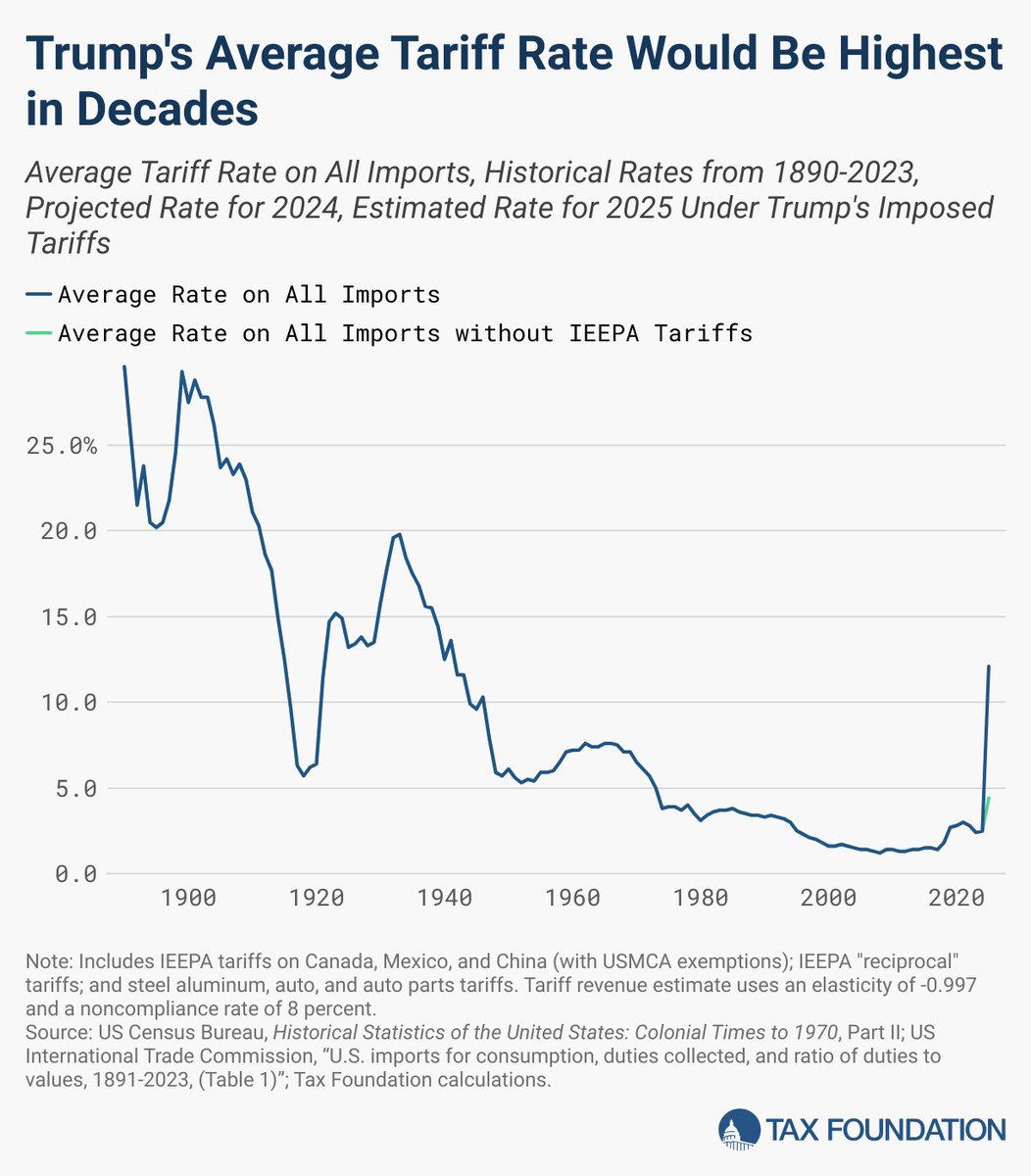

Updated tariff estimates from Tax Foundation explore what happens if all the IEEPA tariffs are ultimately ruled illegal ➡️10-year revenue drops by $1.4 trillion to $533 billion ➡️GDP hit falls from 0.7% to 0.1% ➡️Average tax increase drops from $1,155 to $275

The one big beautiful bill takes a hatchet to the IRA credits but leaves fully intact the IRA's corporate alternative minimum tax, the most dysfunctional part of the IRA. Senate should make the CAMT less bad or scrap it all together. See new analysis by Alex Muresianu.