Tax Policy Center

@taxpolicycenter

Independent, timely, accessible analyses of current and emerging tax policy issues. (Links/RTs/favorites/follows/etc. are not endorsements.)

ID: 61083476

http://www.taxpolicycenter.org 29-07-2009 01:59:01

16,16K Tweet

42,42K Followers

673 Following

Your #DailyDeduction from the Tax Policy Center | Tax Changes From Capitol Hill To State Capitals taxpolicycenter.org/tax-changes-ca…

Your #DailyDeduction from the Tax Policy Center | Changing Tax Code Raises New Questions For Taxpayers And The IRS taxpolicycenter.org/changing-tax-c…

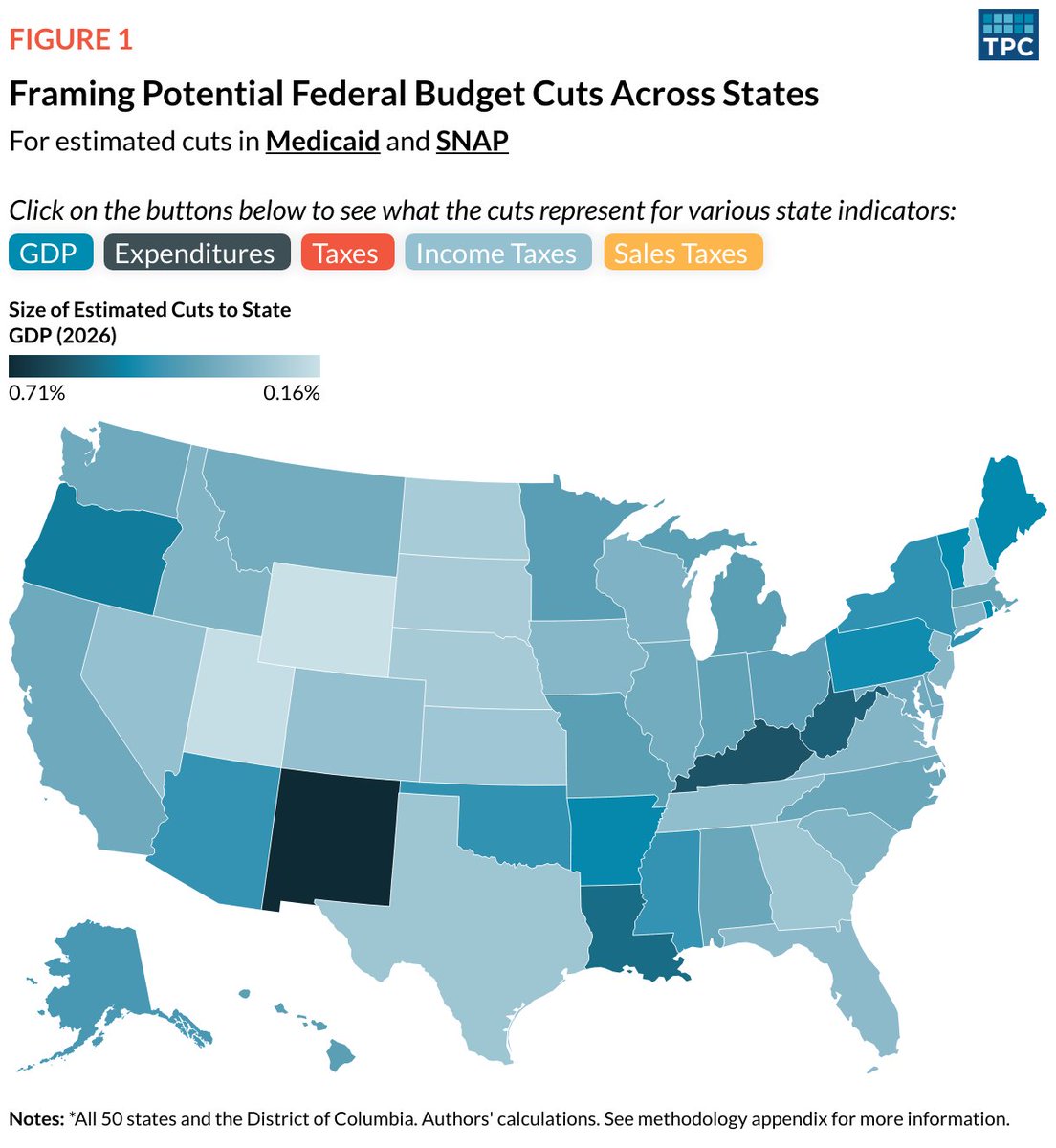

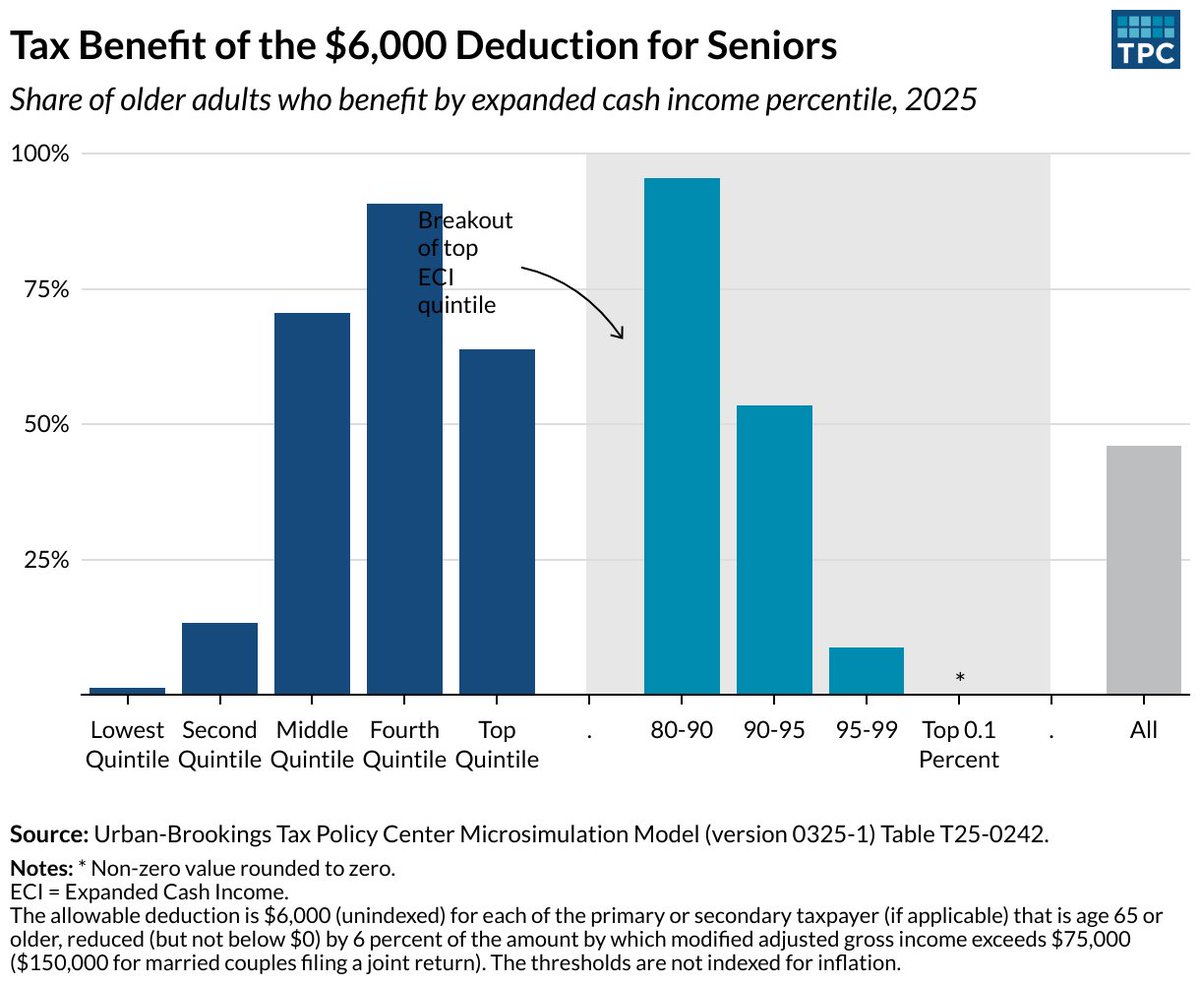

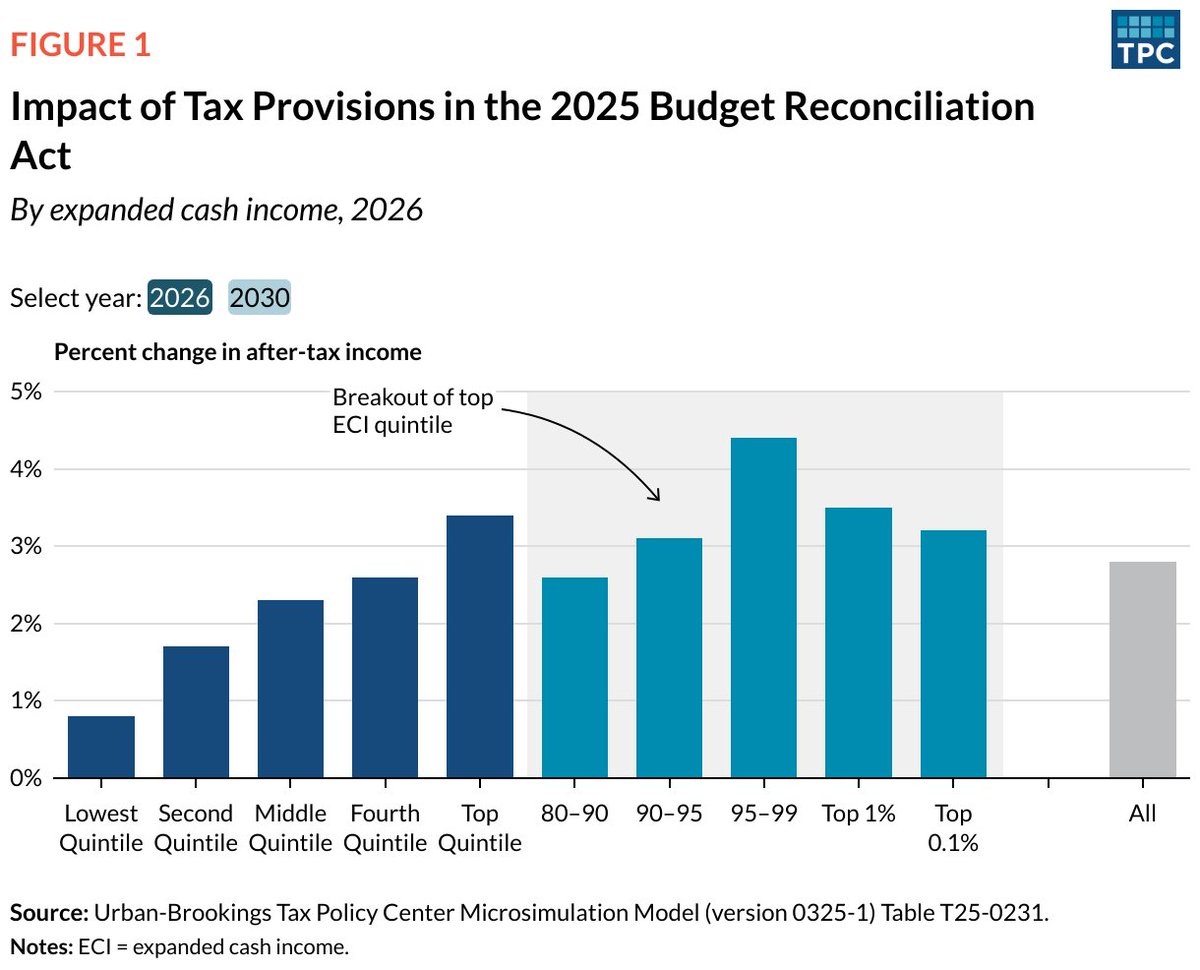

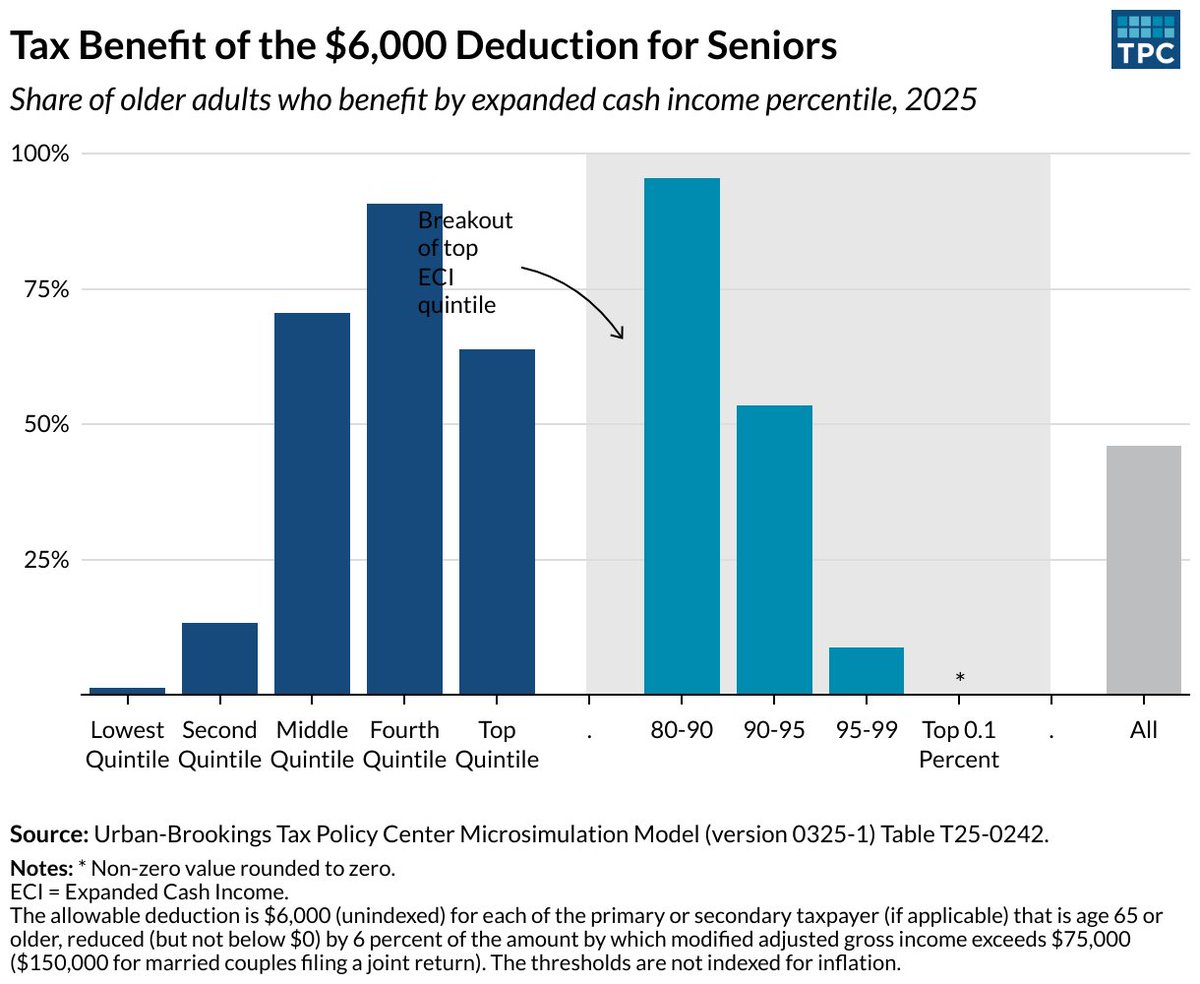

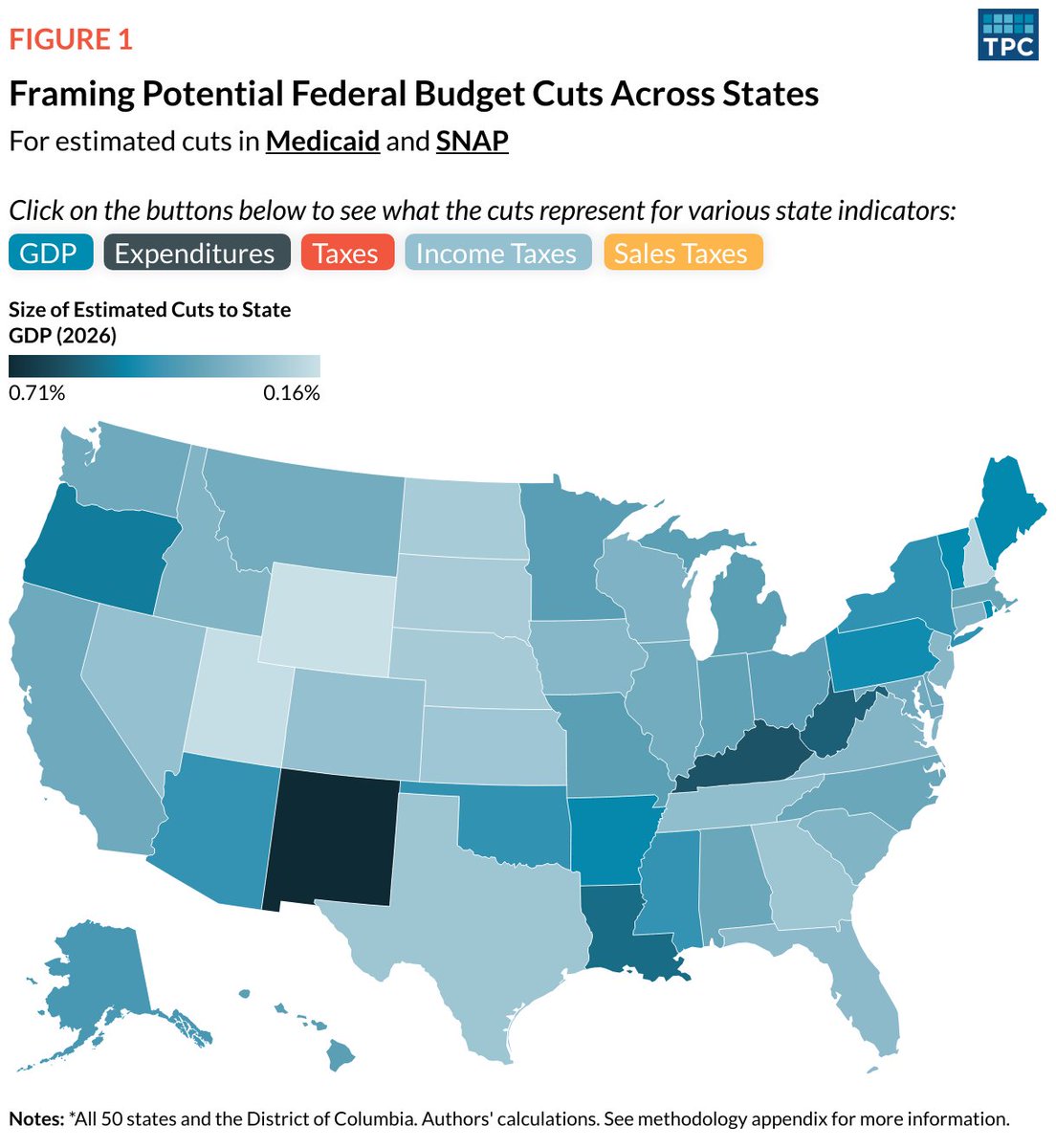

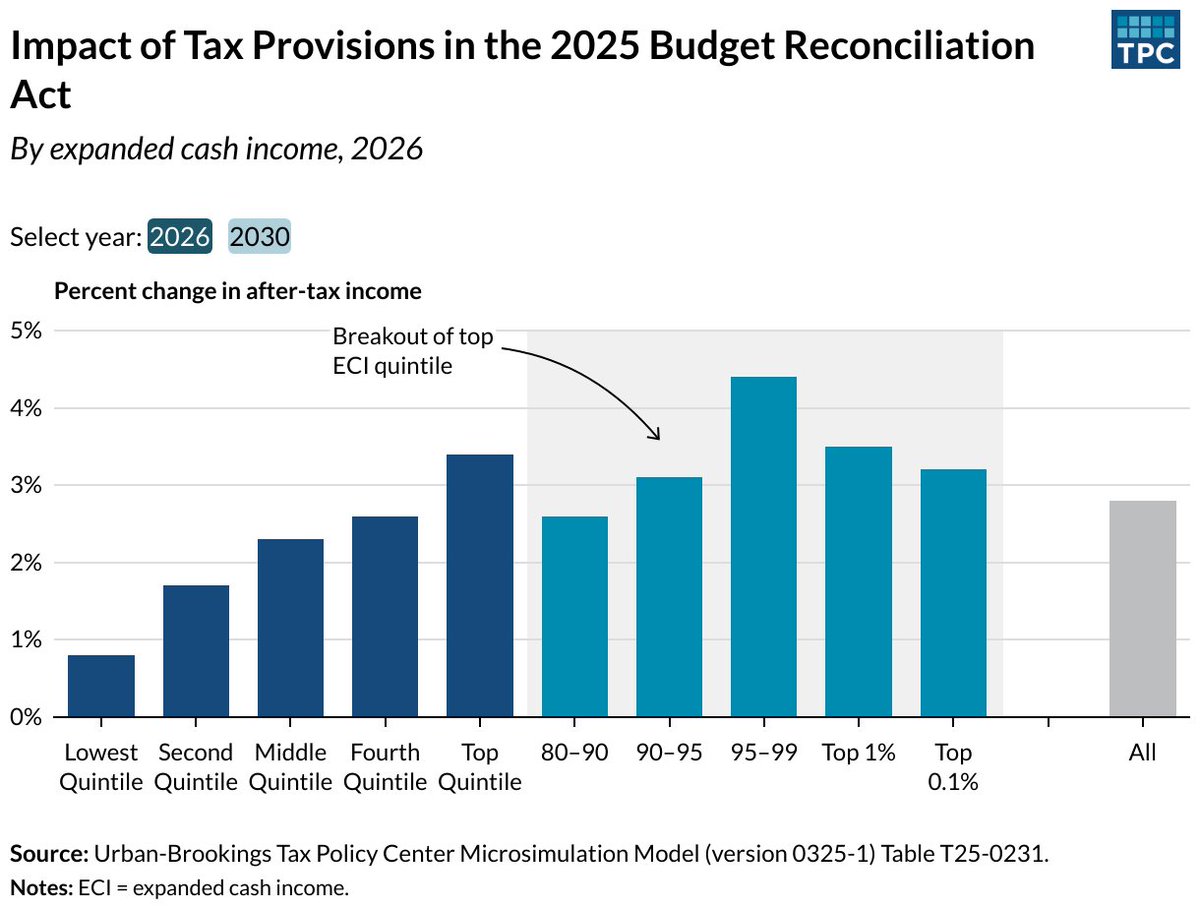

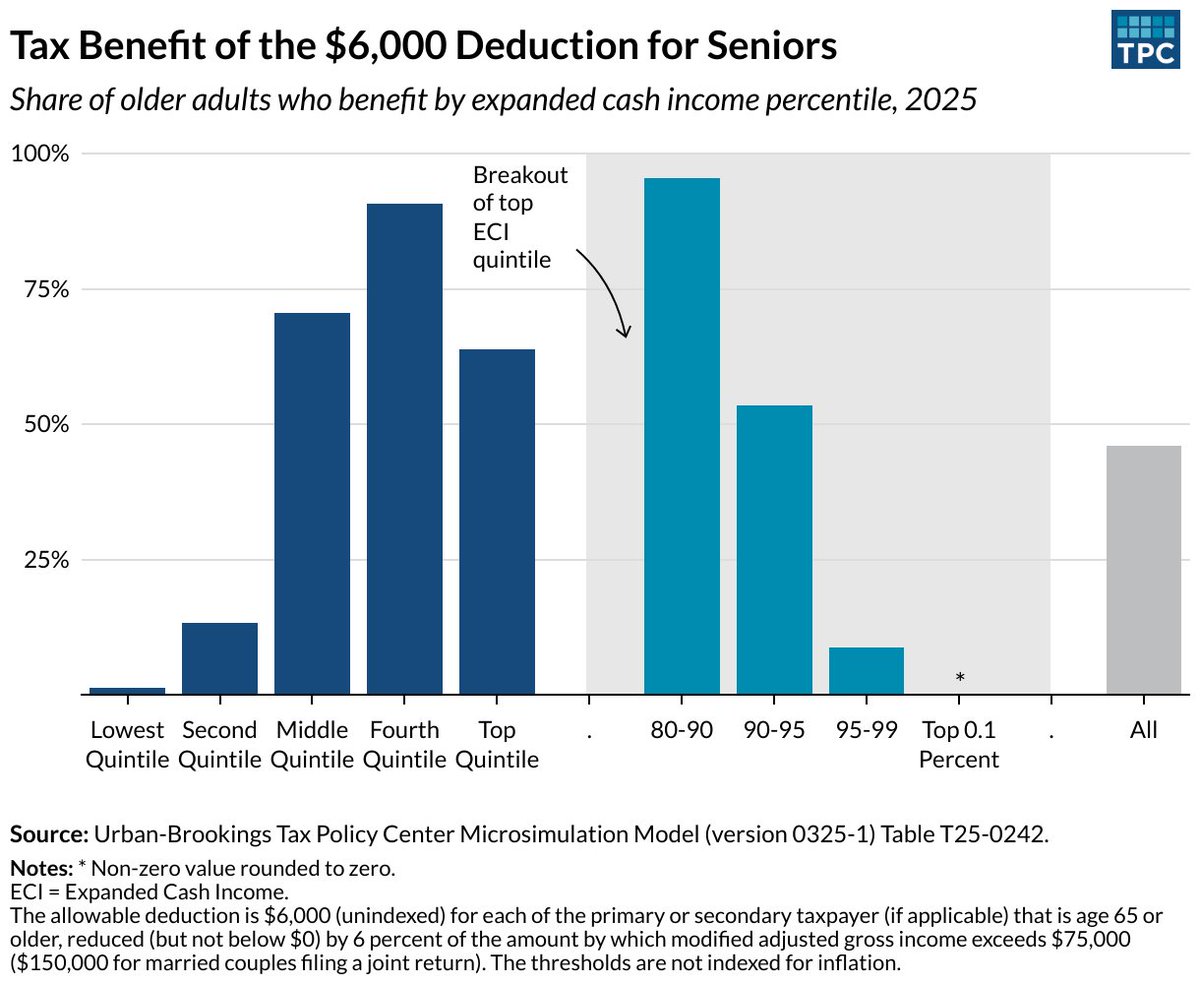

It's cool how Tax Policy Center teamed up with Urban Institute ⬇️ to distribute OBBBA's tax & transfer effects. TCJA in 2017 & esp. now OBBBA were more than tax laws. I'm a tax guy who likes tax tables, but just talking about OBBBA tax effects is incomplete if not misleading.