Tema ETFs

@temaetfs

Tema offers innovative portfolio building blocks through actively managed ETFs.

ID: 1541840943707557891

https://temaetfs.com/ 28-06-2022 17:49:21

413 Tweet

888 Followers

108 Following

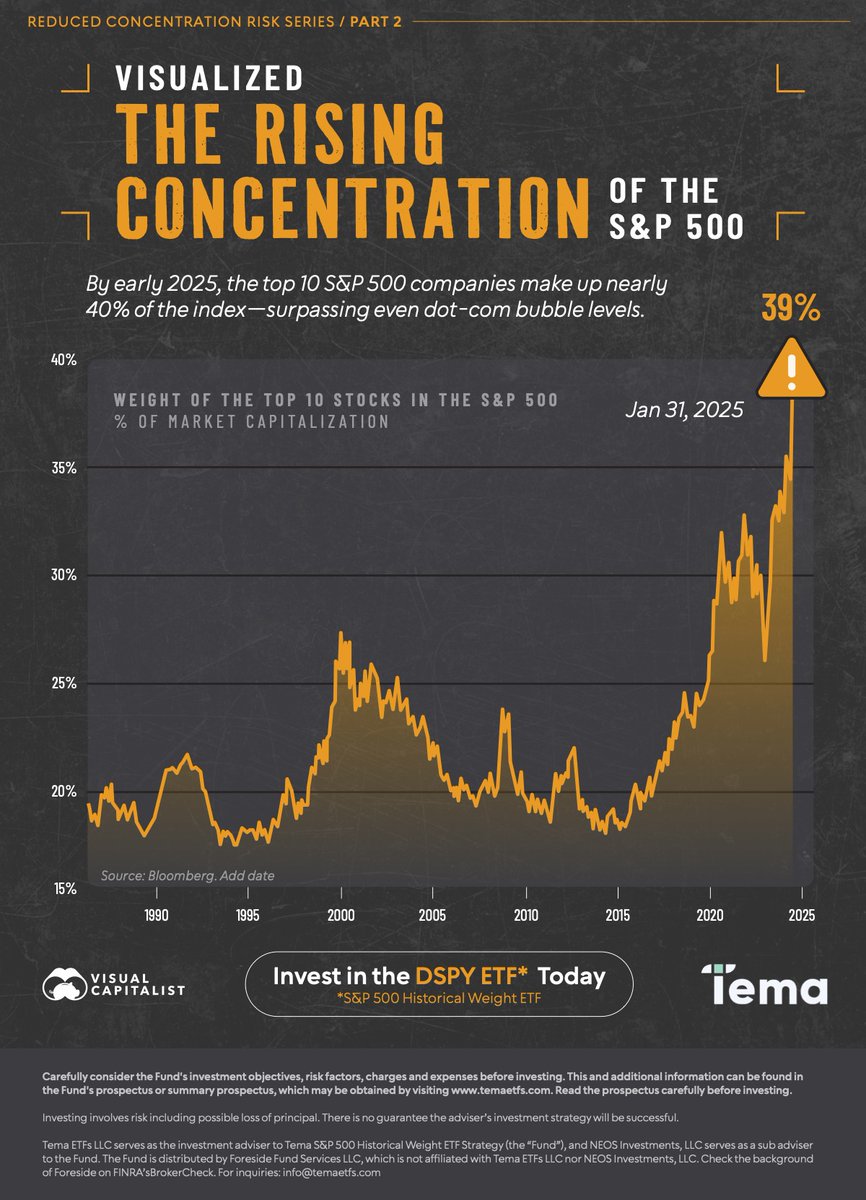

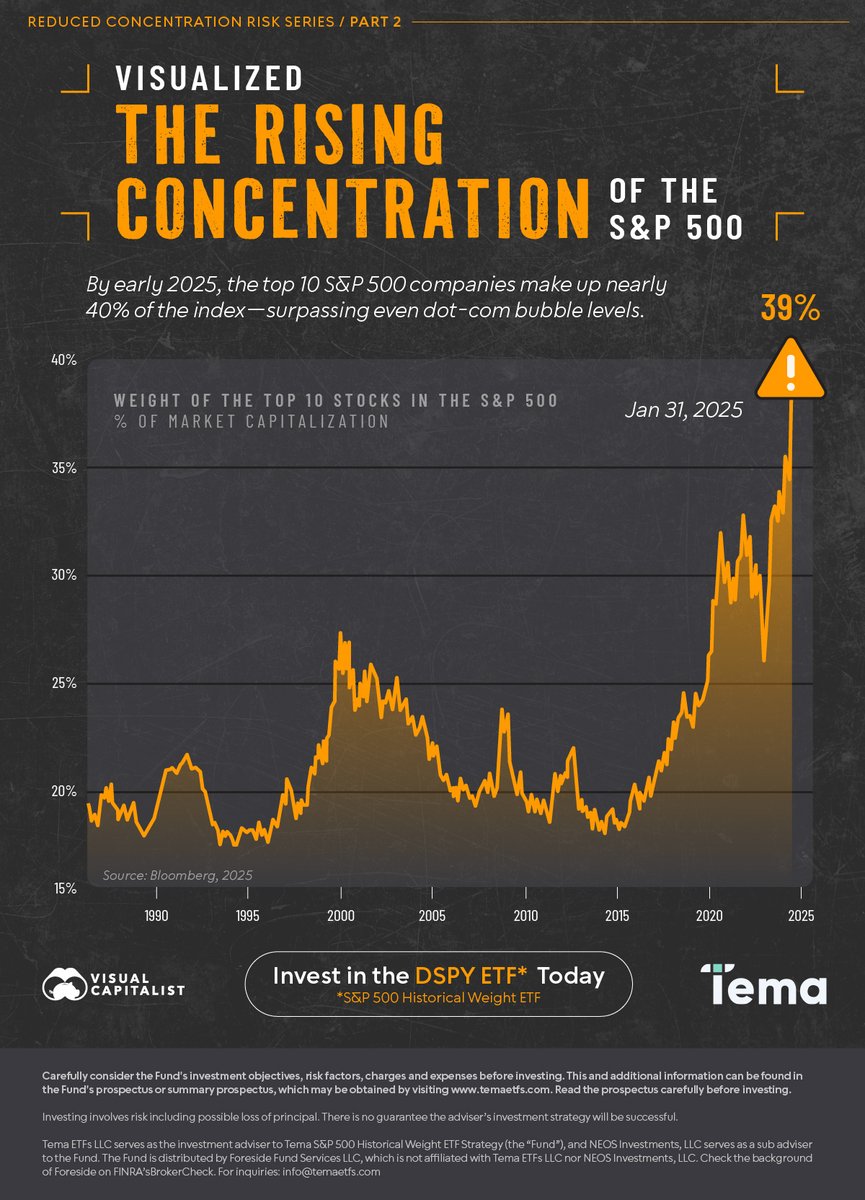

By early 2025, the top 10 companies in the S&P 500 made up about 40% of the index—surpassing even the levels during the dot-com bubble ⚠️ Here, our partner, Tema ETFs, looks at the rising concentration of the largest stocks within the S&P 500 over time. visualcapitalist.com/sp/visualized-…

The top 10 stocks in the S&P 500 make up nearly 40% of the entire index. In partnership with Visual Capitalist, we outline this concentration risk and how investors could allocate toward a more balanced exposure with our S&P 500 Historical Weight ETF, $DSPY. bit.ly/4dZzWjb