Ryan Jackson

@theetfobserver

Analyst at Morningstar Research Services, LLC.

Important disclosure info: bit.ly/MRS0818

ID: 1266115014043279373

28-05-2020 21:12:05

266 Tweet

570 Followers

230 Following

Good overview of the SSGA/Apollo private credit ETF in registration. Raises a host of questions which my colleagues Brian Moriarty and Ryan Jackson gamely attempt to answer. spr.ly/6015Wvg1b

Talking flows, trends, and the Bitcoin effect in ETFs with Ramzan Karmali Check out the video here: reuters.com/video/watch/id…

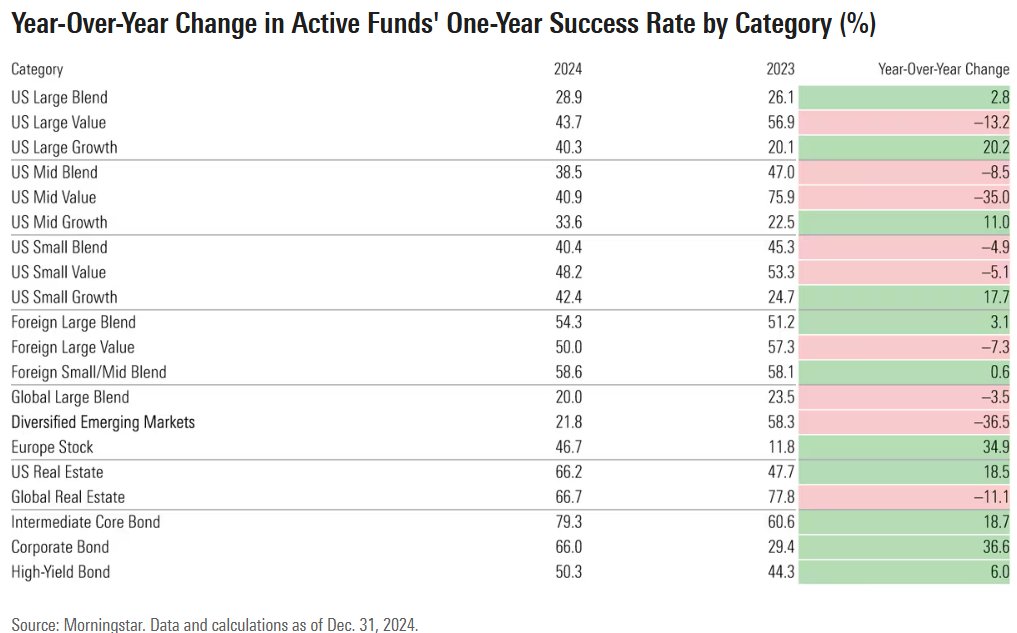

My colleagues Bryan Armour, Ryan Jackson, and Hyunmin Kim just published our semi-annual “Active/Passive Barometer” report. Lots of good data and charts on active and passive fund performance trends, as usual. 👍 spr.ly/6019UNmDZ

Diversification is not only about disaster protection, but miracle exposure--a cool idea that Morgan Housel first called to my attention I dive into the concept through an ETF lens here: morningstar.com/funds/will-you…

ETF Store's Nate Geraci compiles some of the best ETF articles from this past week. theetfeducator.com/2025/01/25/etf… Articles by Justina Lee, Aniket Ullal, Ryan Jackson, Katie Greifeld, Jason Zweig, Steve Johnson, Jeff Benjamin, RT Watson, & more PotW James Seyffart CotW Eric Balchunas

US ETFs added $90 billion net flows in January. Active ETFs contributed nearly half that (!!) as they race toward $1 trillion in net assets. Ryan Jackson with these ETF trends and more: spr.ly/6014IExDe

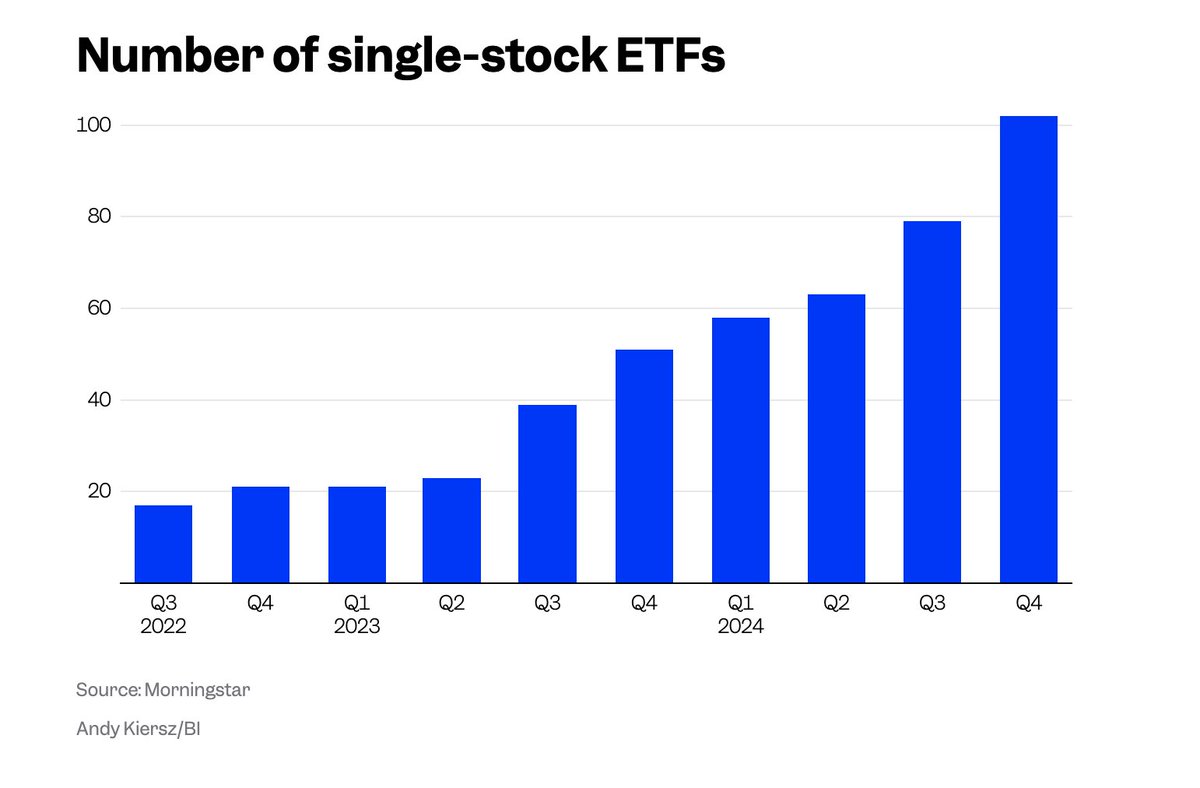

The proliferation of single-stock ETFs is covered well in new Business Insider article Tech meme-ish stocks still the main muses for these ETFs; most recent launches are tied to $AMD $ORCL $CVNA $HOOD

ETF Store's Nate Geraci compiles some of the best ETF articles from this past week. theetfeducator.com/2025/02/22/etf… Articles by Steve Johnson, Vildana Hajric, Ryan Jackson, Cinthia Murphy, André Beganski, Steven Ehrlich, Dave Nadig, & more PotW: Eric Balchunas CotW: Katie Greifeld

Great summary of February ETF flows here from Ryan Jackson morningstar.com/funds/investor…

About 42% of active funds survived and beat their average passive peer in 2024. Bryan Armour is back with a fresh, new-look Active/Passive Barometer: morningstar.com/funds/active-f…

Behind the scenes look at Ben Johnson, CFA Bob Pisani and co. LIVE from Exchange 2025 🔜 Las Vegas, NV #Viva