Trepp

@treppwire

Trepp is the leading provider of data, insights, and technology to the structured finance, commercial real estate, & banking markets.

ID: 268360076

https://www.trepp.com/ 18-03-2011 16:22:05

25,25K Tweet

13,13K Followers

388 Following

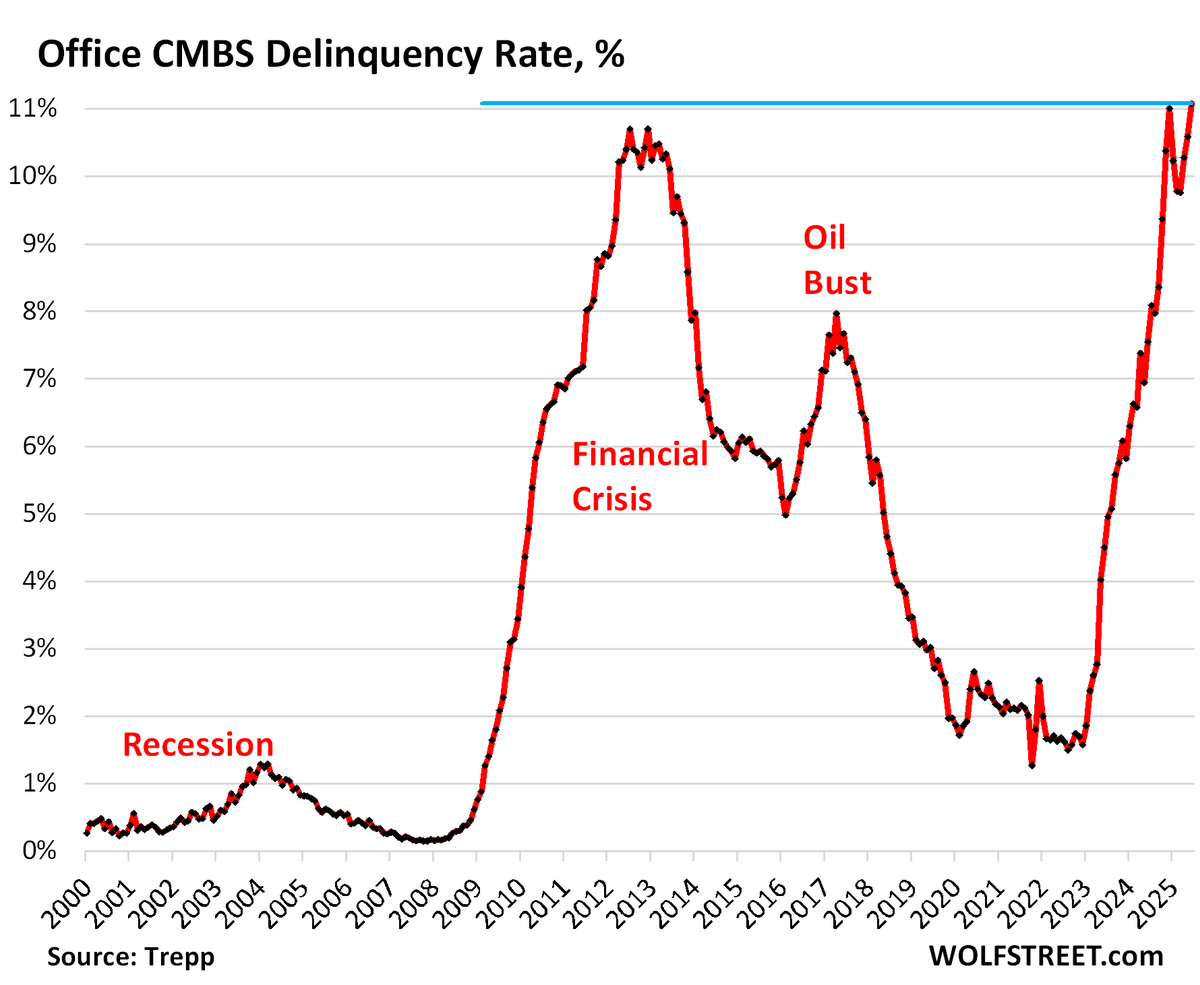

📰#Trepp in GlobeSt.com: "According to Trepp, the office CMBS delinquency rate soared to 11.08% in June, surpassing previous peaks of 11.01% in December 2024 and 10.70% in July 2012." hubs.li/Q03w3sX30