USD.AI || beta May 2025

@usdai_official

The yield-bearing synthetic dollar backed by real-world infrastructure assets | developed by @permianlabs

ID: 1757098063376666624

http://usd.ai 12-02-2024 17:43:33

88 Tweet

1,1K Followers

116 Following

🎙️Deep In DePIN ep.22 Join Karam Lakshman and William for your favourite DePIN space with a panel of big 🧠 builders Brandon Baker CUDIS DePIN Connection Jesse Adams | UpRock ✈️ Solana Summit APAC Vietnam Presearch USD.AI | in Beta Who Loves Burrito? Yog | Farmsent and you 🫵

Congrats on the private beta launch USD.AI | in Beta with $10M in partner deposits 🔥 Aethir is supplying GPUs as hard assets, generating real rewards 💰 The deposits are helping onboard more compute and supporting our joint Tactical Compute (TACOM) financing initiatives.

AI startups in the Web3 space need financing.💰 Conor Moore explains how he believes USD.AI | in Beta will fit best at the capital formation layer 💹 of the ecosystem.

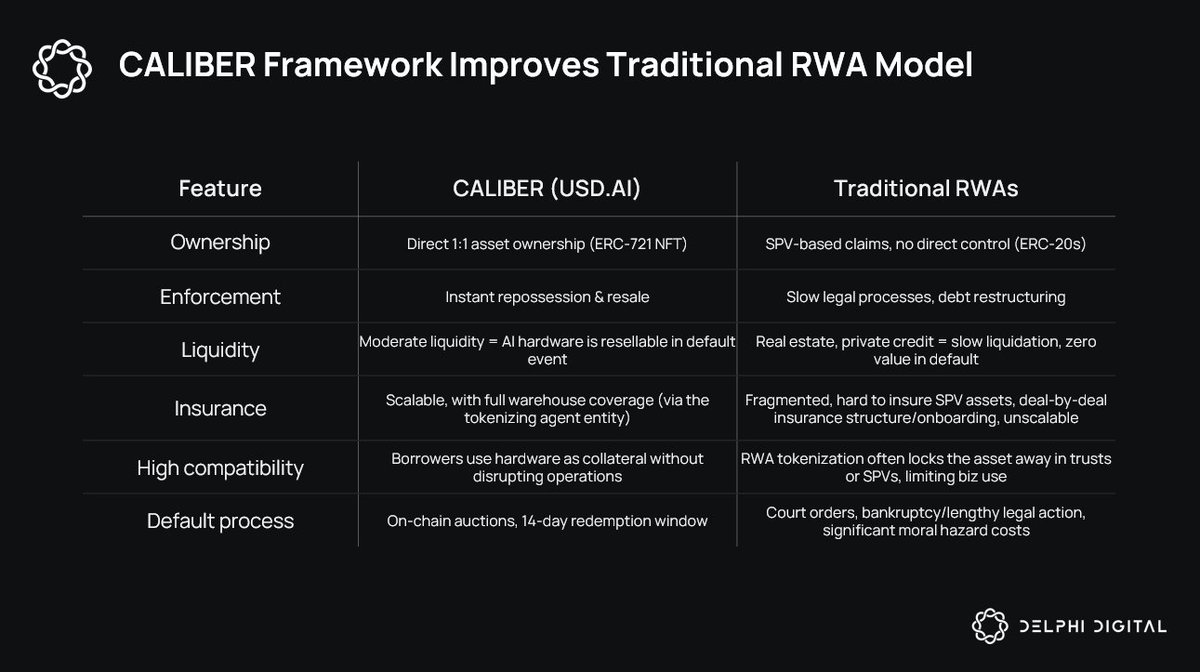

Swept Podcast #10 Featuring Conor Moore, Co-Founder & COO of USD.AI | in Beta; Newar as the host. USDAI introduces InfraFI to Web3 by offering loans based on 🪙tokenized GPU collateral. Consider it a mix of DePIN and DeFi that gives the backbone of AI tech an added

EstateX Antix.in Ostium Calvin Weight RHT🔥 Landy Popeye On The Go Crypto 0xB4dpr|c3 b̾i̾t̾s̾o̾f̾w̾e̾a̾l̾t̾h̾ LadyTraderRa Luca Quai Network ⚡️💵 alan ⚡💵 Dr K - e/acc ⚡💵 OZZY Auny 🧡 Promythi🔥us Matt Case ZET 💪❤️ Tropic 🇯🇲 Ray Buckton | rwa.world 🌐 PIXLRWA MetaWealth AssetMantle 💎🔗📜 SHIFT (Ex Auroca) Re Vinay ₿astien Sinclair 💥 🐃 💥 Thomas Young Sean Hagan, MBA (Matt) MacroMinutes Matt McDonagh Tidal Financial Group WOLF Northstar trendrift kaledora Flow Dabba Network 🟨 Join us to our Space on Thursday at 11 AM EST! Topic: DePIN & DePAI SPACE: x.com/i/spaces/1ynKO… Host: Flux I Decentralized Cloud Co-Hosts: WOLF Crypto Daniel Keller Speakers: @BakerJBrandon Neuron DePIN Crypto Network onocoy Association CUDIS @USDAI_Official Silencio 🤫

Happening now with David | USD.ai If you’re building or backing compute, this will be a conversation worth hearing. Tune in 👇

Most DeFi yields are just moving money in circles. USD.AI | in Beta is aiming to bring real yield through infrastructure powering AI. While most RWA protocols aim to bring TradFi yields on chain, USDAI is designed for a different approach: direct financing of productive hardware