Marine l MC² Finance

@vcmarine

Founder of MC² Finance | VC Investor & Web3 Advisor

→ mc2.fi

ID: 2492921138

https://linktr.ee/mcsquaredfi 13-05-2014 12:42:35

206 Tweet

2,2K Followers

163 Following

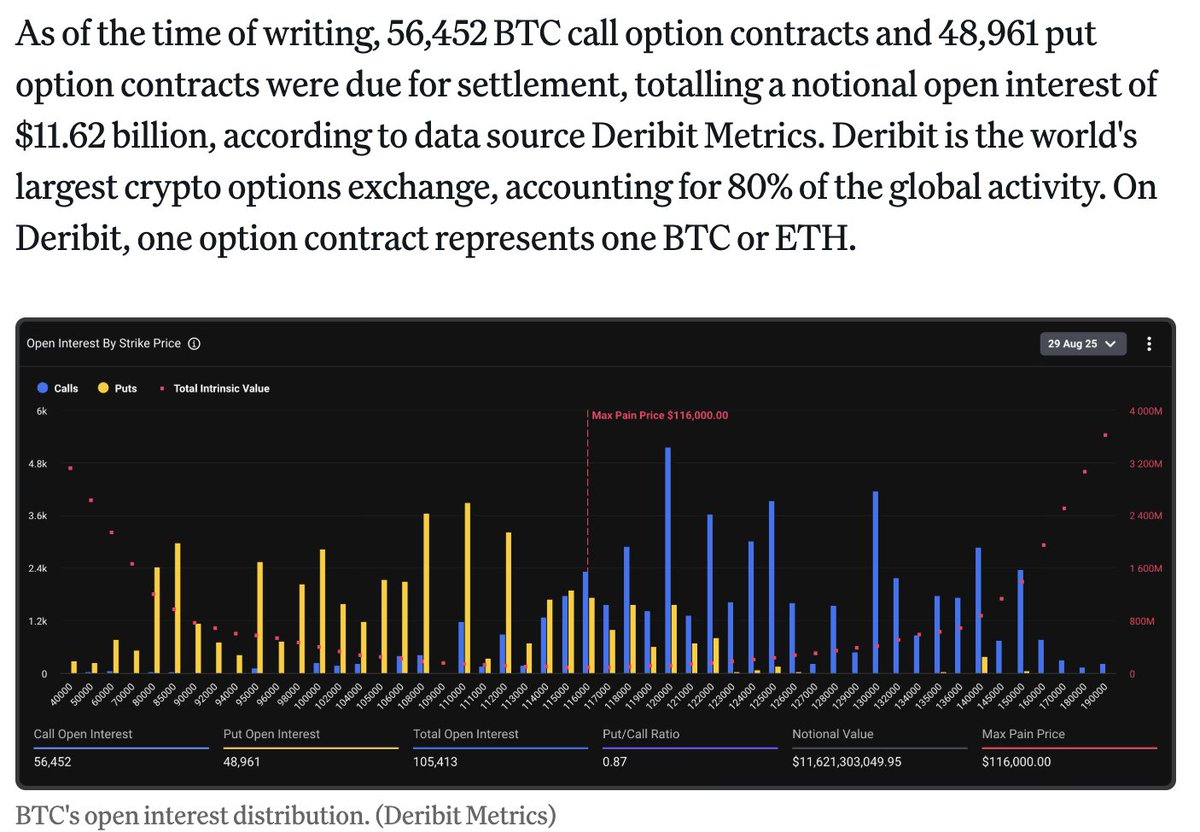

IGNITION TRANSFORMS STARTUPS! "We met mentors who KNOW THEIR SHIT! They told us what we didn't want to hear and pushed us in the RIGHT DIRECTION." - Chris l MC² & Marine l MC² Finance from @MC2finance, Ignition S3 alumni. Their advice? "If you're building on Solana and want to be among the