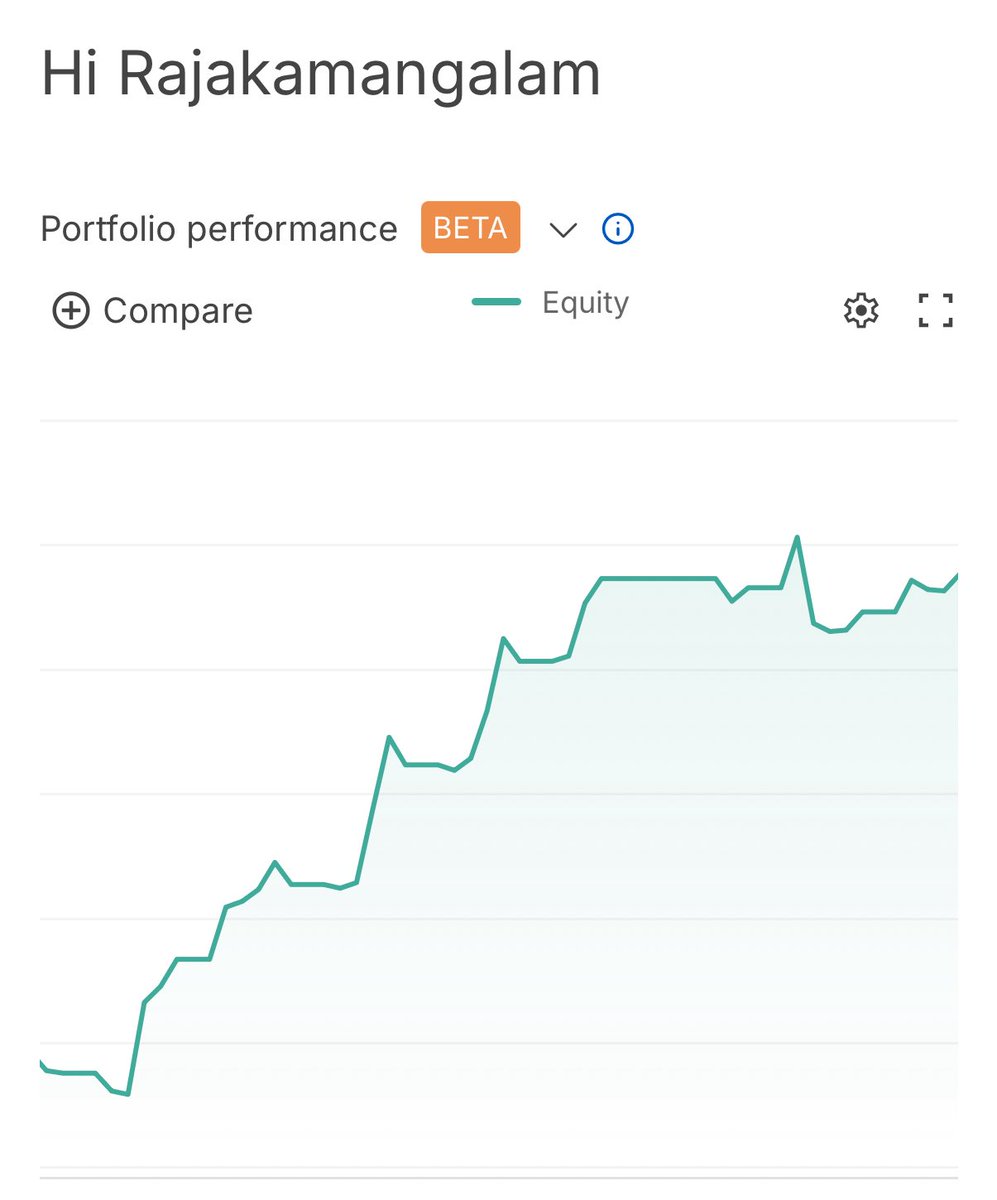

Volatility Volume and Value

@vvvstockanalyst

IIT Madras | Building @_TheValvo, @ValvoInsights | 8 Figure Trader | Growth Investor | Not SEBI Registered | Email : [email protected]

ID: 1421373832770641920

http://www.vvvlearn.com 31-07-2021 07:35:14

20,20K Tweet

109,109K Followers

10 Following