Yaki

@yaki_fomoart

All day degen plays. My view scopes profit | @SonicLabs @base runner.

DM: t.me/Yaki_fomoArt

Degen life: t.me/Degenlife_brot…

ID: 941226161585000448

14-12-2017 08:39:38

4,4K Tweet

14,14K Followers

483 Following

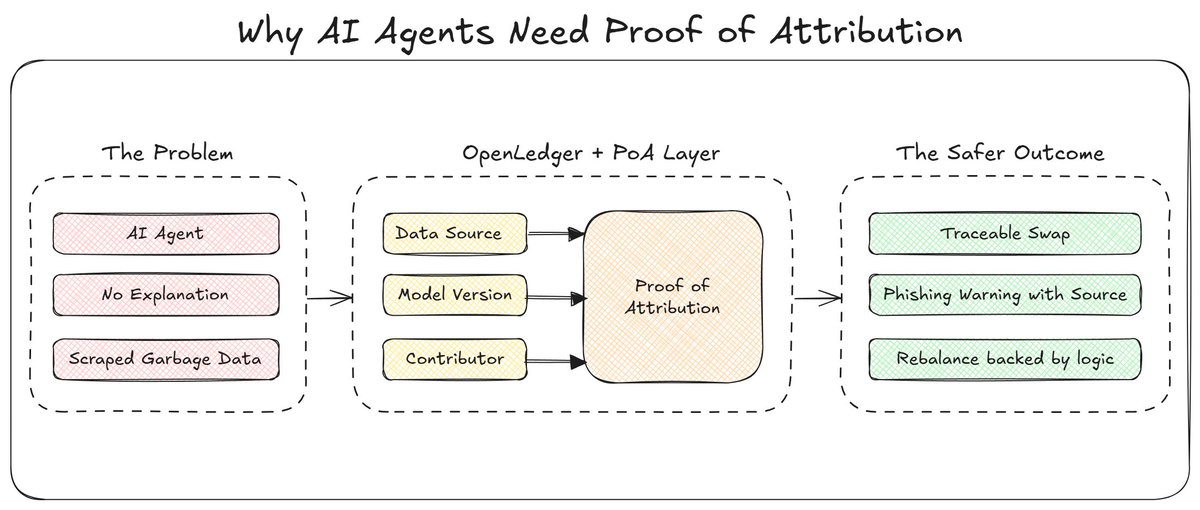

One thing that’s becoming clear is that Openledger is becoming a substrate, something other builders are slotting into their stacks for handle the messy, foundational problems most AI projects don’t want to touch. What I’m seeing here is a slow inversion > Instead of

┈input┈┈╱▔▔▔▔▔▔▔▔▔▔╲ ╱▔▔▔╲▔╲▔╱▔╲ ┈input┈▕ ⚠️Hallucination⚠️ ▏▕ MIRA VERIFY ▏▕✅▏ ┈input┈▕▂▂▂▂▂▂▂▂▂▂▂▏ ╲▂▂▂╱▂▂╱▂▂╱ don’t even talk to me unless ur verifying your outputs w/ Mira (3/3)

What started as a gaming-first chain is now shaping into a broader coordination layer for Asia’s real-world tokenization. Oasys Blockchain upgraded the Oasys Hub to support Ethereum’s Pectra and AA, setting them up for smoother UX and composable account logic, especially important as

Building agent infra is still fragile, slow, and way too reliant on duct-taped data and centralized APIs. SpoonOS 👅🥄 is one of the few frameworks actually architected around that full loop. It’s building an actual OS for AI agents, complete with memory, secure data fetch,

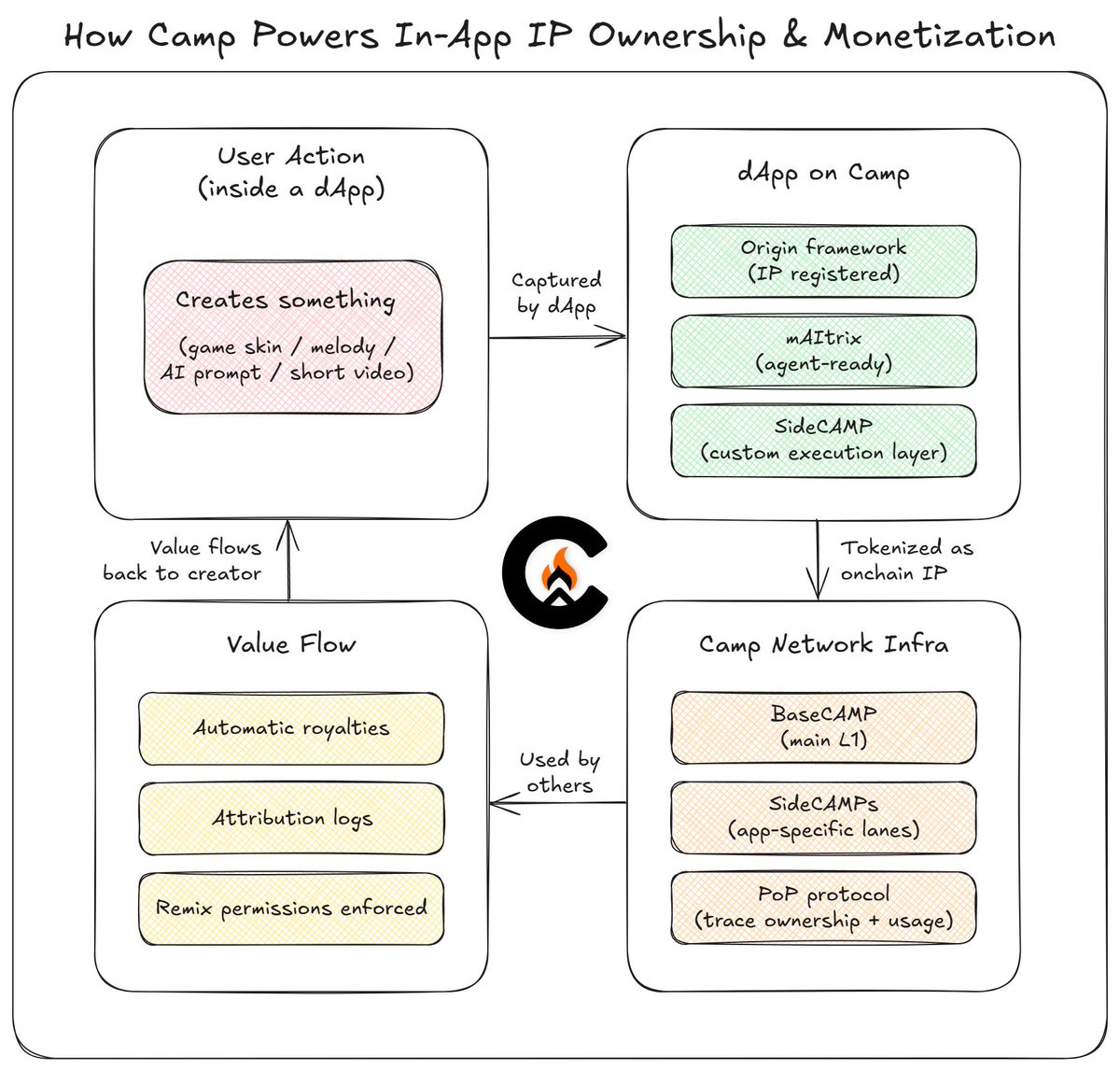

How does user-owned IP actually go mainstream? I don’t think it’s through influencers. It’ll come from apps. From the stuff users already do, remix, and create inside those apps every day. Camp Network ⛺️ gets this at the protocol level. They’re giving dApps the tools to

AI agents in crypto move too fast. And worse, they move too blindly. What if the AI is confidently wrong? Can’t explain itself? Acting on scraped data with zero provenance? We’re still humans here. At some point, Openledger is deliberately slowing agents down at the point of