ACEMAXX ANALYTICS

@acemaxx

Senior Economist - @HSG_Alumni

ID: 21433480

https://acemaxxanalytics.substack.com/ 20-02-2009 21:01:48

86,86K Tweet

6,6K Followers

412 Following

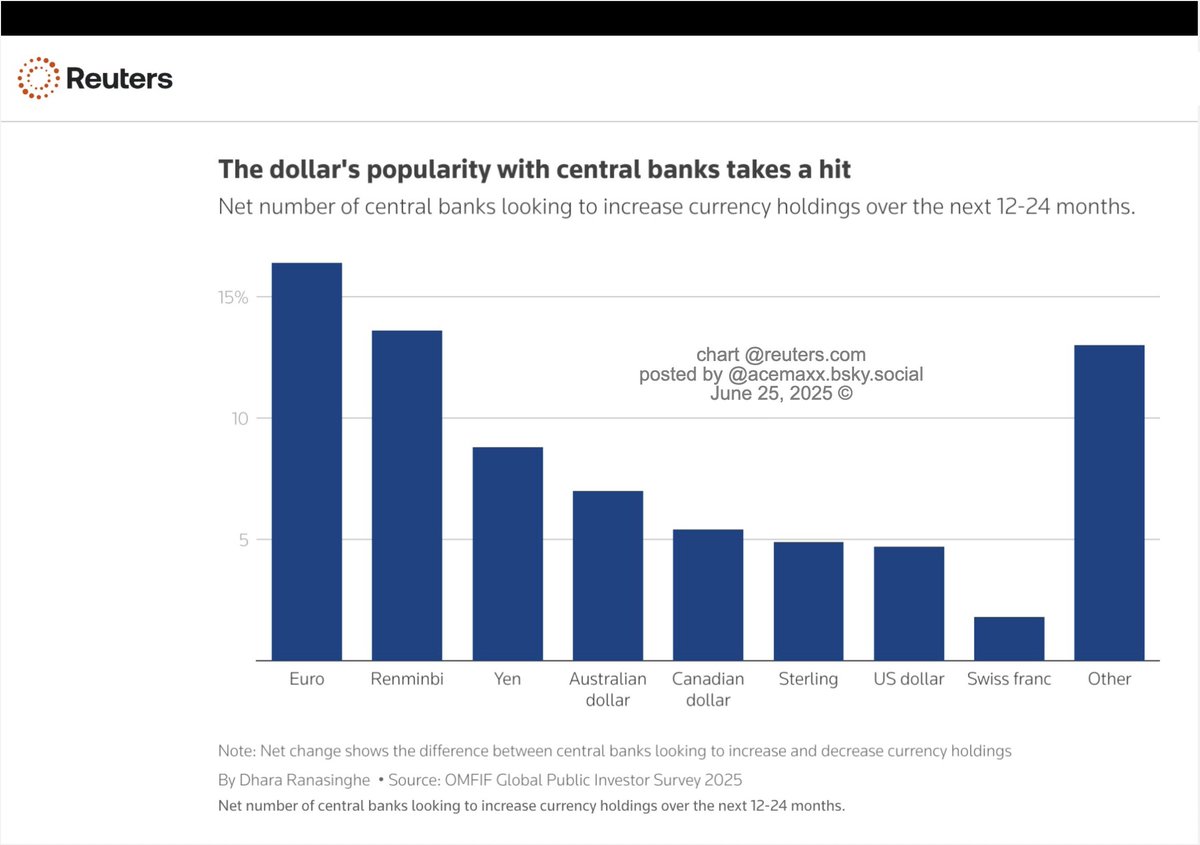

OMFIF #survey #gold seen as biggest winner from USD diversification - #euro seen top currency to benefit in short term, chart Dhara Ranasinghe & Yörük Bahçeli reuters.com/world/china/ce…

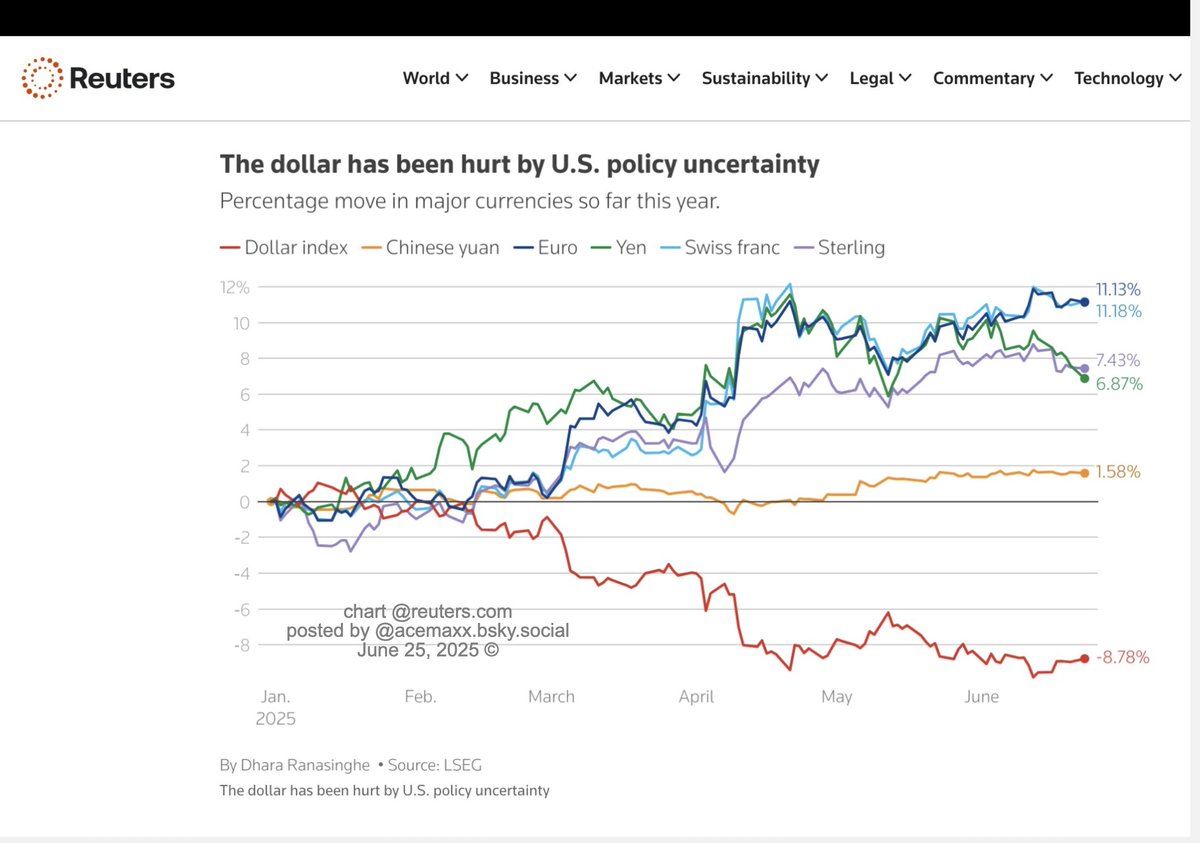

#FX US #dollar has been hurt by US policy #uncertainty, chart Dhara Ranasinghe & Yörük Bahçeli

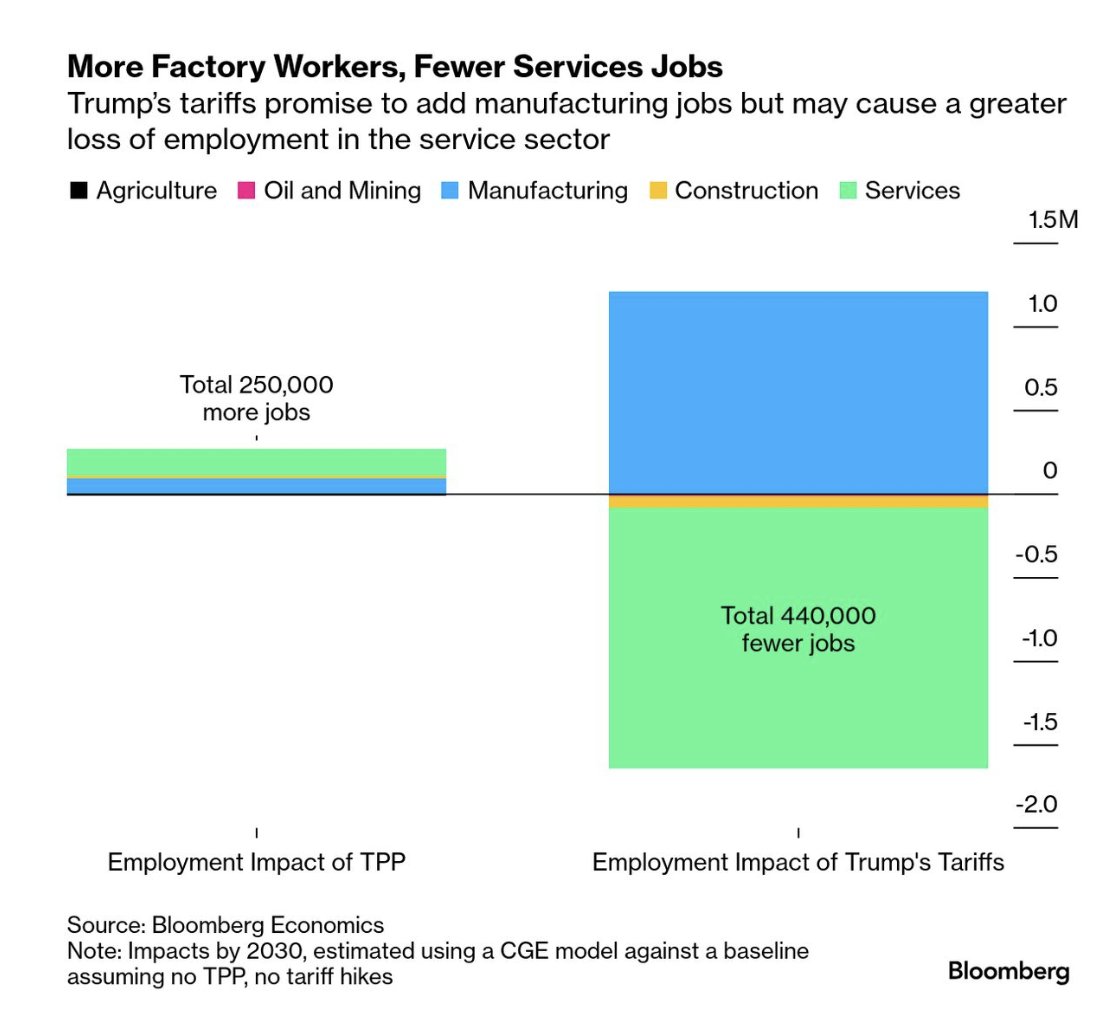

As long as the #tariff outlook remains cloudy, the pain is likely to persist with companies reining in their investments and cutting jobs while adopting a wait-and-see approach, chart Bloomberg Politics bloomberg.com/news/articles/…

Given neither party has expressed a clear commitment to fiscal consolidation, concerns about the US’s #fiscal trajectory may persist, which may lead to an expansion of risk premia and higher bond yields, chart Goldman Sachs

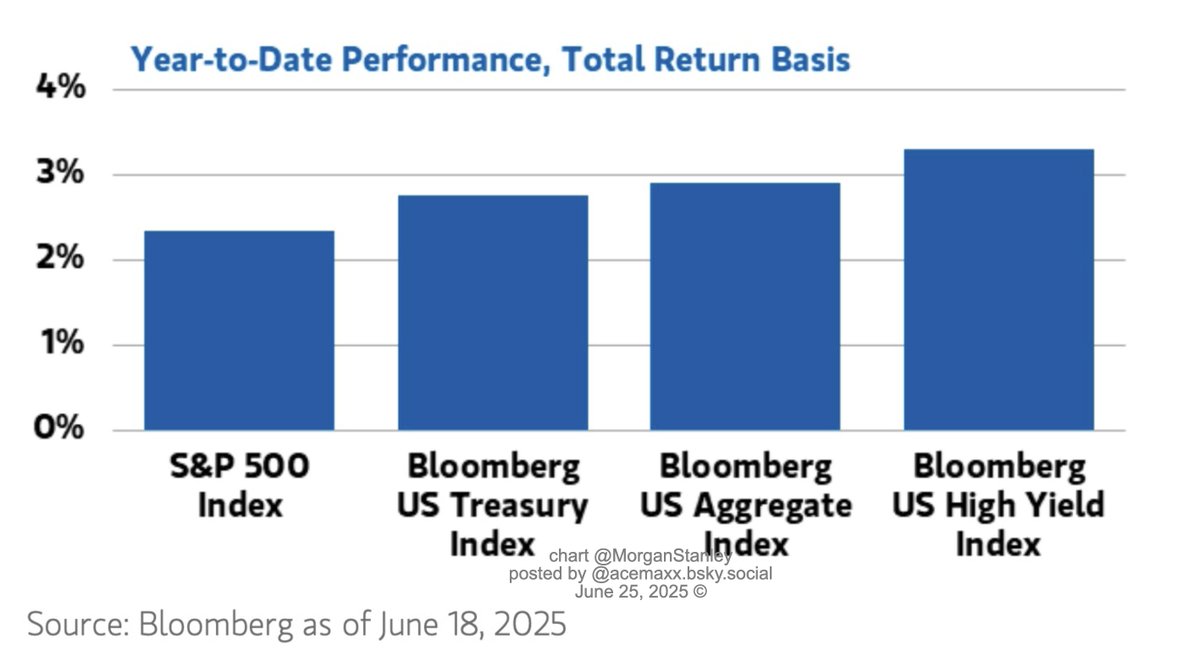

#Bonds have outperformed stocks for the year to date, despite stronger headwinds, from #Fed policy pivot, to tariff -related inflation risks to expectations for growing deficits given upcoming #tax #bill legislation, chart Morgan Stanley

A new #book – “How Progress Ends: Technology, Innovation and the Fate of Nations” by Carl Benedikt Frey Oxford Internet Institute Carl Benedikt Frey Princeton University Press Sept 16, 2025 press.princeton.edu/books/hardcove…

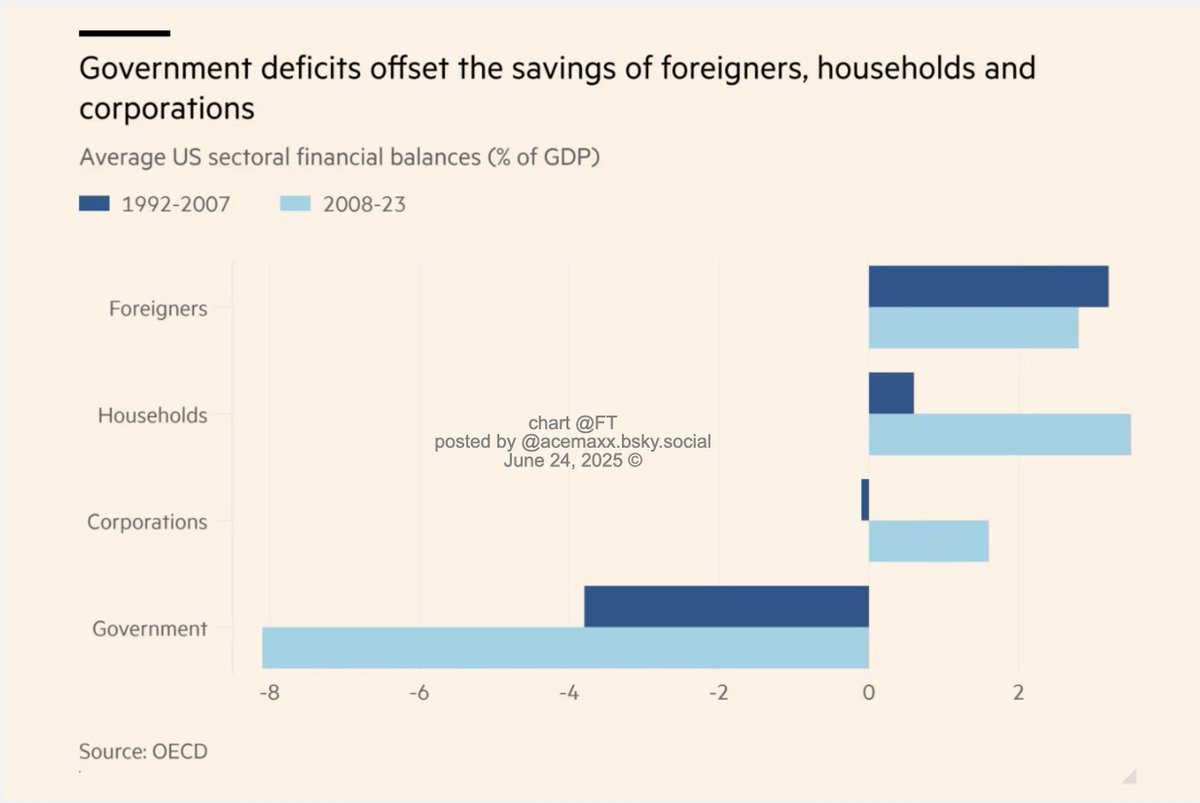

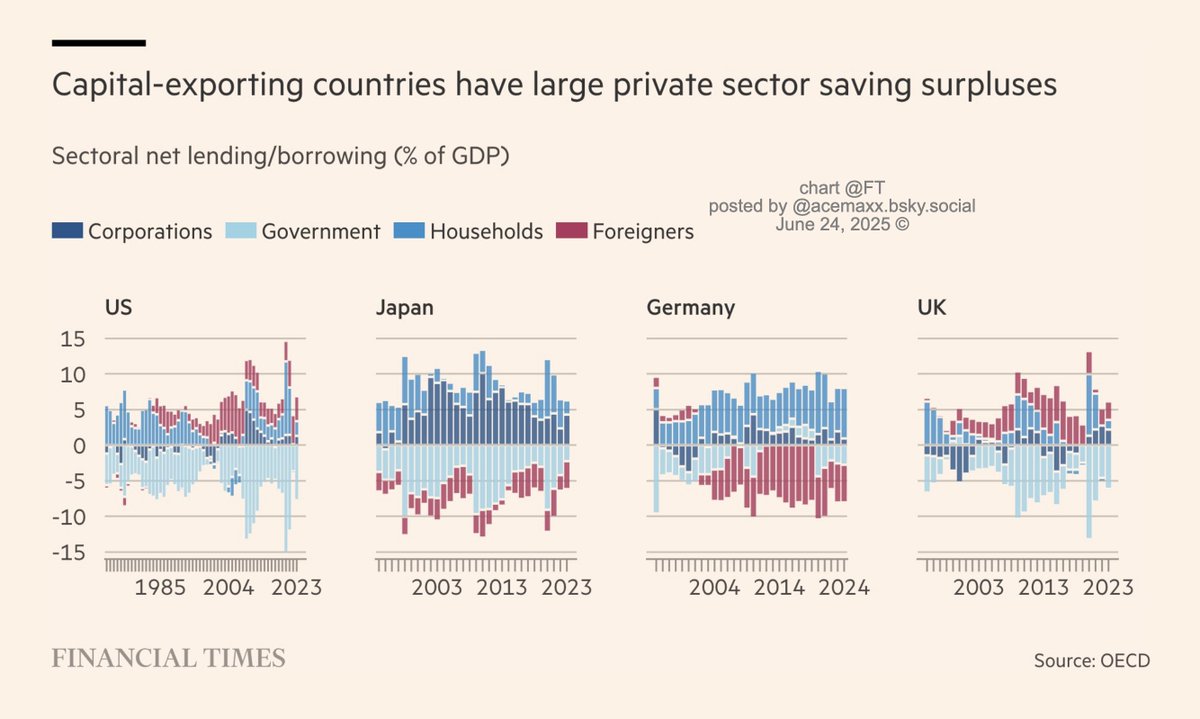

The Govt sector’s liability is the private sector’s asset, note: at the aggregate level, income equals expenditures, chart Financial Times ft.com/content/e2c8c6…

A salient feature in terms of the sectoral financial balances in the US: The private sector is a net #saver – What is US Govt supposed to do, double down on saving? - chart Financial Times ft.com/content/e2c8c6…

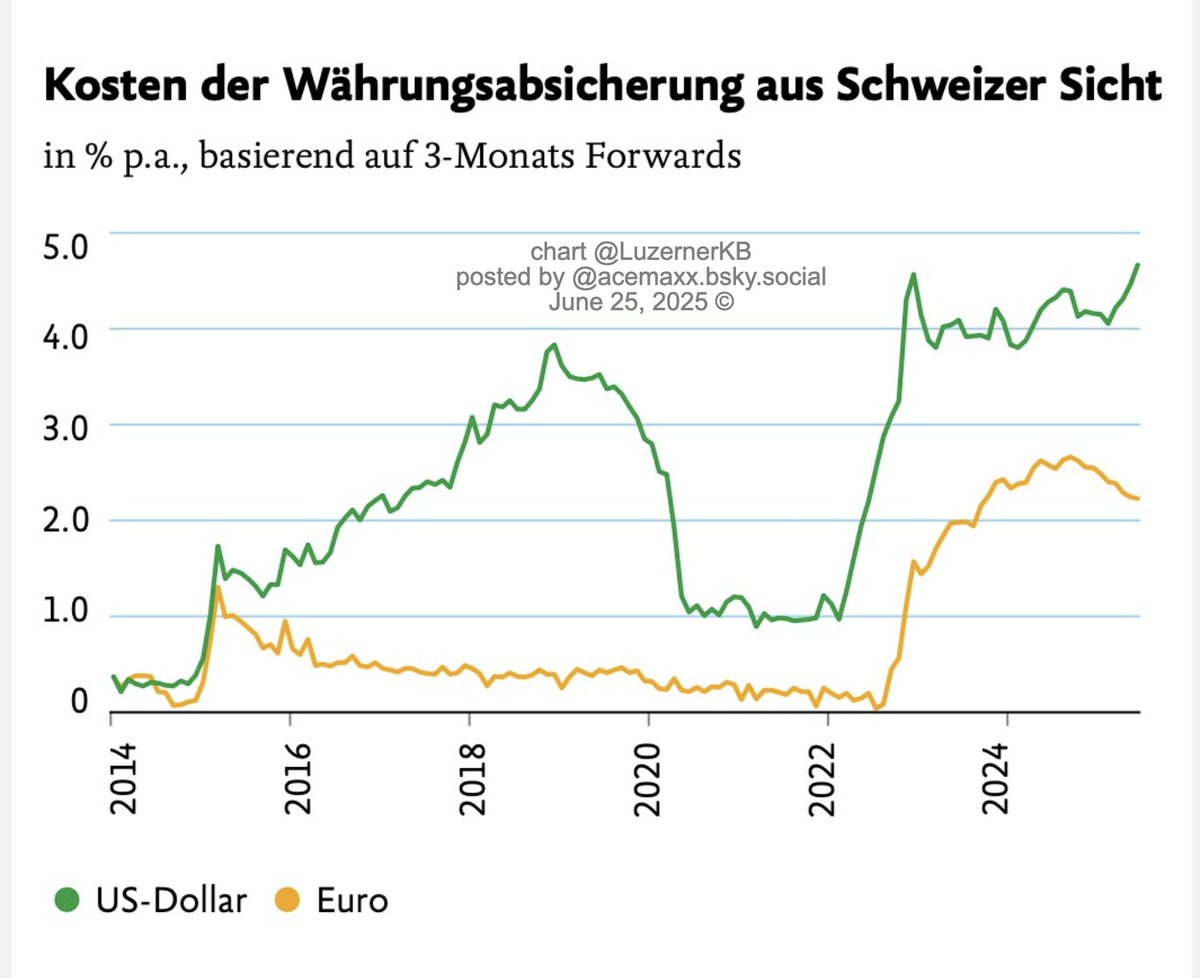

#FX US #dollar and #euro - Swiss franc 3-months forwards The cost of currency #hedging from the view of #Swiss FX traders, chart Luzerner Kantonalbank

Oops! #Swiss SARON (o/n interest rate of the secured money market for CHF) drop below zero: -0.5% vis-à-vis SNB policy rate: 0.0% and 10y Govt bond yield: 0.359% -- #Swiss franc #swaps rate for 2y: -0.1475% and 3y: -0.0575%, 5y: 0.1125% chart Swiss National Bank snb.ch/en/the-snb/man…

JPMorgan Research, like #Fed, expects #tariffs to boost #inflation in the months ahead, pushing y-o-y consumption #deflator inflation to 3% or above by the 4Q2025, chart David Kelly J.P. Morgan Asset Management

(in the light of currents events) A chart from Aug 2024, comparing the US economy under Trump and Biden, chart Enrico Colombatto gisreportsonline.com/r/us-econ-repu…

#economics A new upcoming #book “Intermediate Macroeconomics” Theory, Policy and Competing Perspective Louis-Philippe Rochon June 2025 Elgar Publishing e-elgar.com/shop/gbp/inter…