Asher Siddiqui

@ashercdkey

ID: 3006618943

01-02-2015 12:24:49

404 Tweet

218 Followers

317 Following

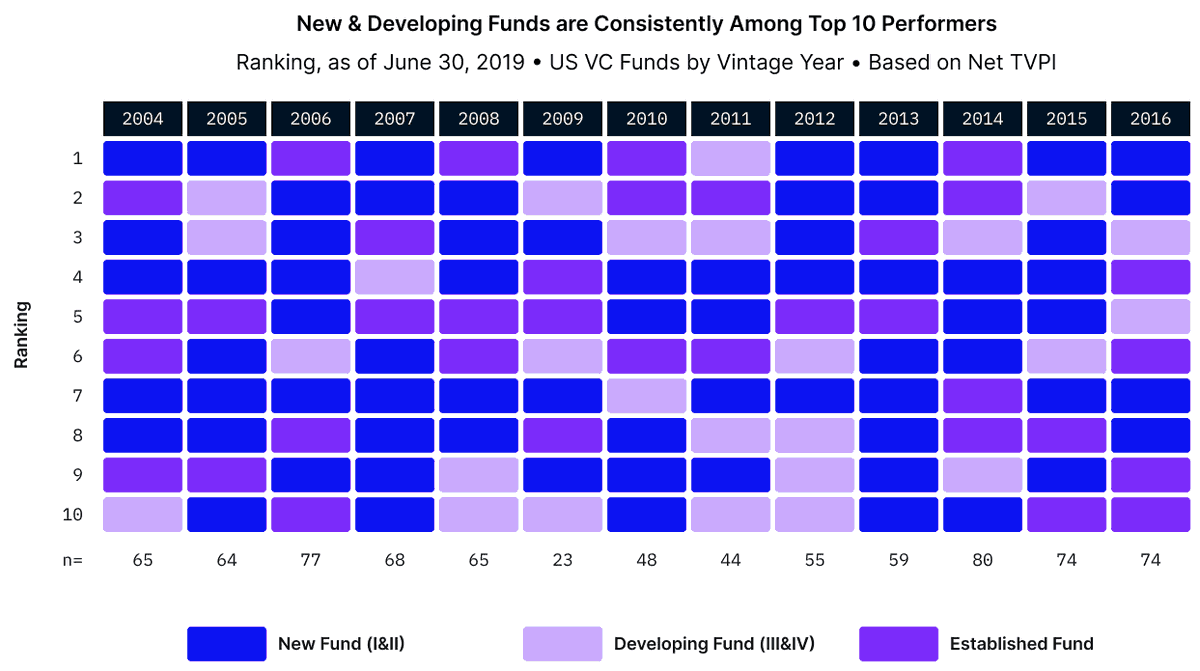

Since everyone has thoughts on the market & VC, thought I'd share our recent newsletter (we also compiled some great resources and data from David Sacks CB Insights fintechjunkie Carta) ventureunlocked.substack.com/p/the-bull-mar…

"We're transitioning from a very loose liquidity regime to a much tighter liquidity regime so we're going to have to overshoot historical levels before we stabilize," says Mohamed A. El-Erian on why the markets could have more losses ahead.

New Ep! Tusk Venture Partners Jordan Nof talks with samir kaji about evolving to an early-stage firm, navigating regulatory hurdles for startups, and what the future holds for crypto Listen and subscribe at ventureunlocked.substack.com

Never thought I would see Alfred Chuang from Race Capital switch to shorts!…seen here in conversation with SBF

Best part of this episode was David Sacks maintaining intellectual integrity and highlighting that “woke-ism” and “mob mentality” have existed on both the right and the left of the political spectrum for a long time … podcasts.apple.com/us/podcast/all…