Vishranth Suresh

@assetplusvish

Founder & CEO @assetplusapp. Strong believer in Mutual Funds. Helping 10000+ MFDs and 1L+ investors in their wealth creation journey.

ID: 1727374592464044032

22-11-2023 17:13:16

426 Tweet

664 Followers

144 Following

Did a podcast after AssetPlus crossed ₹5000 Cr in AUM! Spoke about - How AssetPlus started, Future of mutual funds, Role of MFDs, What’s next for us. Candid, honest chat on all things wealthtech. Watch here: youtu.be/DC4ngJn1FQo Thanks avanne dubash ! AssetPlus - Best Platform for MFDs

Hit play and unfold the stories behind the success. dub.link/cDgLDgP What happens when you swap a formal debrief with a bowl of mystery chits? Presenting "Unfold with Founders" - a one-of-a-kind candid chat with AssetPlus founders Vishranth Suresh & Awanish Raj , as they

Woke up to these comments on one of our videos. This is what keeps us going at AssetPlus - Best Platform for MFDs. Although we are a digital platform, this business is all about trust & relationships. #Assetplus #MutualFunds #Fintech

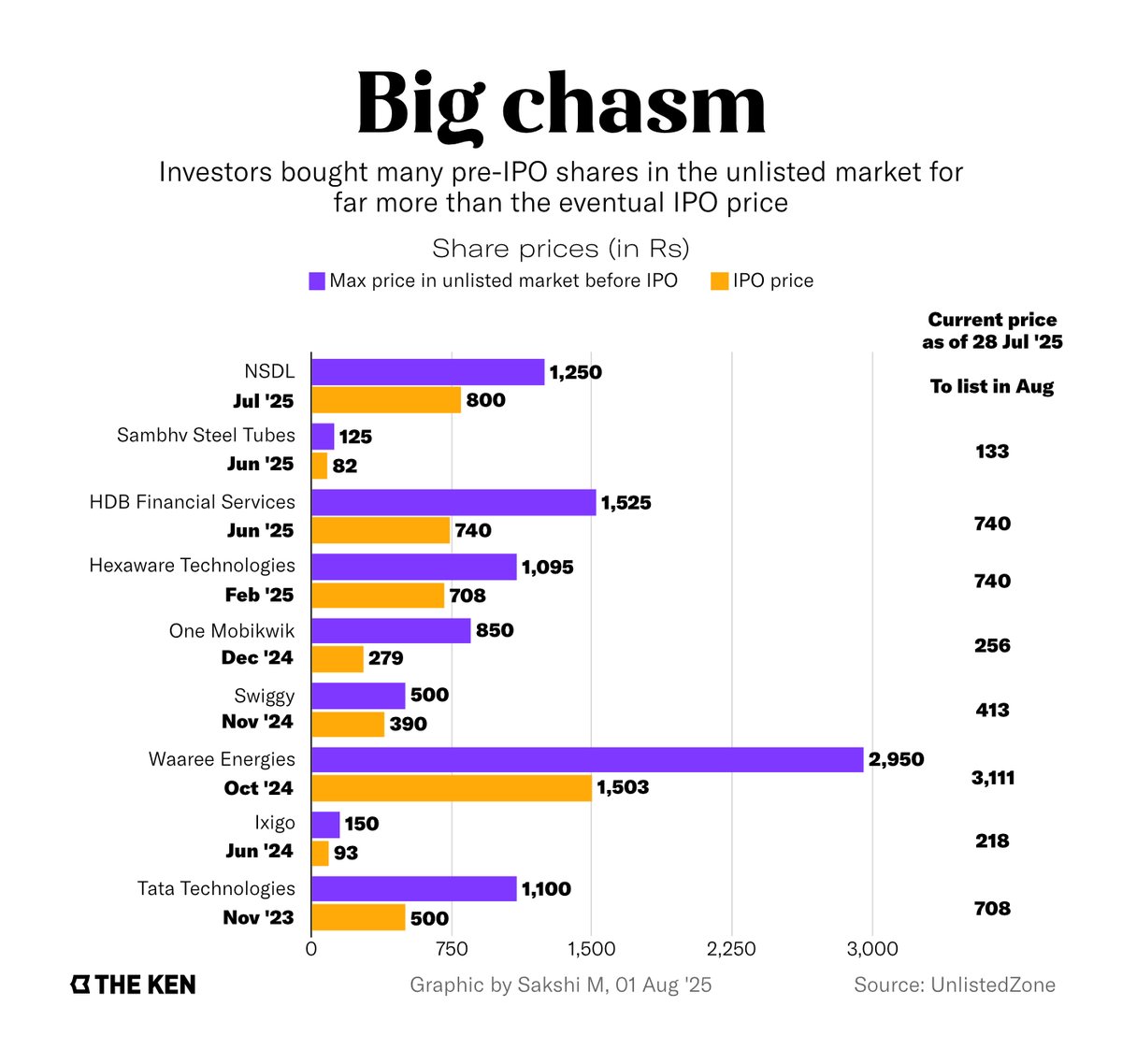

Unlisted shares have become the new frenzy. Retail investors are chasing early entry into pre-IPO names but many are paying a steep price. NSDL, HDB, Hexaware, even Swiggy! Several listed well below their unlisted highs. Some still haven’t recovered. At AssetPlus - Best Platform for MFDs, we’ve