ASXN

@asxn_r

Boutique Digital Assets Research and Infrastructure | @asxnlabs

ID: 1651245573226332160

https://www.asxn.xyz/ 26-04-2023 15:23:31

1,1K Tweet

12,12K Followers

943 Following

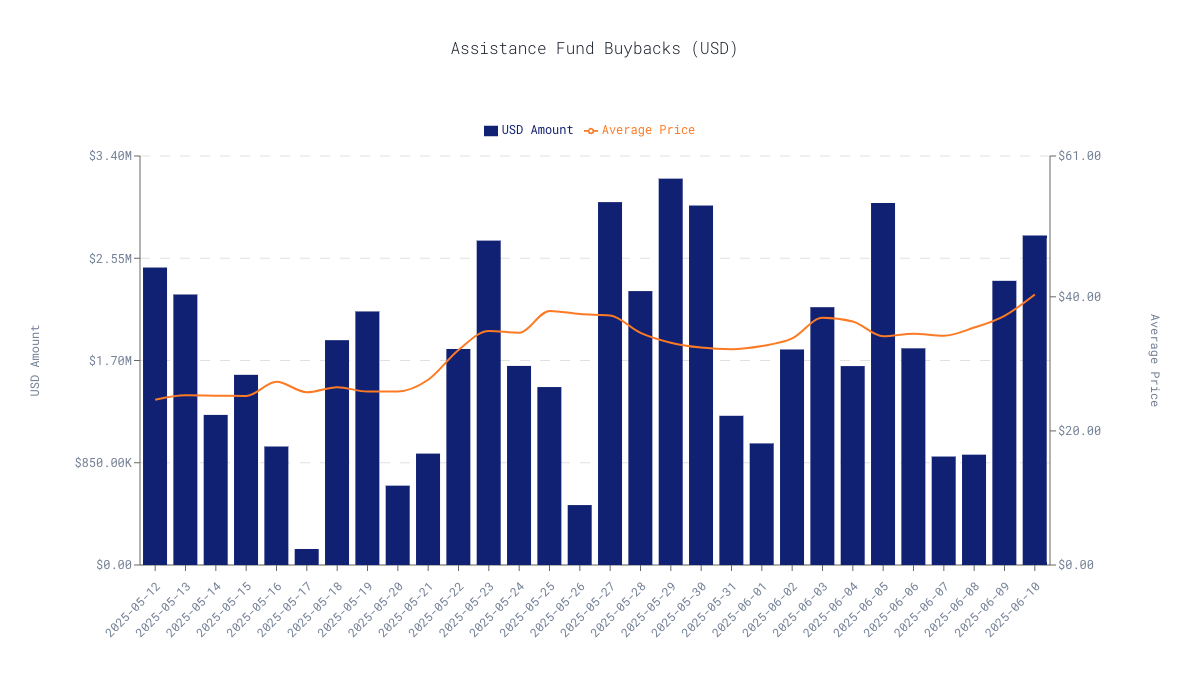

The Hyperliquid AF bought $2.74M USD (67.88K HYPE) in HYPE yesterday, at an average price of $40.35. Over the past week, the AF has bought back 427.85K HYPE ($15.53M USD) - approximately 0.13% of the circulating supply.

Great report on HIP-3/builder-deployed perps on Hyperliquid