Ben Valdez

@benmvaldez

Reporter @TaxNotes covering the IRS. Cat dad. @GWtweets alum. Signal: benmvaldez.53

ID: 1433497011542757377

02-09-2021 18:28:40

47 Tweet

92 Followers

78 Following

The IRS has begun to fire thousands of probationary employees in the enforcement arena as part of the Trump administration’s ongoing effort to shrink the federal workforce. Ben Valdez has the story: taxnotes.co/4hY5GGo

IRS Chief Operating Officer Melanie Krause is set to take over as the interim leader of the agency following the retirement of acting Commissioner Douglas O’Donnell. Read more from Ben Valdez: taxnotes.co/4bhRoxU

From Ben Valdez: The National Treasury Employees Union estimates that as many as 5,000 IRS employees accepted the deferred resignation offer from the Office of Personnel Management. taxnotes.co/3F5MesY

As senators continue work to address tonight's government funding deadline, Ben Valdez has the details on what happens to the IRS in the case of a shutdown: Acting IRS Commissioner Melanie Krause said that all employees will be exempt from furlough. taxnotes.com/tax-notes-toda…

Some news from Doug Sword: The chair of the House Ways and Means Oversight Subcommittee, which has jurisdiction over the IRS, said the agency is no longer returning his calls. “I’ve had no one to talk to for a while,” Schweikert told reporters April 1. taxnotes.com/tax-notes-toda…

A proposed 20 percent IRS funding cut in the administration’s fiscal 2026 budget would reduce the tax collector’s funding to its lowest level since 2002, despite accumulated inflation amounting to 70 percent in the interim. From Doug Sword & Ben Valdez: taxnotes.co/44poTwX

Via Doug Sword: The House Ways and Means Committee released details of its much-awaited $4 trillion-plus tax package including an extension of expiring Tax Cuts and Jobs Act provisions, scheduling the 28-page legislation to be marked up May 13. taxnotes.com/tax-notes-toda…

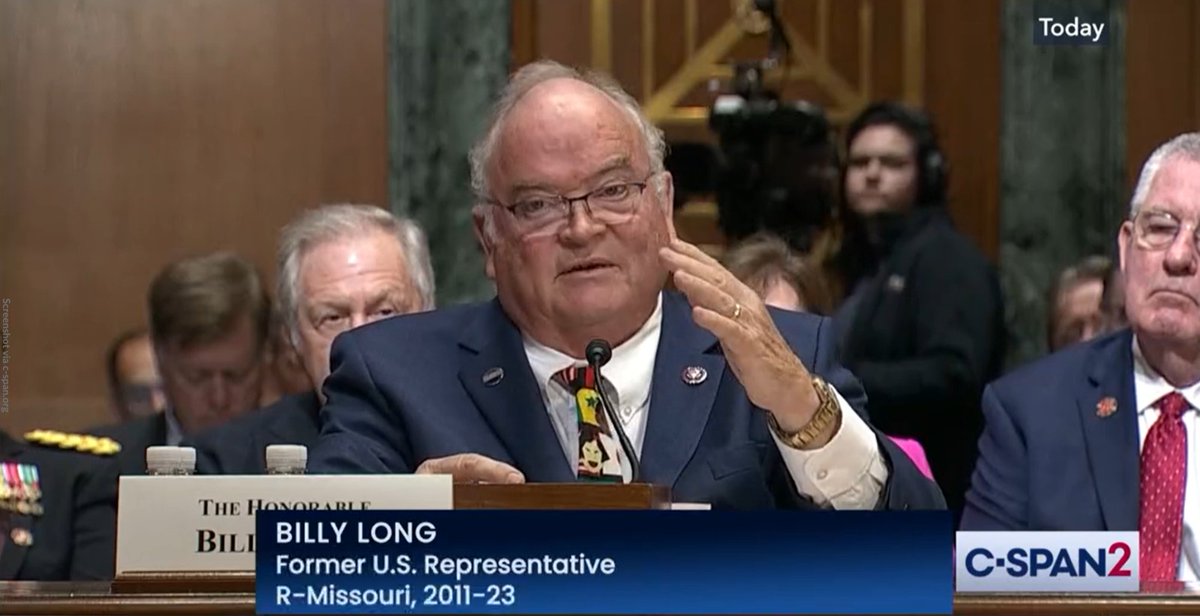

Prospective IRS commissioner Billy Long downplayed concerns from Senate Democrats over his connection to a business that sells tax credits the IRS says don’t exist, saying “the jury’s still out” on their legality. More on Long's hearing from Ben Valdez: taxnotes.co/3ZtnFNL

Our IRS reporter Ben Valdez covered Commissioner nominee Billy Long's confirmation hearing, and how he downplayed concerns over his connection to a business that sells tax credits the IRS says don’t exist, saying “the jury’s still out” on their legality. taxnotes.com/tax-notes-toda…

JUST IN: The IRS has lost over 26,000 employees and will likely struggle to meet taxpayer needs next filing season without more hiring, according to National Taxpayer Advocate Erin Collins. Read more from Ben Valdez: taxnotes.co/4ltZrvH