Heather Long

@byheatherlong

Economic columnist @washingtonpost | Data aficionado | Views my own | Email: [email protected]

ID: 257354839

https://www.washingtonpost.com/people/heather-long 25-02-2011 07:04:07

36,36K Tweet

76,76K Followers

2,2K Following

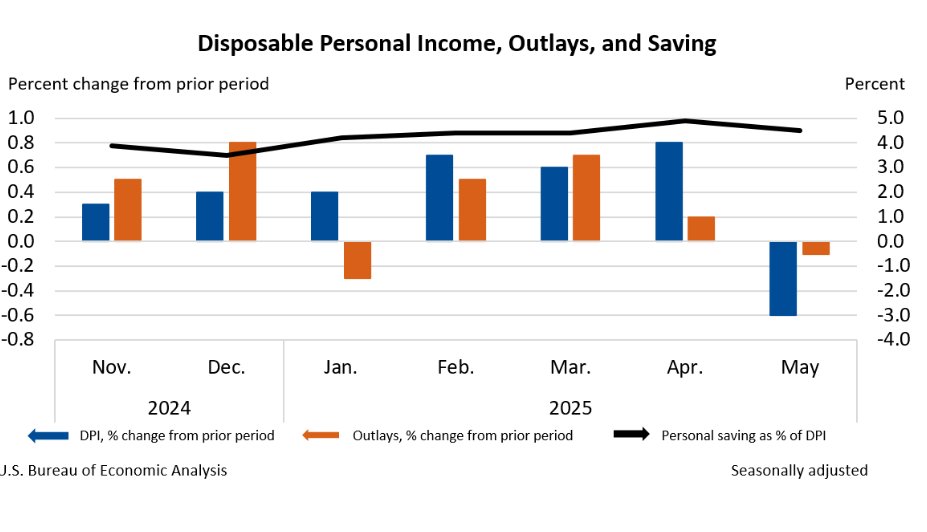

Close to 70% of U.S. consumers think there will be a recession in the next year, according to the The Conference Board release today. Economists put the odds at about 30 to 35%. It's interesting that on "Main Street," fears of a recession have remained high, even as trade tensions