cami

@camidarling

posting @cointracker @cointrackerent

ID: 1518746929529819142

http://www.camidarling.xyz/ 26-04-2022 00:21:09

1,1K Tweet

926 Followers

506 Following

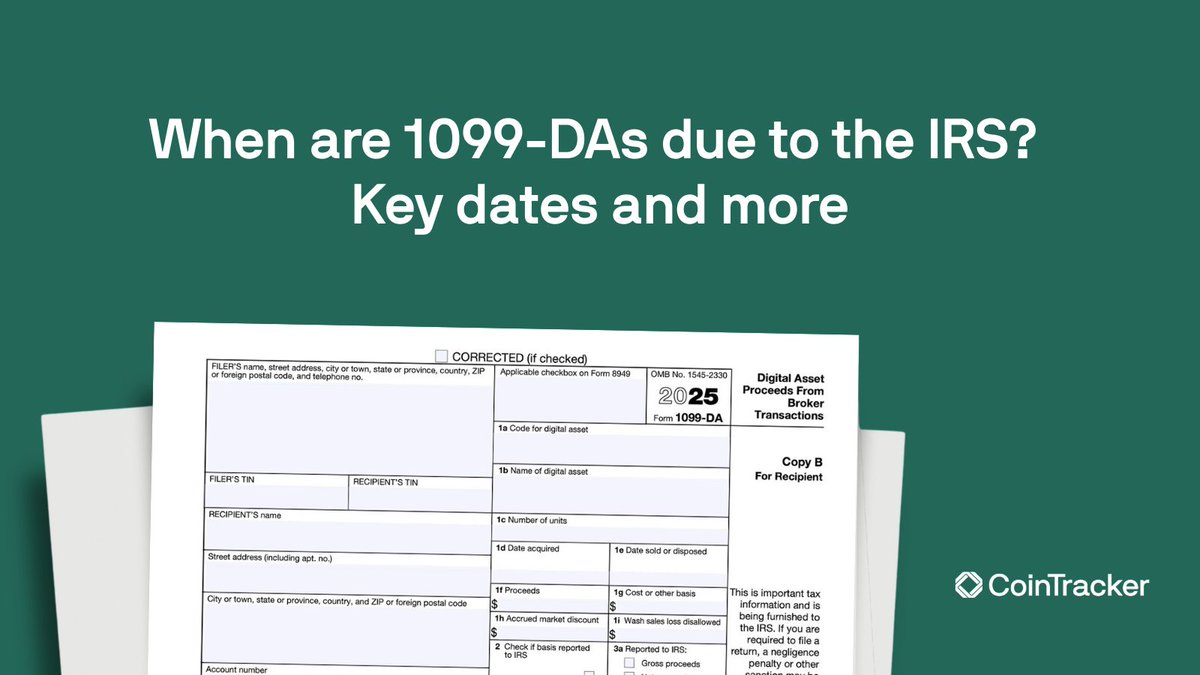

WATCH: CoinTracker COO, Vera Tzoneva, says IRS data shows low compliance, but new broker 1099 rules could push awareness close to 100%. Interview by Alp G. CoinTracker | Vera Tzoneva | Alp Gasimov