Capitalmind

@capitalmind_in

We are a SEBI-registered Portfolio Management Service offering long-term wealth-building with effective investment strategies.

More: cm.social/pms

ID: 2744421848

https://capitalmind.in 19-08-2014 09:16:54

23,23K Tweet

48,48K Followers

57 Following

Just dropped a conversation with Deepak Shenoy , founder of Capitalmind . We covered everything from asset allocation and stock picking to gold myths, global investing, and how Gen Z is building wealth. Let’s break it down 🧵👇

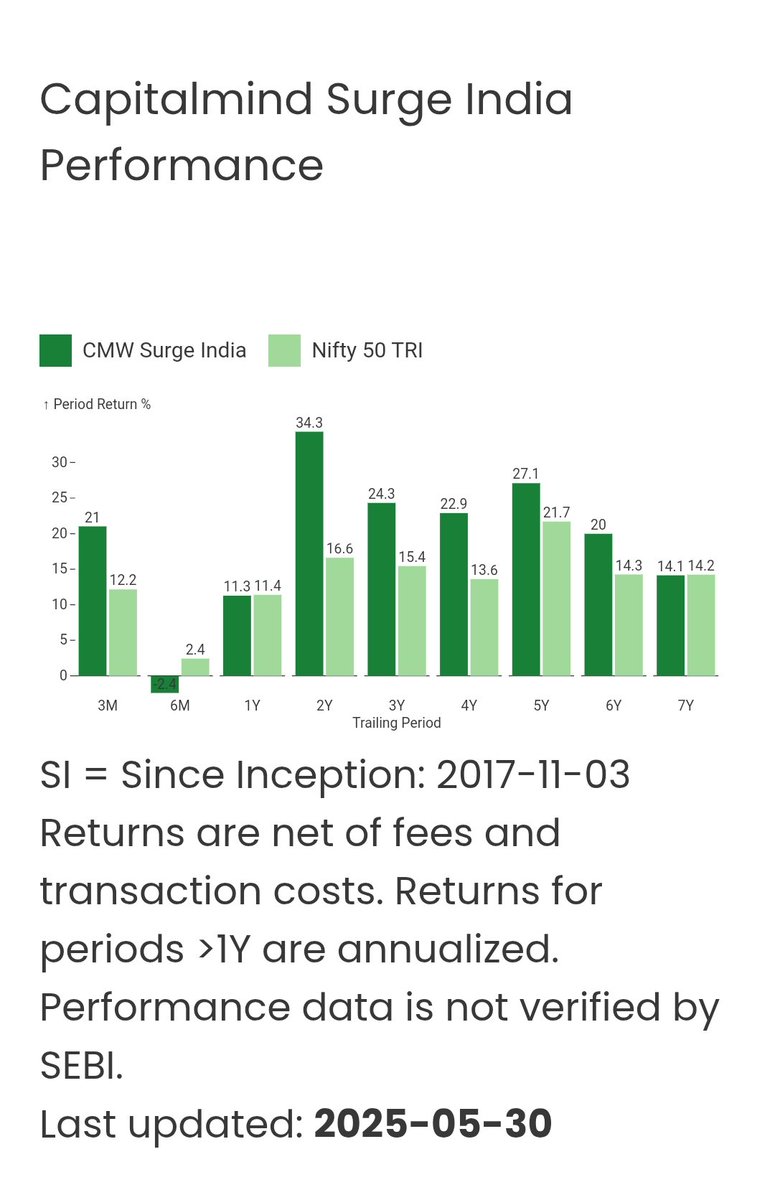

Pradeep Nalluri Hi Pradeep, thank you for your interest. Yes, not just the model portfolio, but the actual domestic Surge India portfolio (which mirrors our NRI offering) has outperformed even the S&P 500 in dollar terms (here are the numbers as of mid-may). Let me know if you would like more

Surge India's has a good three months, and has managed to get back to par on a 1 year basis. It's done well in most longer periods. Connect with the Capitalmind PMS at cm.social/pms-connect