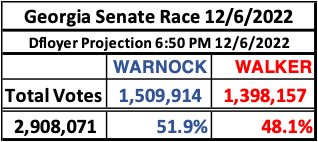

David Floyer

@dfloyer

Wide & deep international datacenter experience

ID: 23650527

http://www.wikibon.org 10-03-2009 20:33:11

1,1K Tweet

1,1K Followers

103 Following

Matt Baker Sarbjeet Johal Dell EMC I guess it's like seeding the cloud...once it's populated w/ apps & data it's agile but there's a setup time. Sort of like a caching architecture that has to be "warmed up" - but it's not identical to public cloud pricing...neither is Outposts :-)

Sarbjeet Johal Massachusetts Institute of Technology (MIT) Dr Efi Pylarinou John Furrier Dion Hinchcliffe Tim Crawford Crawford Del Prete Fintechwali Sharena Rice, PhD Eric Kavanagh on #DMRadio Simple you young entrepreneurs- It’s all about the cash! Rule #1 - don’t run out of cash Rule # 2 - refer to rule #1

Dave Vellante 2022 total Amazon revenue was 514 billion and AWS was 80 billion. Normal IT spend on such business will be around 3%-4% of revenues (at such scale). If 50% to 60% of that is on AWS, it will be between $8-$10 billion. Hold on, (now that I am thinking), because AWS is all/pure

Here's how we see the semiconductor ecosystem growing over the next 5 years. NVIDIA projections include more than just chips. Broadcom is semis only. $900B+ by 2028 Sarbjeet Johal John Furrier Qualcomm TSMC $AVGO $NVDA = 45% of the market by '28 #thecuberesearch

Patrick Moorhead This makes a lot of sense to me. For a reference point, ARM market cap is $123 billion (rounded) and Intel market cap is $81 billion (rounded). It’s amazing how Nvidia abstracted ISA (instruction set architecture) with CUDA. It kills one of the biggest objection for adoption of