Dave Brock

@drbrock37

the bullish brock - ag commodity researcher/consultant/speaker - dad of 4 - Purdue BSME & MS ag econ, IU MBA - tweets r mine & not advice - prez @thebrockreport

ID: 259733194

http://www.brockreport.com 02-03-2011 13:52:29

5,5K Tweet

3,3K Followers

2,2K Following

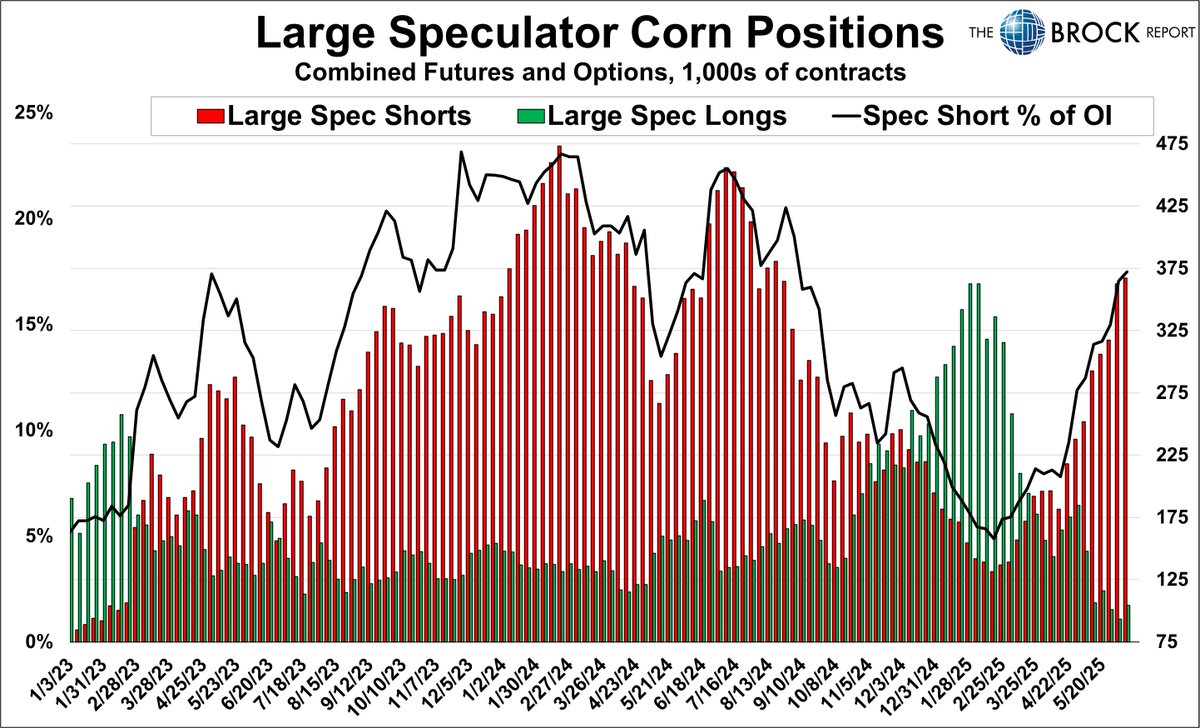

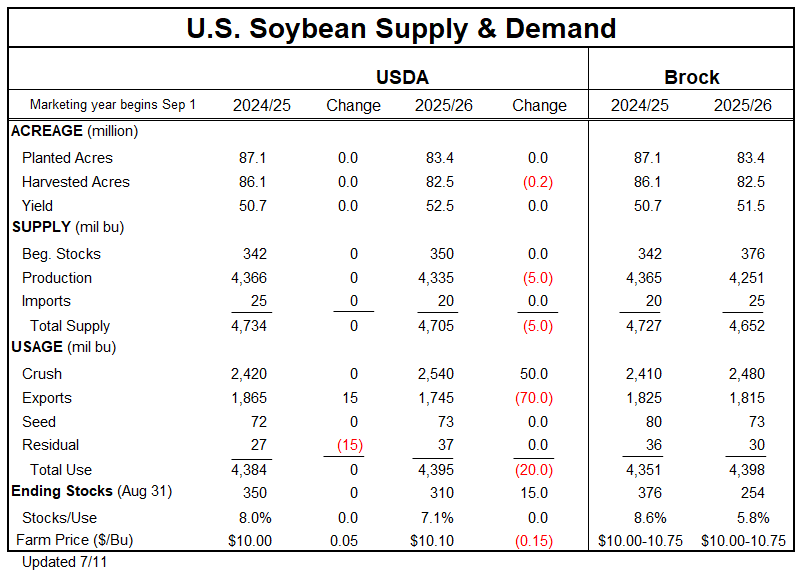

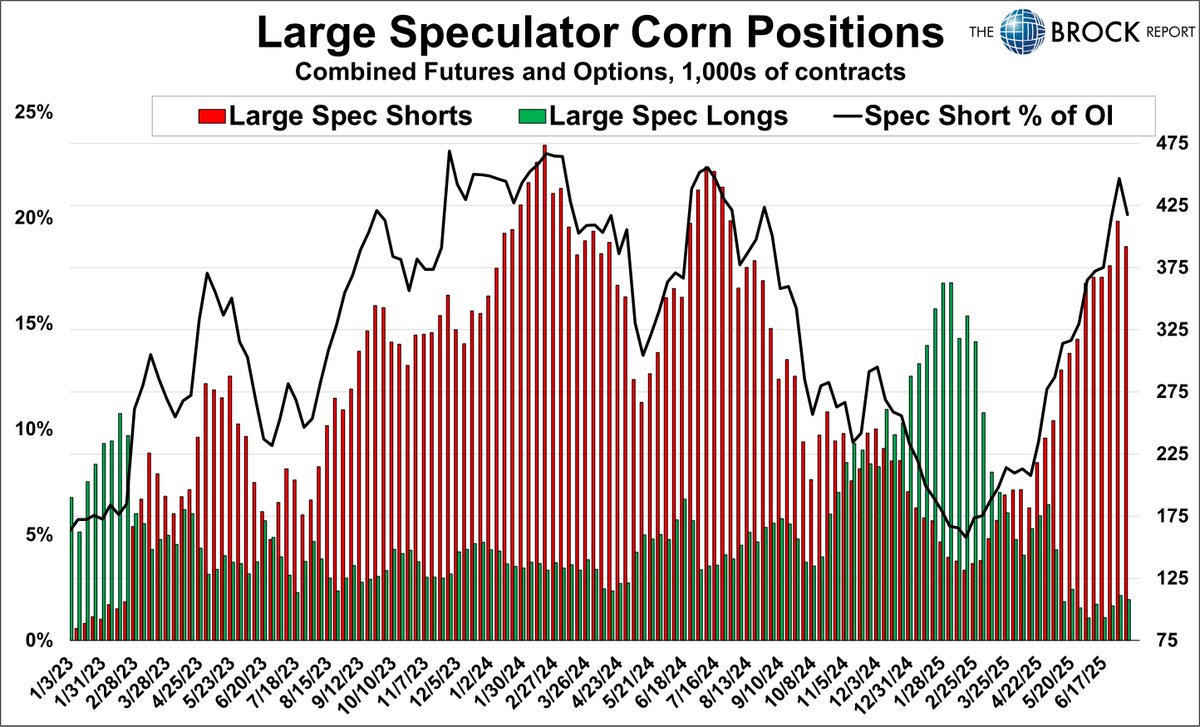

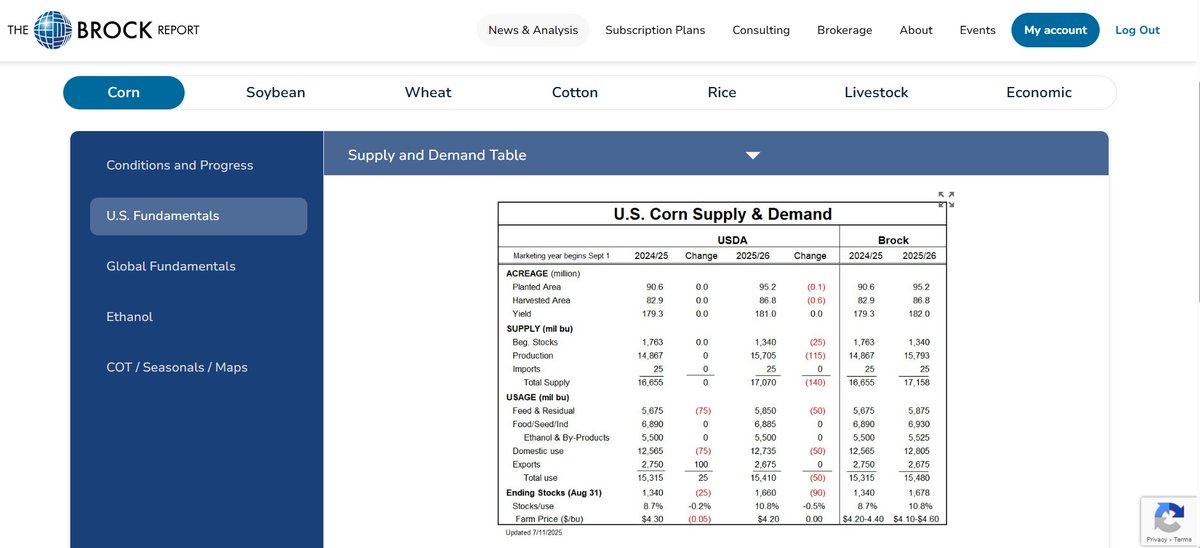

This corn market can't seem to find a way out of this sideways to lower pattern since there doesn't seem to be a weather story along with funds short the market and trade uncertain. David Brock (Dave Brock) from Brock Associates joins us to talk about it. youtube.com/watch?v=VLmZ02…

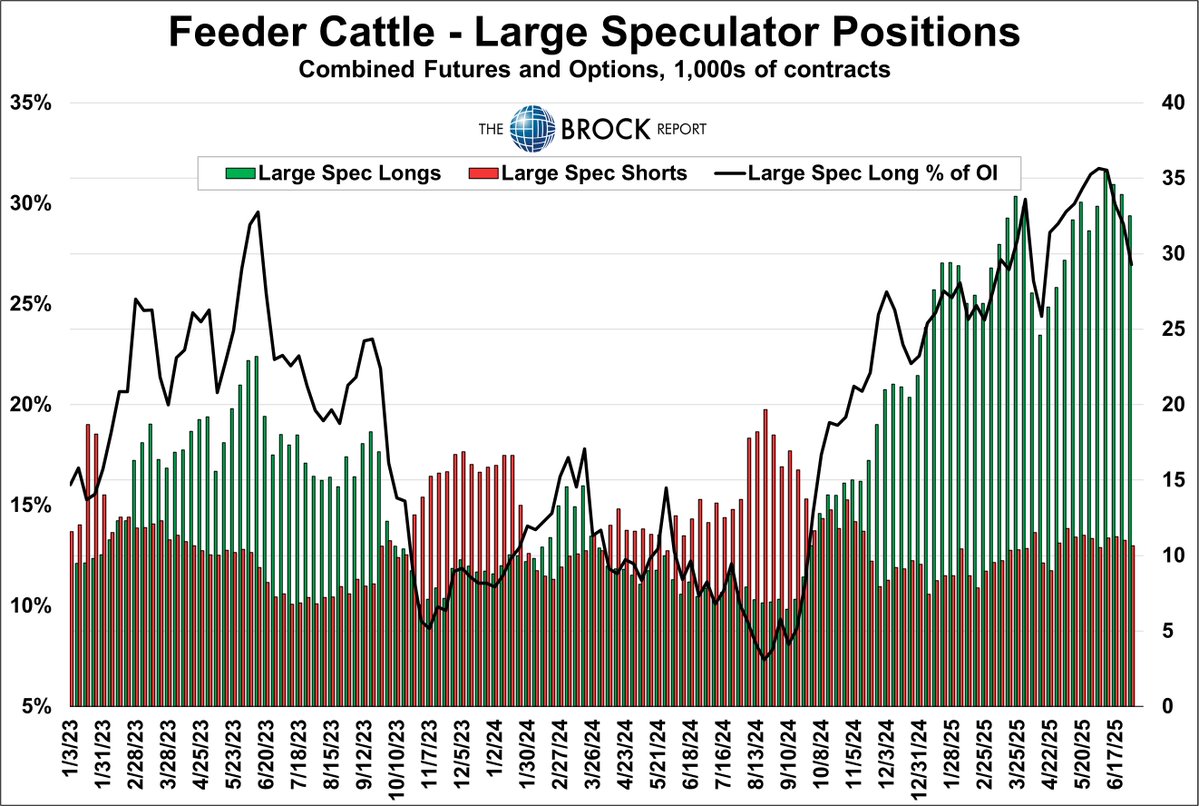

BREAKING: Dept. of Agriculture announces a new case of New World Screwworm has been reported by Mexican officials, 370 miles south of the U.S./Mexico border. Secretary Rollins has ordered the closure of livestock trade through southern ports of entry effective immediately. Stay tuned for more