DYθR

@dyorcryptoapp

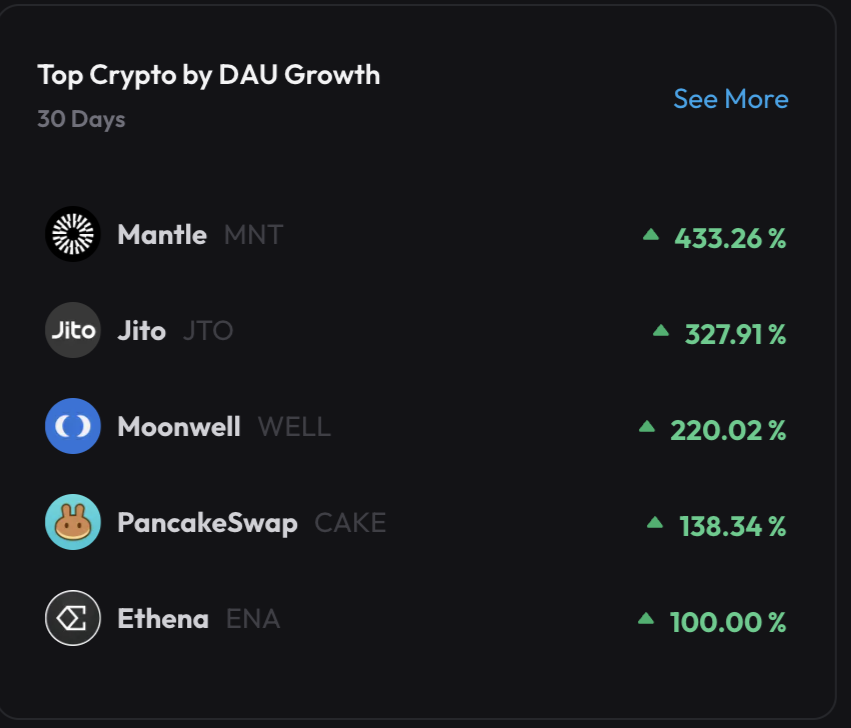

Discover Onchain Growth of Your Favorite Crypto

- Experimental fair-price analysis for savvy investors

- Use as part of your comprehensive research strategy

ID: 1615970699289722880

http://dyor.ag 19-01-2023 07:13:47

1,1K Tweet

16,16K Followers

130 Following

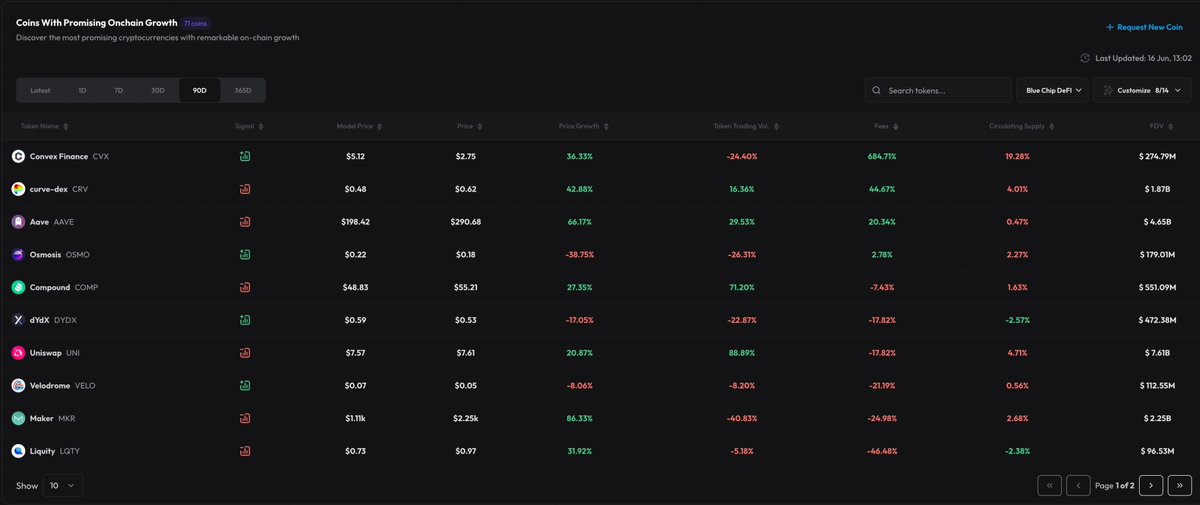

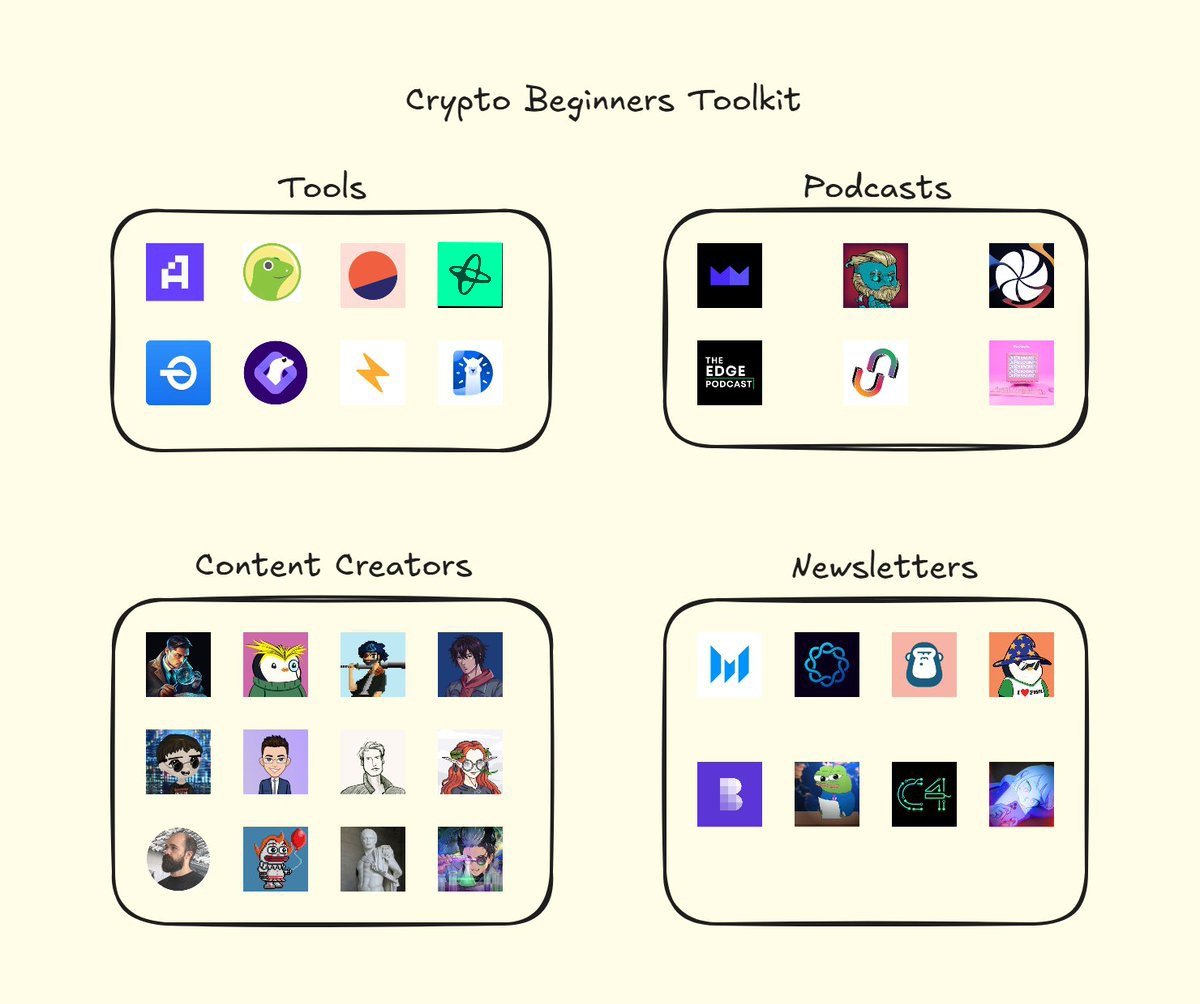

Beginner toolkit for crypto Tools DefiLlama.com Nansen 🧭 Dune CoinGecko GeckoTerminal Snapshot.eth Artemis DYθR Podcasts The Modern Market Show Stoic The Rollup Unchained The Edge Podcast 0xResearch Newsletters 🉐 Crypto Linn The Daily Degen

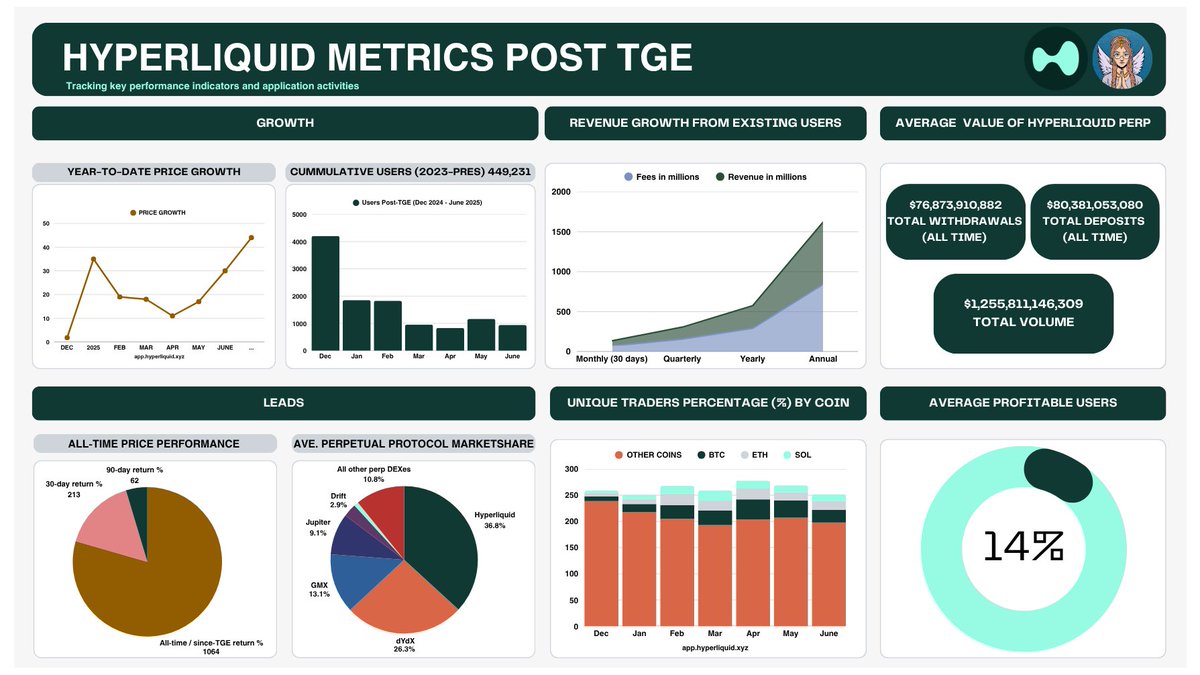

Why don't we have a Crypto App Revenue ETF yet? Reserve 🌐 Index Coop 🦉 Mudrex – let's make it happen! hitesh.eth and DYθR already created the perfect tracker: dune.com/dyorcrypto/cas… ETF should include only top revenue-generating tokens per category,