Emelie Pepito

@emeliepepito

#QUB JD Candidate- #DeFiRegulation, #privacy and accountability, and a #decentralizedfuture, and people trying their best. And...☕️🌲🧗♀️🌄

ID: 1044604221587410944

25-09-2018 15:07:09

481 Tweet

79 Followers

300 Following

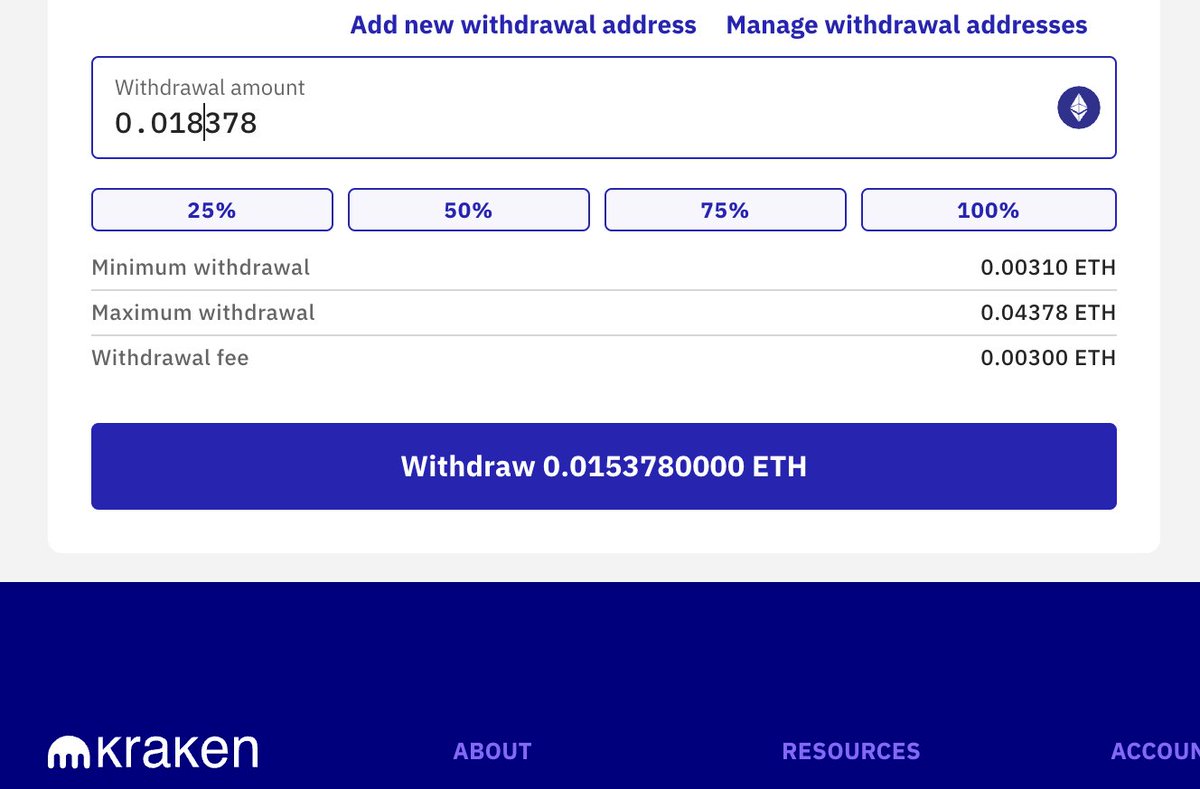

Withdrawing 0.018 of $ETH via the Optimism network. Coinbase Exchange 🛡️ will charge me 0.00008648 ETH in fees, and Kraken and Kraken Pro .00300 ETH. Why the L1 cost on Kraken for an L2 withdrawal?

Congratulations Emelie Pepito 🥂

It's not too late to email your Senator, and Stand With Crypto🛡️ makes it straightforward, so no excuses.