Goods & Services Tax

@gstindiacom

Taking #GST in #India seriously

ID: 459978076

https://www.gstindia.com 10-01-2012 07:51:29

426 Tweet

27,27K Followers

29 Following

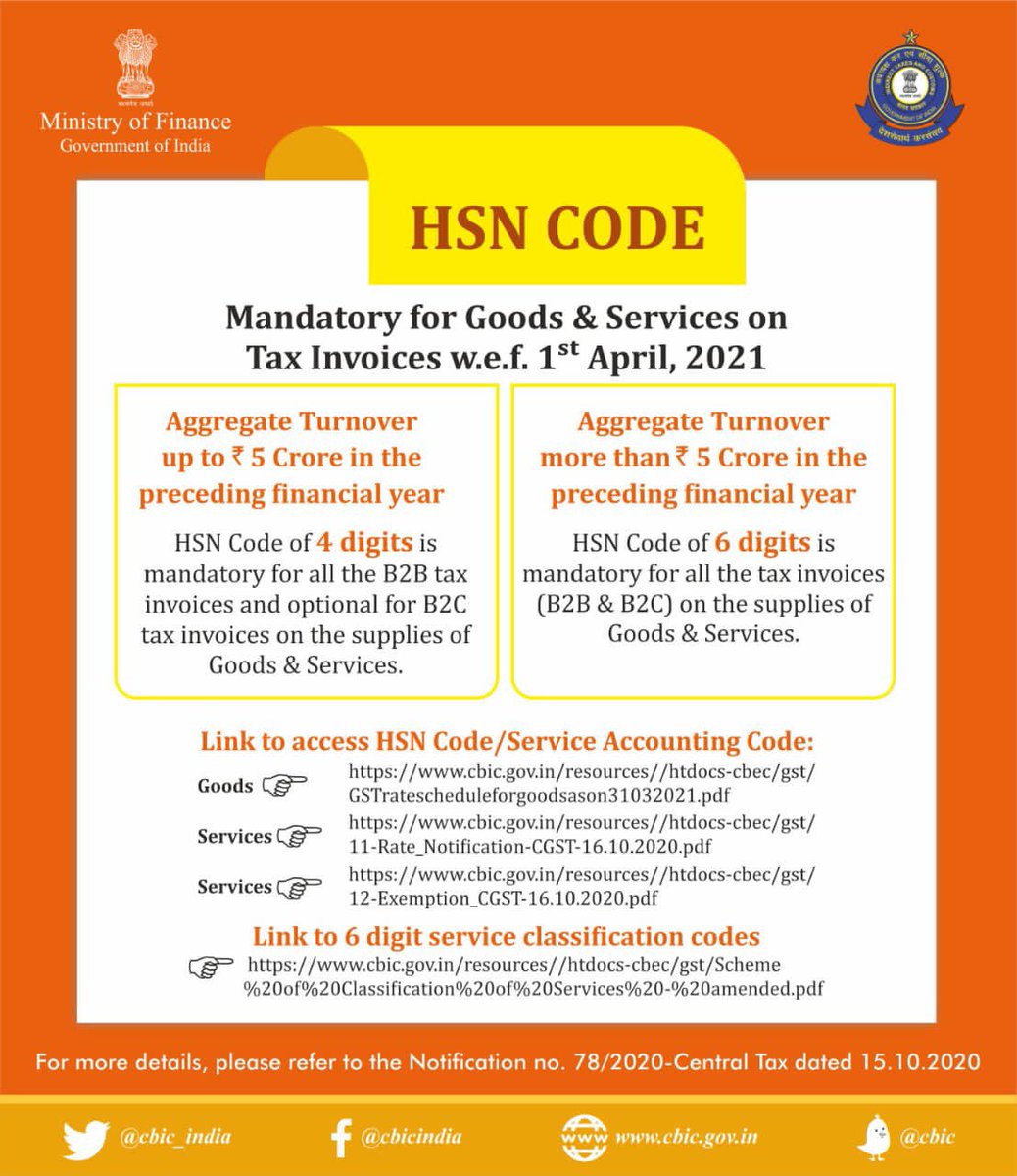

Attention GST Taxpayers! Link to access HSN Code/Service Accounting Code: Goods 👉 cbic.gov.in/resources//htd… Services 👉 cbic.gov.in/resources//htd… Services 👉 cbic.gov.in/resources//htd… Nirmala Sitharaman Anurag Thakur Ministry of Finance