Insurance Information Institute

@iiiorg

Triple-I, the trusted voice of risk and insurance; providing unique, data-driven insights to educate, elevate, and connect consumers & industry professionals.

ID: 36736490

http://www.iii.org 30-04-2009 18:38:26

16,16K Tweet

25,25K Followers

1,1K Following

💬 "When it comes to legal system abuse, attorneys are leveraging robocalls to reach people within 24 hours of an accident. The RiskStream Rapid X app will help #insurers share data after an accident and stay ahead." — Patrick Schmid 🔗, The Institutes RiskStream Collaborative

💬“The #insurance industry has worked better together on legal system abuse in recent years, but the trial bar operates in lockstep on every single issue.” — Fred Karlinsky, Greenberg Traurig LLP #JIF2025

💬 “#Insurance pricing is based on decisions made by many other stakeholders. This is a business of risk assessment and analysis. But the public perception often assumes that if you just ‘fix the insurance problem,’ everything else will fall into place.” — Frank Nutter, Reinsurance Association of America

💬“We’re seeing more people move out of urban areas and build more expensive homes in regions vulnerable to convective storms. Texas alone has had 25 billion-dollar convective storm events. That drives costs up.” — David Sampson, American Property Casualty Insurance Association #JIF2025 #Insurance

💬 “Once beneficial legislation is passed, you have to be ready to defend it. You can’t fall asleep— you need to play defense as much as offense.” — Charles Symington, Independent Agent #JIF2025

Thank you to our sponsors for helping make #JIF2025 a success! Your support advances meaningful dialogue and moves the #insurance industry forward. Proud to partner with: Crawford & Company, PreFix, UL Standards & Engagement, Argo Group, Greenberg Traurig LLP, Hanover Insurance, Swiss Re

⚡ Lightning strikes caused an estimated $1.04B in U.S. #homeowners #insurance claim payouts in 2024, reflecting a drop in frequency, according to new data from Insurance Information Institute and State Farm. ▶️ Read the full release: bit.ly/3G4L2Xx

🏍️ Happy #WorldMotorcycleDay! Whether you're a seasoned rider or gearing up for your first summer road trip, being prepared is key. Explore what you need to know about motorcycle #insurance: bit.ly/3PyNvcT National Safety Council

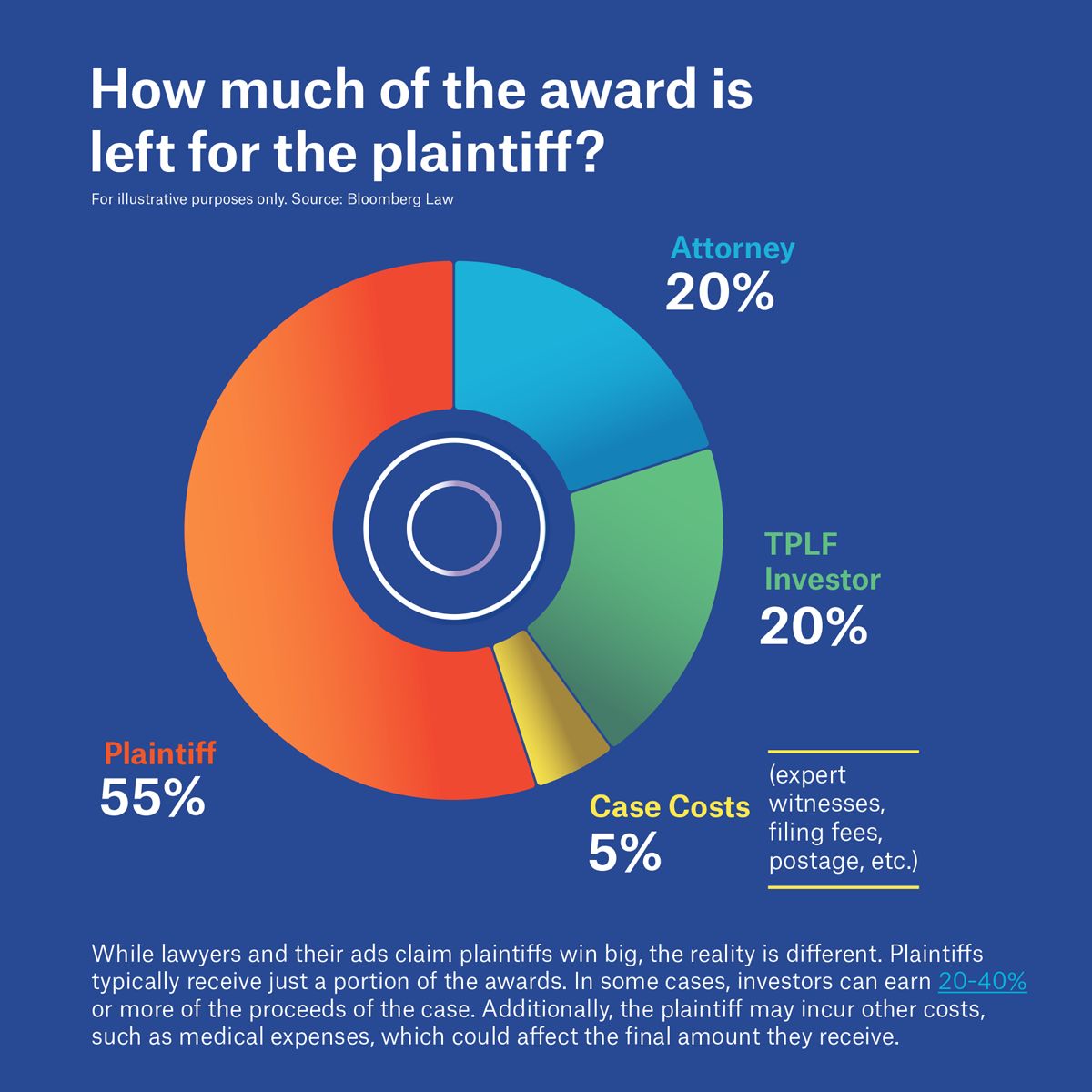

A new consumer guide from Insurance Information Institute & Munich Re US breaks down how legal system abuse is driving up costs for consumers and businesses, and pushing #insurance premiums higher. Read the release: bit.ly/4kJDbOp Dive deeper: bit.ly/4e1uQ5Q