Institute for Macroeconomic & Policy Analysis IMPA

@impamodel

An initiative of @AmericanU, IMPA produces research and policy ideas rooted in the public interest—with insights on macro, taxation, inequality, and more.

ID: 1521847744582856707

https://impa.american.edu/ 04-05-2022 13:42:49

23 Tweet

75 Followers

47 Following

Out today in Bloomberg Tax, my opinion piece written with Juan Antonio Montecino and Ignacio González on why corporations must pay their fair share of taxes news.bloombergtax.com/tax-insights-a…

news.bloombergtax.com/tax-insights-a… Great op-ed today in Bloomberg by Institute for Macroeconomic & Policy Analysis IMPA co-directors Nacho González and Juan Antonio Montecino with Joseph E. Stiglitz

A reminder of why corporate taxes matter: significant revenues, yes, but also other social and economic benefits Great oped from Joseph E. Stiglitz Nacho González Juan Antonio Montecino in Bloomberg Bloomberg Tax news.bloombergtax.com/daily-tax-repo…

NEW: In Bloomberg, Joseph E. Stiglitz and Institute for Macroeconomic & Policy Analysis IMPA's Nacho González and Juan Antonio Montecino make the case for raising the corporate tax rate in 2025 and getting our payback: "Corporations play an important role in our society ... They need to pay their fair share." news.bloombergtax.com/tax-insights-a…

"There are economic and social benefits to the corporate tax that go beyond the revenue raised." Columbia University's Joseph E. Stiglitz and American University Institute for Macroeconomic & Policy Analysis IMPA’s Nacho González and Juan Antonio Montecino make the case for raising the corporate tax rate in 2025. More in Bloomberg Tax: news.bloombergtax.com/tax-insights-a…

"Unless corporations and the wealthy pay their fair share of taxes, the US will struggle to address numerous pressing challenges..." Read Joseph E. Stiglitz, Nacho González and Juan Antonio Montecino op-ed for Bloomberg Tax news.bloombergtax.com/tax-insights-a…

A huge congratulations to our board member Simon Johnson and his fellow laureates Daron Acemoglu and James Robinson on receiving the Nobel Prize! 🎉 A well-deserved honor!

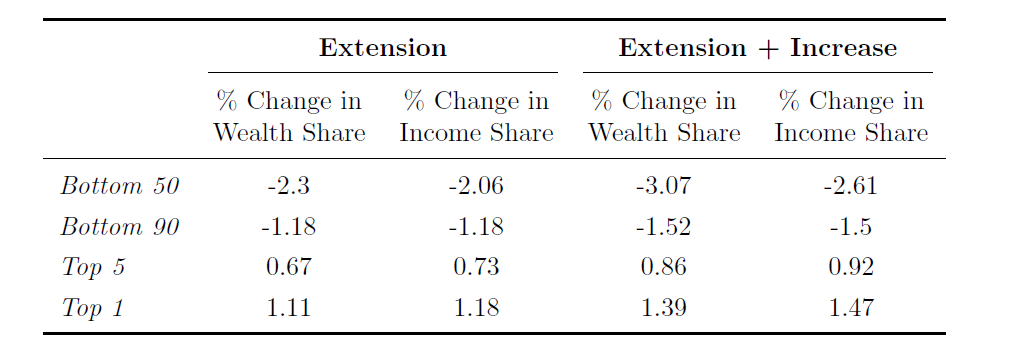

🚨New Research! Our co-chair Joseph E. Stiglitz with Juan Antonio Montecino & Nacho González explore the optimal design of corporate tax policy in a new NBER paper 🔹Market Power Wealth crowds out productive investment, this justifies higher corporate tax rates for a more efficient economy.

Join us this Wednesday, April 23, as we host Joseph E. Stiglitz, Ilyana Kuziemko, Vanessa Williamson, and more for a timely conversation on U.S. economic policy—and the values that underpin it. 🕥 10am–12pm 📍 AU campus, SIS Building 🔗 RSVP here: impa.american.edu/tax-policy-ine…

Research from Institute for Macroeconomic & Policy Analysis IMPA shows that cutting taxes on the rich doesn’t help the economy, and would actually weaken the government’s fiscal position. Alternatively, raising the top marginal tax rate to just 44% could significant increase federal revenue. buff.ly/lwb7Uym

Trump's proposed budget would switch off huge swaths of America's scientific enterprise - from NASA to cancer research to disaster forecasting. "The economy tomorrow is going to be smaller because you decided to cut that funding today.” New research from Institute for Macroeconomic & Policy Analysis IMPA in NPR 👇

Proposed cuts to federal research funding won’t just affect #scientists — they impact our #economy. A study from Institute for Macroeconomic & Policy Analysis IMPA found a 25% reduction in public research funding would decrease GDP by 3.8% — comparable to the Great Recession. Learn what we’re doing to support science