Isabelle Lee

@isabelletanlee

Cross-asset reporter at Bloomberg News | [email protected] | Views my own

ID: 630241851

https://www.bloomberg.com/authors/AU78taIg_dM/isabelle-lee 08-07-2012 12:07:19

3,3K Tweet

6,6K Followers

749 Following

Wall Street Can’t Beat Michael Saylor’s Runaway Crypto Engine — by Vildana Hajric (Bloomberg) bloomberg.com/news/articles/…

Great article from Isabelle Lee on the new Solana and Ethereum staking ETF filings: “Greg King, founder and chief executive officer of REX Financial, said the company is targeting a launch by mid-June for both” bloomberg.com/news/articles/…

Update: SEC sent letter to REX last night saying it was concerned SEC improperly filed. REX lawyer says they can work it out. Feels a bit like the $PRIV situation. Issuers pushing envelope hard in effort to get first to mkt. Saturday scoop from Isabelle Lee

ICYMI details on the Truth Social Bitcoin ETF filing from Vildana Hajric. My take: On one hand, unchartered territory bc its POTUS-linked company, but on other it's a late to the party filing in crowded category where multiple ETFs already are super cheap/liquid. Will be really

Bye America turned into Buy America real quick didn’t it? In latest Trillions we discuss the rebound in US and how it’s at odds w headlines, a gap that investors are just gonna have to get used to for a while w/ Joel Weber @psarofagis Isabelle Lee bloomberg.com/news/articles/…

More confirmation of the SEC's move toward engaging on Solana ETFs and Staking from my colleague Isabelle Lee bloomberg.com/news/articles/…

Bloomberg confirms SEC engaging w/ issuers on spot sol ETFs… Includes discussion around staking, which would obviously impact spot eth ETFs as well if approved. Strap in… going to be wild next couple of months. via Isabelle Lee

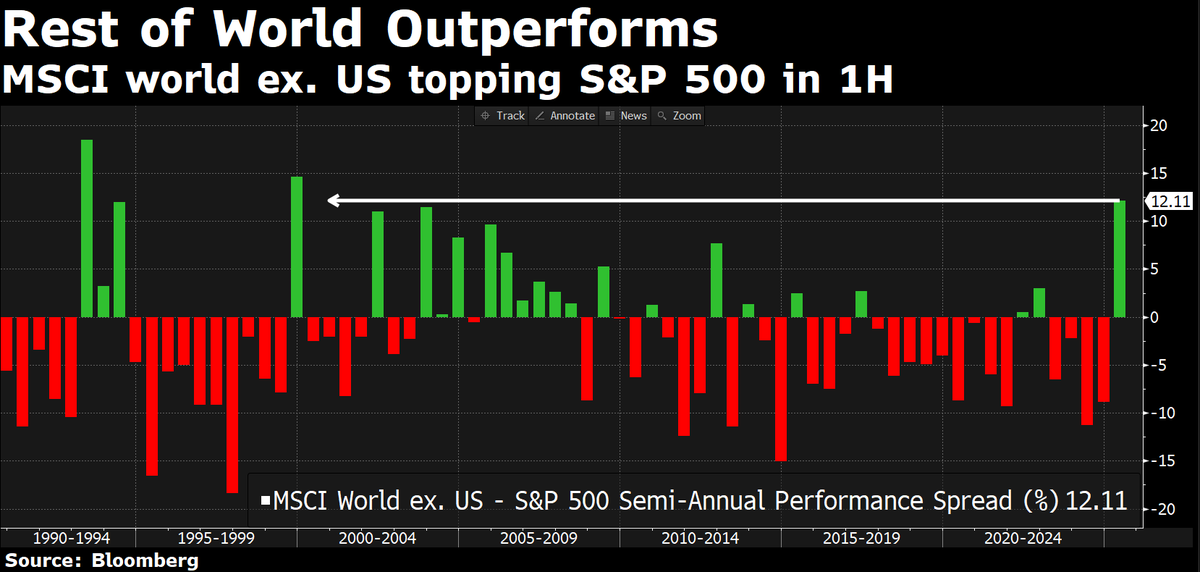

World stocks ex-US are outperforming the S&P 500 by more than 12% in the first half of 2025, the most for a similar period going back to 1999: Bloomberg TV h/t Dan Curtis

The Rex-Osprey Sol + Staking ETF $SSK is officially set to launch on Wed, as reported by Isabelle Lee, and will be the first to stake in US. 40% of its holdings will be "securities" via other Sol ETPs (to qualify under 40 Act) and fee is 75bps but 1.28% once tax expense from

Here are mine and Eric Balchunas' most recent odds on spot crypto ETF approvals by the end of 2025. We expect a wave of new ETFs in this second half of 2025.

Headlines you absolutely love to see on Bloomberg… That’s right. Crypto ETF Summer kicks off. via Isabelle Lee

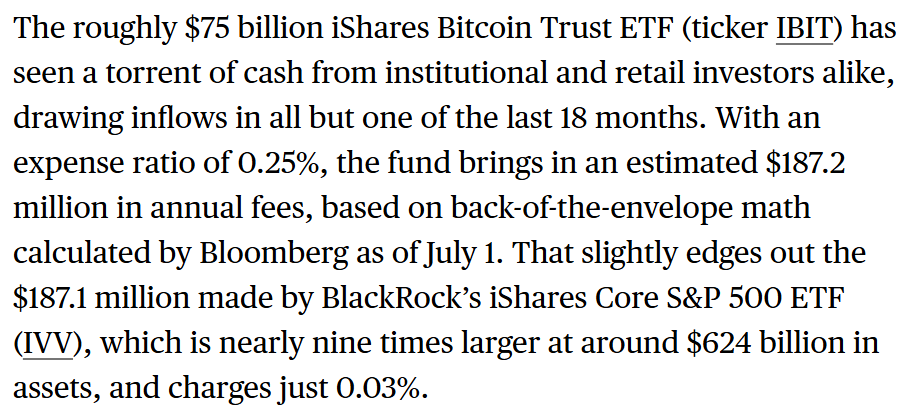

The nearly $75bil iShares Bitcoin ETF has only one month of outflows since Jan 2024 launch… Now generates more fee revenue for BlackRock than its largest ETF, the iShares S&P 500 ETF. Simply a machine. I offer a few thoughts here. via Isabelle Lee bloomberg.com/news/articles/…