John Burns

@johnburnsjbrec

@jbrec founder and teammate, posting about our passion solving today's housing market conditions to help our clients navigate to a better tomorrow.

ID: 14902479

http://www.jbrec.com 25-05-2008 22:21:45

1,1K Tweet

20,20K Followers

385 Following

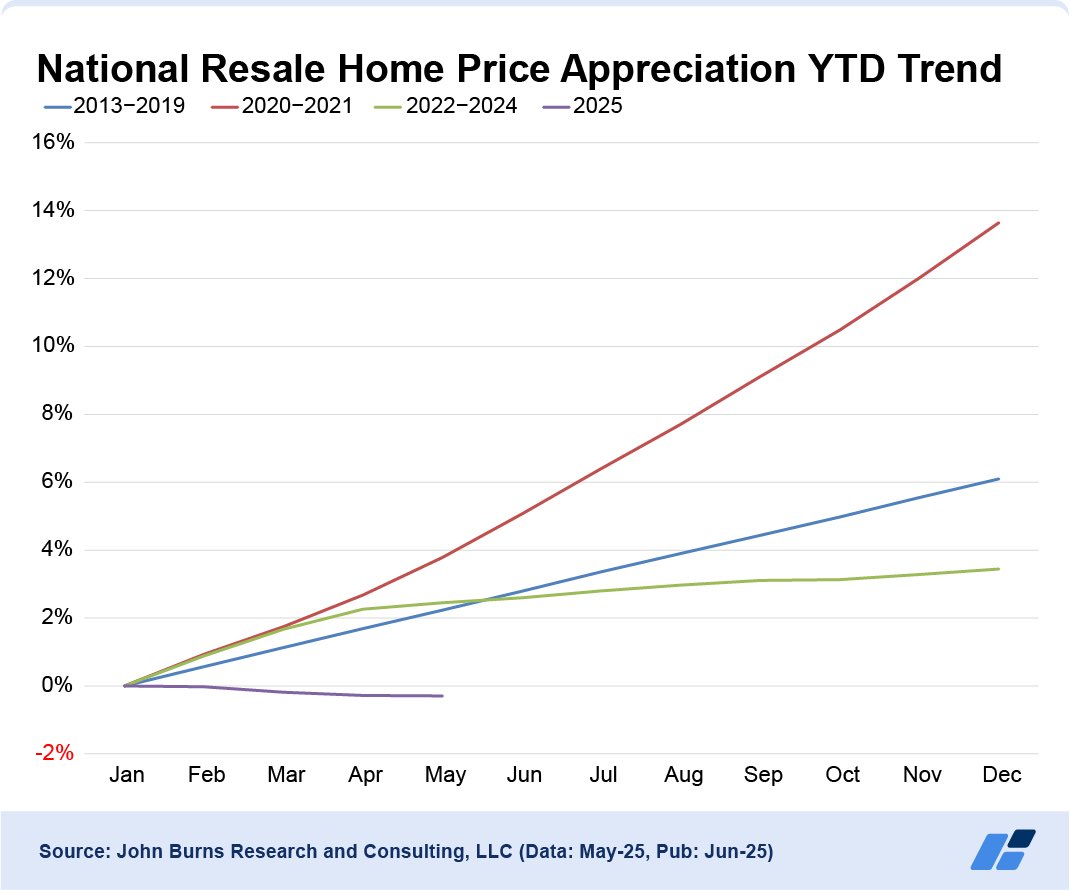

"The biggest issue for housing across homebuilding and for sale on the resale side over the last year or two has just been affordability," John Burns Research & Consulting's Rick Palacios Jr. says. "The entire space would prefer to see a 6% mortgage rate, not a 7% mortgage rate."

A big year for home building M&A Diana Olick cnbc.com/2024/11/13/hom…

![Alex Thomas (@housing_alex) on Twitter photo To show which materials are most likely to be impacted by a East/Gulf Coast port strike, we sent this chart to our clients over a week ago.

Most disrupted products:

- bricks [clay]

- furniture

- kitchen cabinets

- aluminum

- lighting equipment

- hardware To show which materials are most likely to be impacted by a East/Gulf Coast port strike, we sent this chart to our clients over a week ago.

Most disrupted products:

- bricks [clay]

- furniture

- kitchen cabinets

- aluminum

- lighting equipment

- hardware](https://pbs.twimg.com/media/GYzxAnMWYAcrvTu.jpg)