Laurence Fletcher

@journofletcher

Deputy Markets News Editor @FT. Hedge funds, human rights, fine wine. Ex-WSJ, Reuters. Liverpudlian. Views my own. Tips: [email protected]

ID: 252629526

http://ft.com/laurence-fletcher 15-02-2011 15:51:10

3,3K Tweet

4,4K Followers

1,1K Following

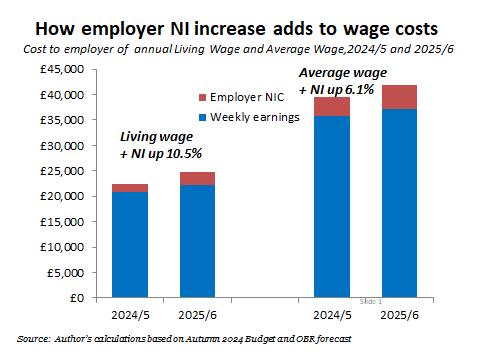

“I went back and read the manifesto and it says very clearly, we will not raise rates of national insurance.” Labour would be in a "straightforward breach" of their manifesto if the chancellor hikes employer national insurance contributions, says IFS director Paul Johnson.

‘The vice-president largely avoided a question on when she had observed Biden’s cognitive decline, replying: “Joe #Biden is not on the ballot, and Donald #Trump is.”’ - Kamala #Harris pledges break from Joe Biden in combative Fox News interview ft.com/content/cc0c87… via Financial Times

Loeb-winning journalist "Owen Walker" bids farewell at HQ and prepares for higher office in a new geography

A hike in employers’ NI contributions in Rachel #Reeves' #Budget will weigh on wages and employment or increase prices for consumers, while fuelling bogus self-employment, say economists. ft.com/content/4085c9… via Financial Times

Reeves said she was going to crack down on fraud, saving £4.3bn. Pundits had expected measures to save closer to £2bn. Previous gvts have claimed they will crack down on such fraud and it rarely generates the savings they claim. ft.com/content/2095fa… via Financial Times Anna Gross

The increase in employers’ #NICs will not raise “anything like” the £25bn stated on the Treasury’s scorecard, the Institute for Fiscal Studies has warned, because it will result in lower #wages, reducing its net revenue to about £16bn.ft.com/content/72ddc7… via Financial Times

The #Guernsey #stockexchange trying to break into the booming private market secondaries sector. Read the Financial Times's take here. #privateequity #markets ft.com/content/12cb67… via Financial Times

The unlikeliest Trump trade ever? #Ukraine’s bonds jump as investors bet #Trump will end war ft.com/content/3848e7… via @ft w Joseph Cotterill

Last week we were named among the Financial Times Reinvention Champions 2024 & the FT’s Deputy Markets News Editor Laurence Fletcher wrote a profile. Read it here: on.ft.com/3YUsZsC Read our summary here: bit.ly/4fRoEwZ #reinventionchampions #privatemarkets #privateassets

John Lewis chief criticises UK #Budget as ‘two-handed grab’ from business ft.com/content/ed1f22… via Financial Times