Mukesh P Kalra

@kalramukesh

builder, intense, pragmatic | founder, ceo @ETMoney | co-founded moneysights (acq. by @TimesInternet) | was core team #1 @inmobi | ❤️#startups #mancity #barca

ID: 14854371

https://play.google.com/store/apps/details?id=com.smartspends&hl=en 21-05-2008 09:29:59

6,6K Tweet

5,5K Followers

398 Following

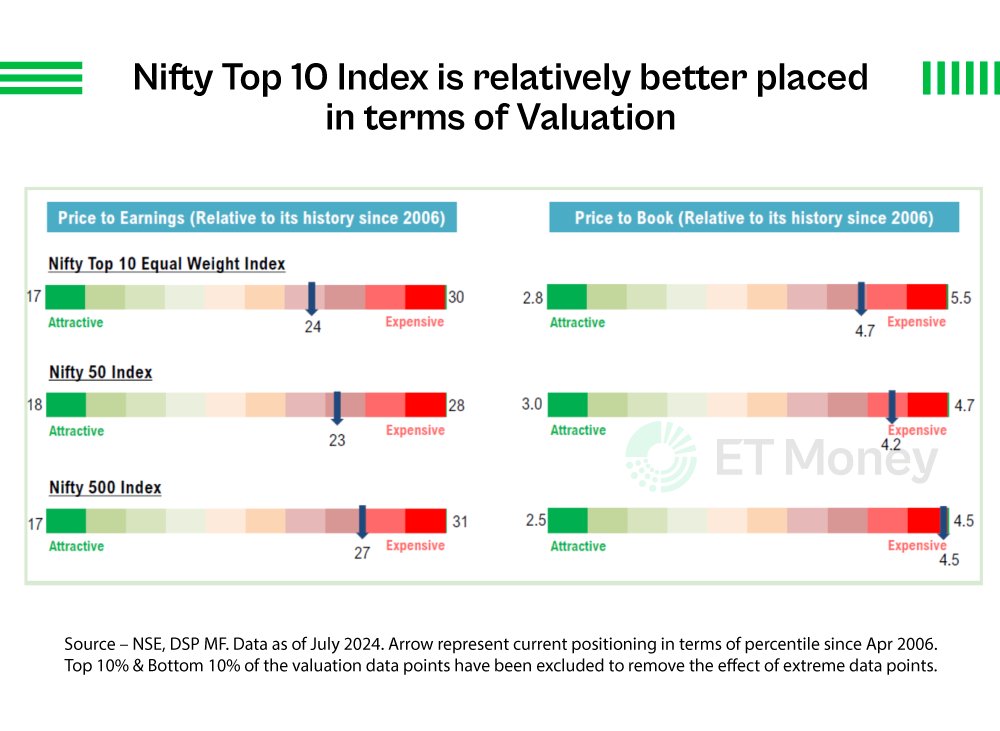

Looking for stocks that aren’t ridiculously overvalued right now? You need not look beyond the 10 biggest stocks, says DSP Mutual Fund. The fund house has launched passive schemes to track the Nifty Top 10 Equal Weight index. Let’s check how rewarding & risky this index can be. A🧵