Komodo Cap

@komodo_capital

Proud American. Investor... maybe growth, maybe value. Formerly Microcap Mindset. Substack below:

ID: 1446247275727106051

http://substack.com/@komodocapital 07-10-2021 22:54:02

1,1K Tweet

1,1K Followers

454 Following

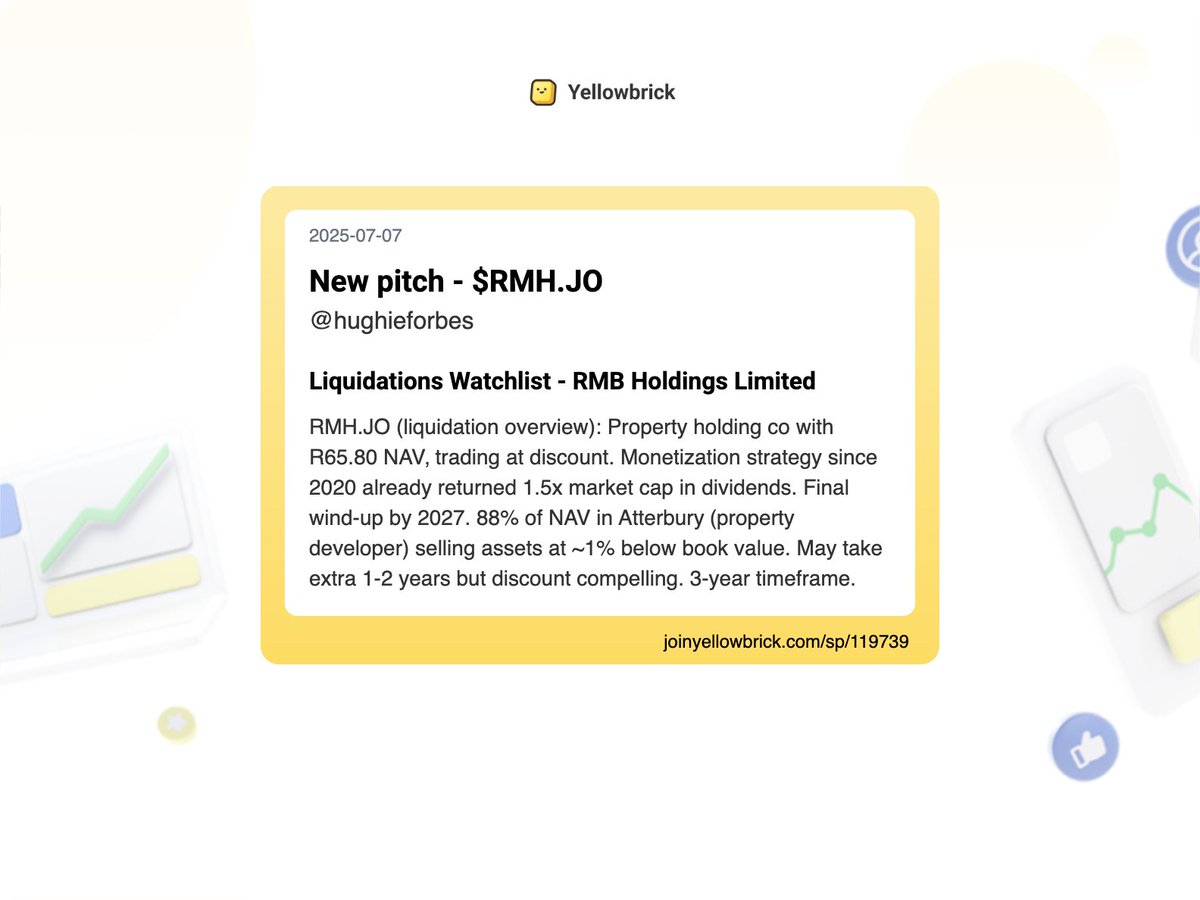

Added 57 new stock write-ups to the site (pt 2): Accrued Interest - $UBER (update) Nugget Capital Partners (NCP) (holding updates) - $ERE-UN.TO, $BCE.TO, $TLT, $SCR.TO, $NXR-UN.TO, $DRR-U.TO Komodo Cap (holding updates) - $FTAI, $JXN, $FOA, $ASPI, $IREN Clark Square Capital - $GPP.WA

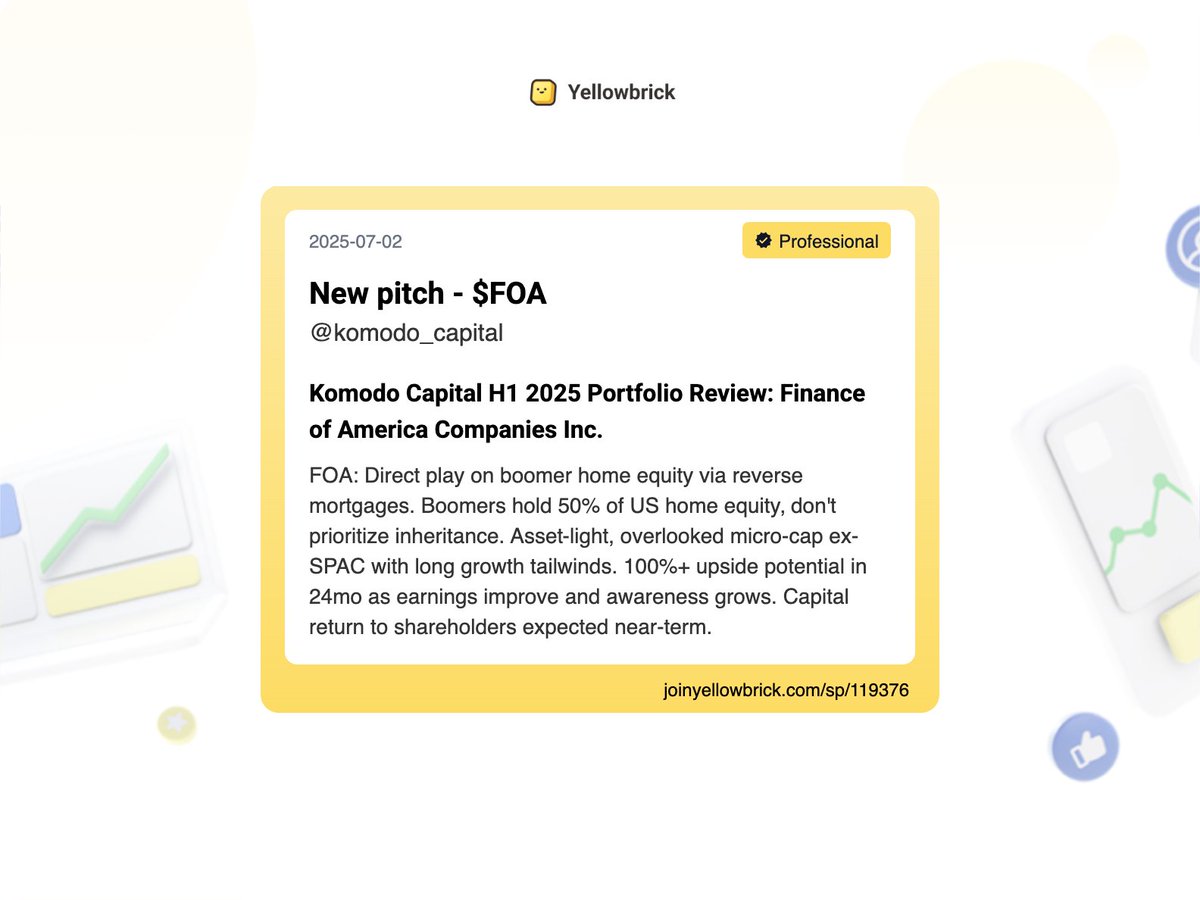

Added 57 new stock write-ups to the site (pt 1): Komodo Cap - $DAVE Uzo - $XPOF Liquidation Stocks (liquidation overviews) - $EPE.JO, $BPT, $SCPT-A.V, $CHN, $BAT.JO, $NXS.AX, $RMH.JO, $NBDX.L, $KCR.L, $FJV.L TopSecretStocks 🤫 - $GRAB (deep dive) SpruceHill Capital - $ANGL.ST