Karthik Srinivasan

@ksrini_

co-founder @SorellaLabs | math/physics dropout @UChicago | contributing @angstromxyz

ID: 1516871819868860416

20-04-2022 20:10:18

255 Tweet

1,1K Followers

496 Following

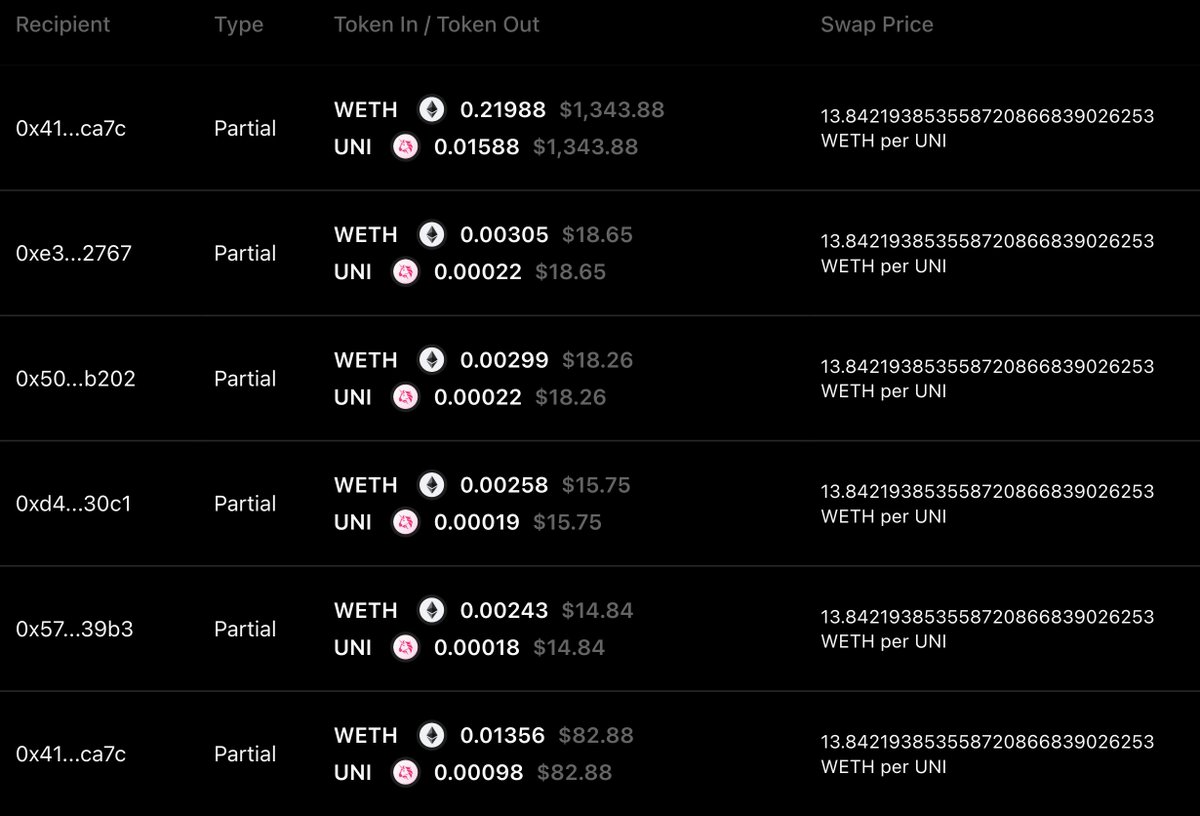

Good sleuthing from Alex Nezlobin. Remember to rigorously analyze a mechanism from the perspective of a motivated adversary prior to shipping it in prod Good mechanisms always prove malfeasance is -EV. Great mechanisms prevent it entirely

Last year, Tarun Chitra, Matheus Venturyne Xavier Ferreira and I wrote about credible auctions in blockchains (arxiv.org/pdf/2301.12532). We demonstrated how blockchains can be used to implement auctions where the auctioneer doesn't have an incentive to shill bid & manipulate the auction outcome. In

1/ At Paradigm, we spend a lot of time thinking about MEV and baselayer markets. So we were excited when Hester Peirce and the U.S. Securities and Exchange Commission Crypto Task Force posed a number of important questions on the subject. Today (with a hand from Rodrigo), we filed our response: