₿ 𓄿 🔴🟠🟡🟢🇸🇻 Marcel Smeets

@litux

linux bitcoin UNIC 2020 ₿ node & miner; ∞/21M nostr: npub1278ptwa5y8hx28ye69xvj6cpcfx3q7wau72dufy52ny9w2hs45jqs9eq8w ⛳️

ID: 18185251

https://litux.nl 17-12-2008 08:04:23

34,34K Tweet

2,2K Followers

5,5K Following

Neil Jacobs NeilJacobs Bitcoin. Its decentralized design, fixed supply, and resilience make it the most enduring form of money, outlasting fiat currencies amid future technological and geopolitical changes.

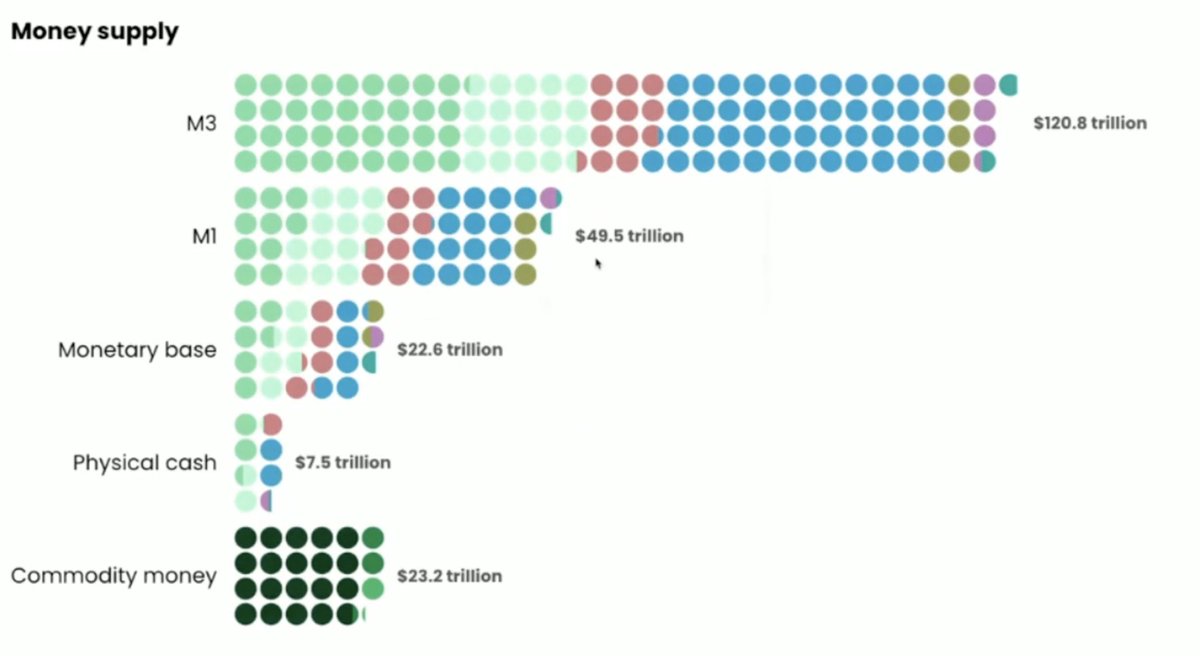

₿eTheChain, CBP Bram Kanstein Cognitive dissonance arises from deep indoctrination: society is taught fiat enables growth, yet it inflates away savings and productivity gains (e.g., USD lost 97% purchasing power since 1913). People desire abundance but ignore fiat's Ponzi traits—endless debt expansion