Martha Gimbel

@marthagimbel

Executive director @the_budget_lab, former @whitehousecea, @indeed, @jecdems, @USDOL, among others. Personal opinions.

ID: 4834184626

22-01-2016 04:02:55

12,12K Tweet

13,13K Followers

1,1K Following

Quick new The Budget Lab post breaking down the distribution of the size of income tax cuts under the new tax law *above and beyond extension of existing 2025 law*. From this perspective, close to half of households will see a tax cut of less than $100.

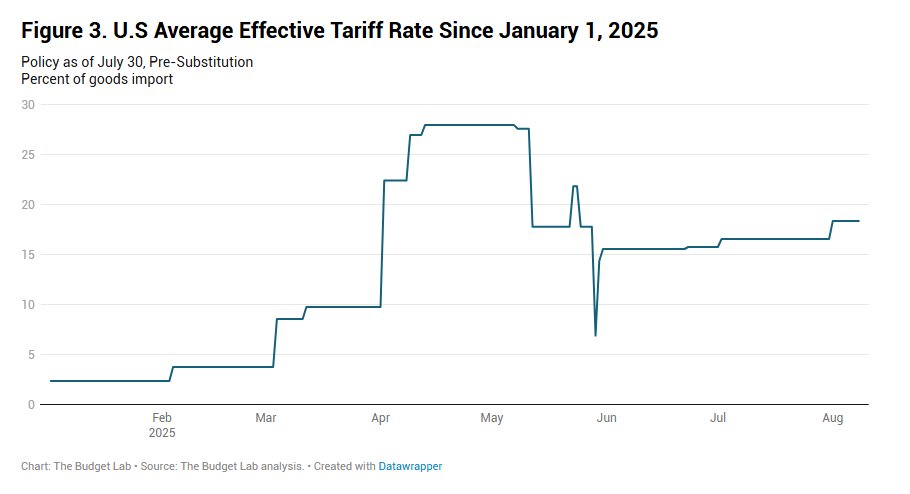

New The Budget Lab tariff analysis incorporating the 25% tariff on India, up from our previously-assumed 10% and which goes into effect August 1. In brief... 1/10

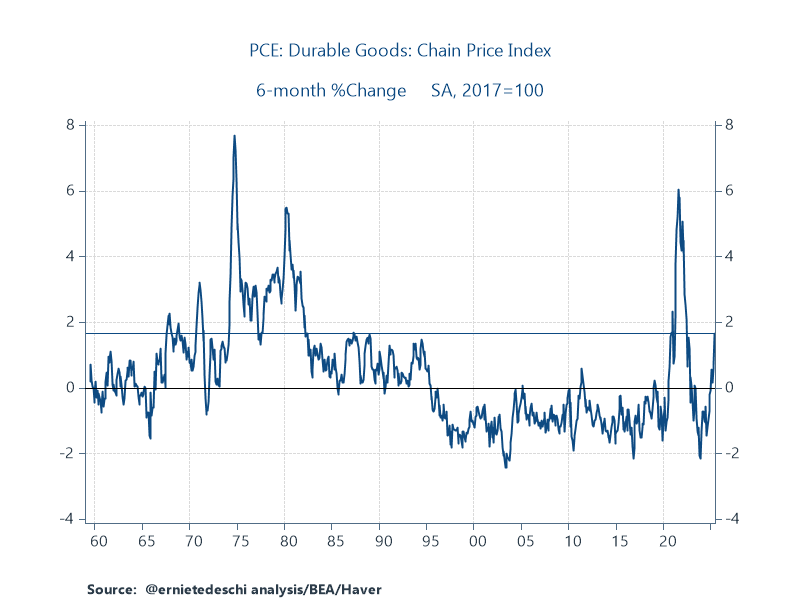

The Budget Lab Consumers face an overall average effective tariff rate of 18.4%, a 16pp increase from 2024 & the highest since 1933. After consumers & businesses shift spending in reaction to the tariffs, the average tariff rate will be 17.5%, a 15.1pp increase & the highest since 1934. 2/10

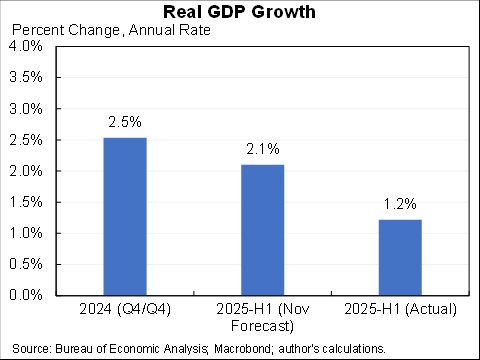

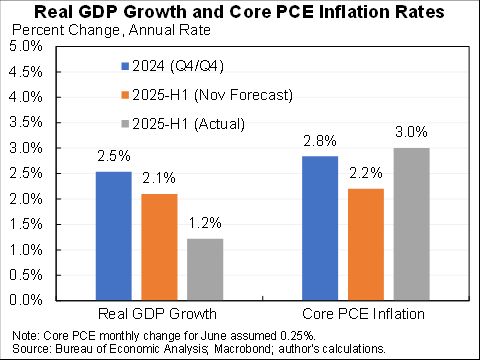

As US population growth slows, we need to reset expectations for economic data. Payrolls, GDP, expenditures, and income will all grow more slowly now that the immigration surge has ended. That changes how we interpret ... everything. My first piece for Peterson Institute (link follows)