Nitin Mathur

@mathurn78

CEO at Tavaga, a SEBI Registered Investment Adviser (RIA) | Equity Research Analyst in previous life | tavaga.com | bit.ly/DownloadTavaga…

ID: 451573400

https://bit.ly/introtoETF 31-12-2011 18:06:31

2,2K Tweet

1,1K Followers

5,5K Following

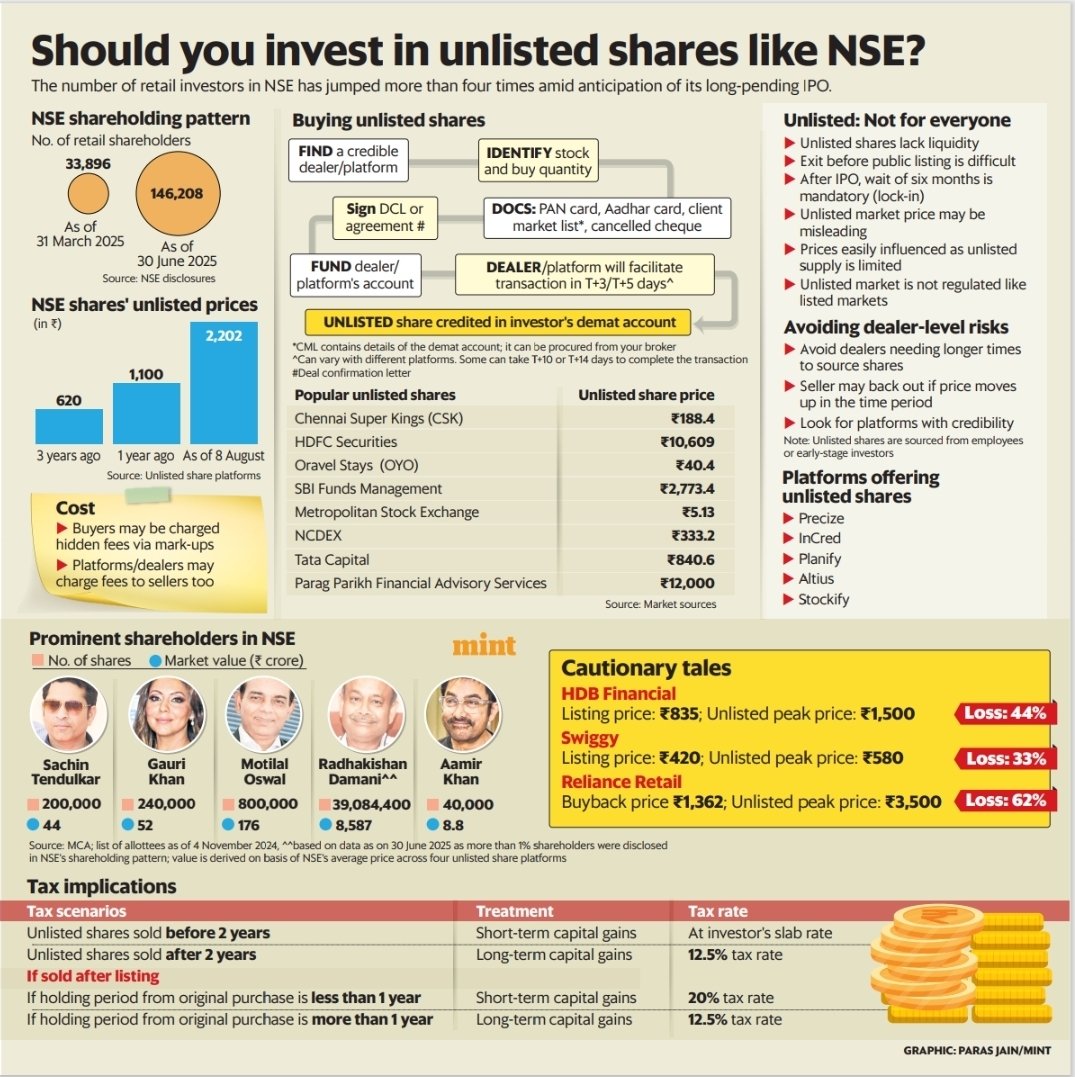

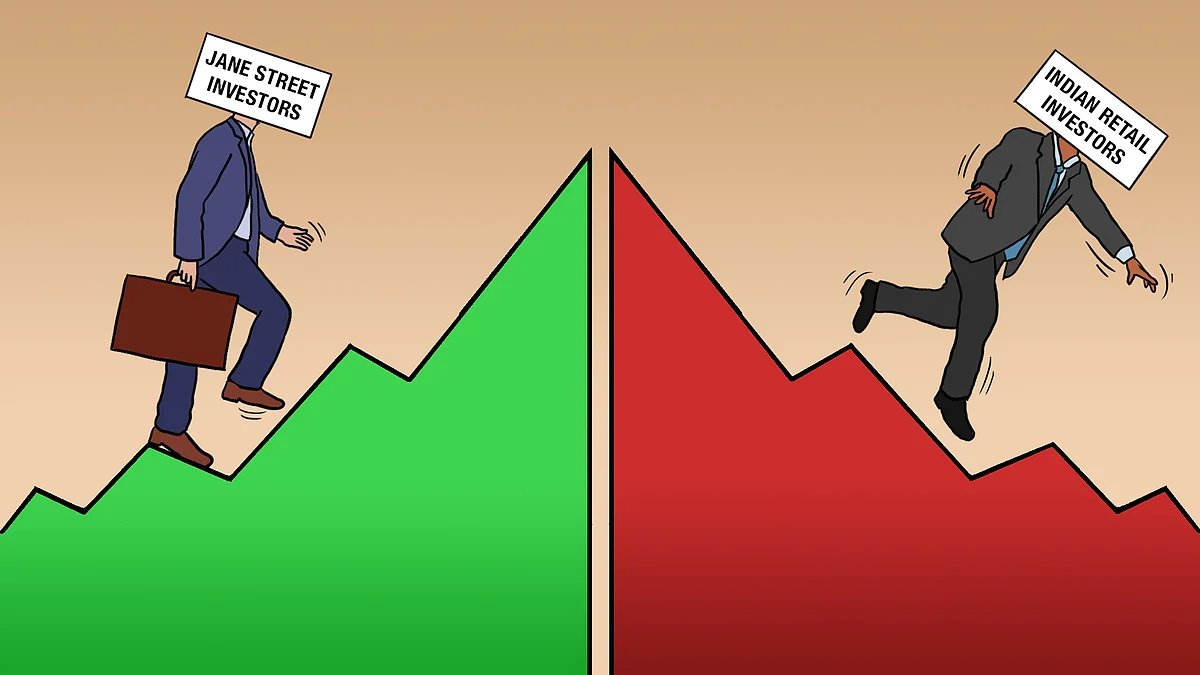

Today Jash Kriplani, CFPᶜᵐ gives you a primer on unlisted shares. Inputs from Sidhoji Sawant. The frenzy behind NSE has brought retail investors here. Do note: 1) Price discovery is inefficient 2) Platforms may default 3) 6 month lock-in (cannot flip shares) livemint.com/money/personal…