Michael Santoli

@michaelsantoli

CNBC Senior Markets Commentator.

Markets. Business. Baseball.

Cranky New York parochialism.

ID: 898301664

https://www.cnbc.com/pro/columnists/ 22-10-2012 20:09:36

39,39K Tweet

111,111K Followers

1,1K Following

Great getting to chat with Michael Santoli today on CNBC's Closing Bell !

As always, great discussing markets w/ Michael Santoli to end the week. Bottom Line: Despite the run up this year, strategist forecasts are more bearish (relative to the S&P) than they have been entering any other Q4 historically. This is not how tops form.

Caught up w/ Michael Santoli to talk China x.com/i/status/18397…

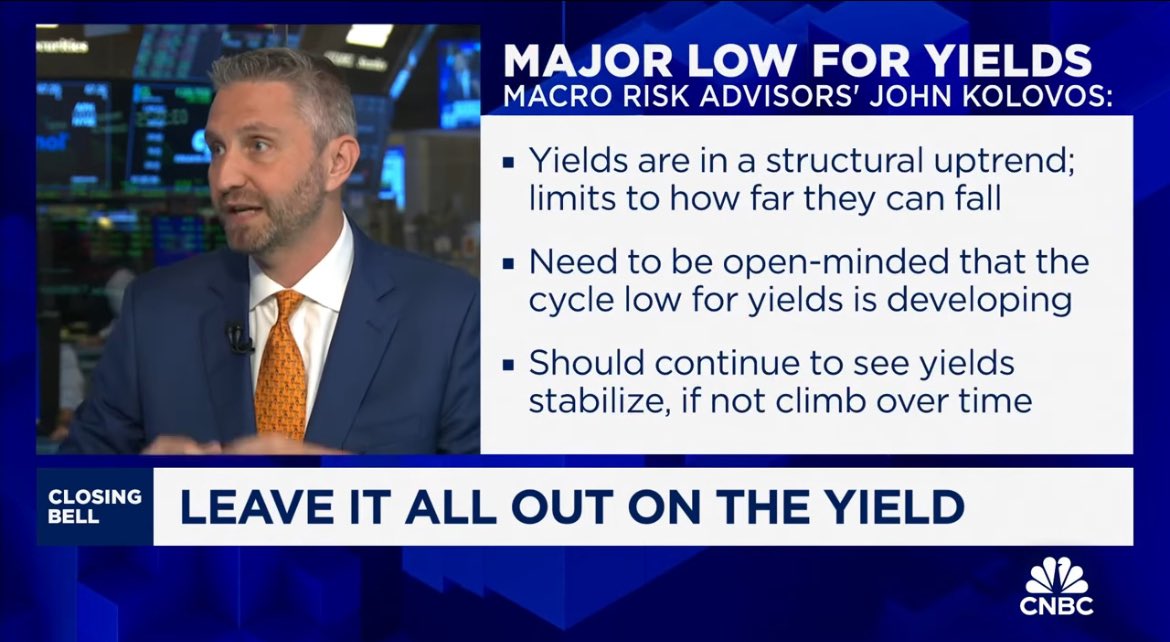

The September Fed cut should prompt investors to reconsider the relationship between Fed actions and longer-term yields. Also, first time at the NYSE! Such a pleasure meeting Michael Santoli and the rest of the team at CNBC Closing Bell. Thank you for the invite.

Pleasure to speak with Michael Santoli on CNBC's Closing Bell today to discuss our Q4 outlook. We covered the give & take between economic expectations & rates, earnings, and how big Q1-Q3 gains tend to continue thru Q4. Ned Davis Research cnbc.com/video/2024/10/…

This move higher in interest rates has to be taken seriously. As always it was great to catch up with Michael Santoli and the rest of the team. youtu.be/cezxBOMqbmQ?si… CMT Association CNBC's Closing Bell #technicalanalysis $SPY $FXI $TLT

Over 20% of the S&P 500 made new 52-week highs yesterday. Michael Santoli on what that has meant historically in today's #MarketDashboard:

#utilities hitting an all-time high today. Michael Santoli takes a look at what's powering the sector in his #MarketDashboard:

Great getting to chat with Michael Santoli on CNBC's Closing Bell overtime today!

Great speaking with Michael Santoli about the likely path for equities through year end and how we are using strategists targets to gauge sentiment heading into 2025. Thank you for having me and Happy Thanksgiving Mike!