Jason Polansky

@polan13

Nothing posted should be taken as advice.

ID: 38108853

06-05-2009 03:59:16

13,13K Tweet

3,3K Followers

452 Following

Westinghouse targets $75bn US nuclear expansion after Trump order via Financial Times #uranium #nuclear $CCJ Cameco Corporation on.ft.com/45fwkHs

WHAT A WEEK! “World Bank lifts ban on funding #nuclear energy in boost to industry” via Financial Times #uranium on.ft.com/45moU5q

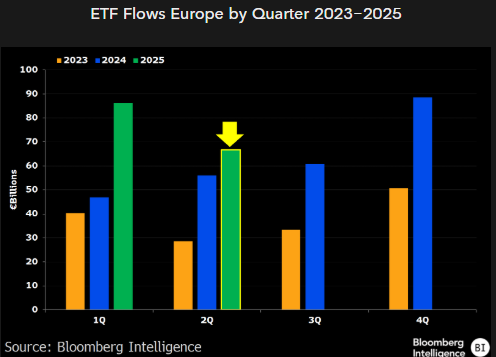

ETFs in Europe are on pace to smash last year's record flows. Like in the US ppl just keep on keepin' on despite alarmist headlines. That said, European stocks have had really good year, that always helps too. Good stuff via ETF Hearsay by Henry Jim