Everhash 🟩🟥🟧

@proofhash

Sniping legendary assets on @Scatter_art since 1971

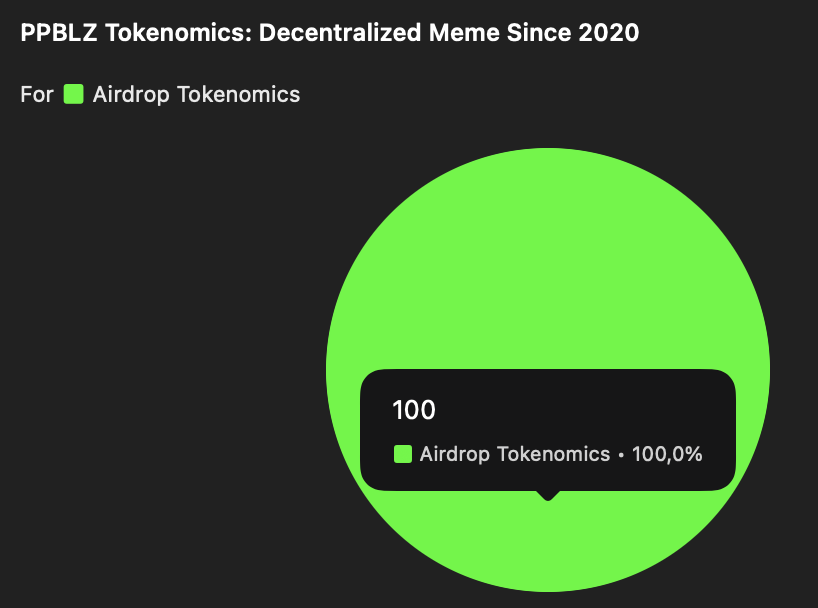

Pay close attention to @VTR_10NEKO $ETHEREUM x $SCHIZO, for it is the true arch nemesis of ticker $BITCOIN.

ID: 1314045673319419904

08-10-2020 03:31:56

3,3K Tweet

298 Followers

945 Following