revert

@revertfinance

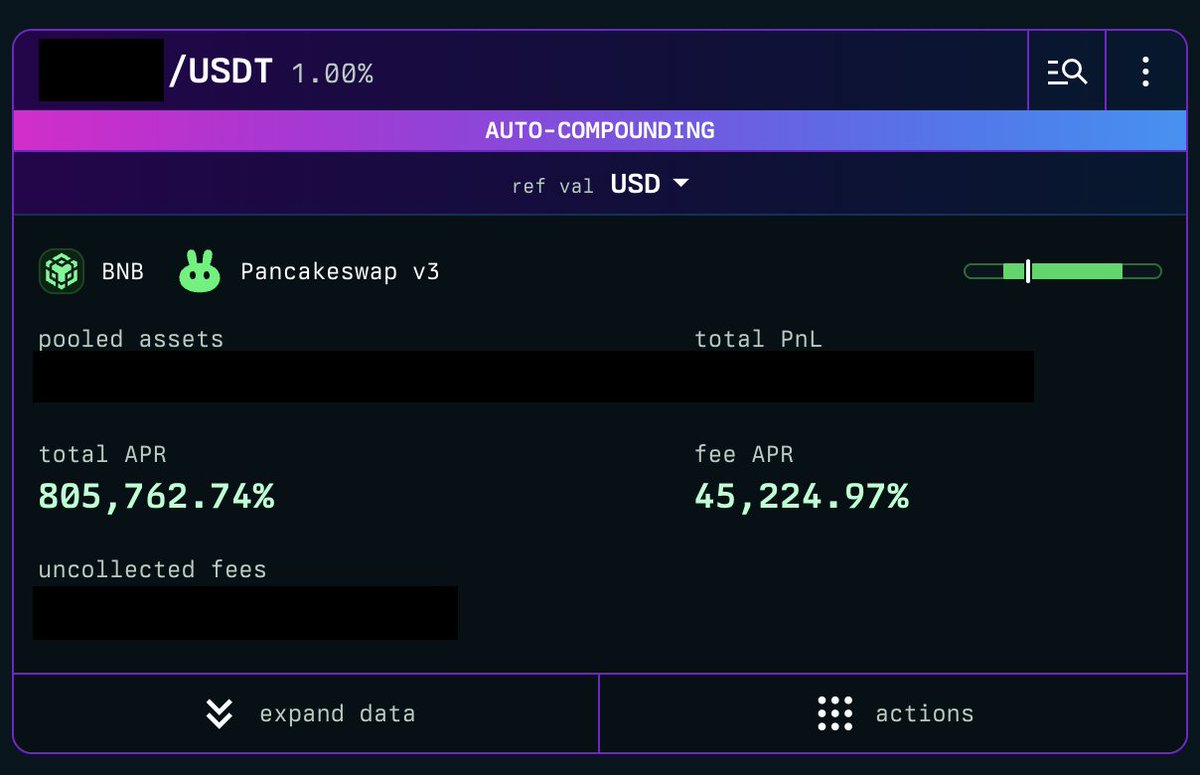

Actionable analytics, lending, and automation for AMM liquidity providers.

ID: 1351396188097040386

https://revert.finance 19-01-2021 05:10:20

2,2K Tweet

13,13K Followers

2,2K Following

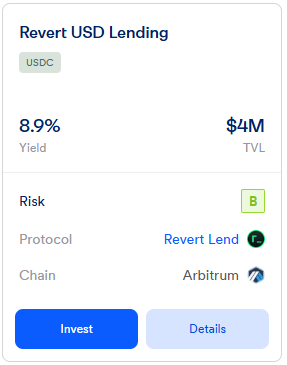

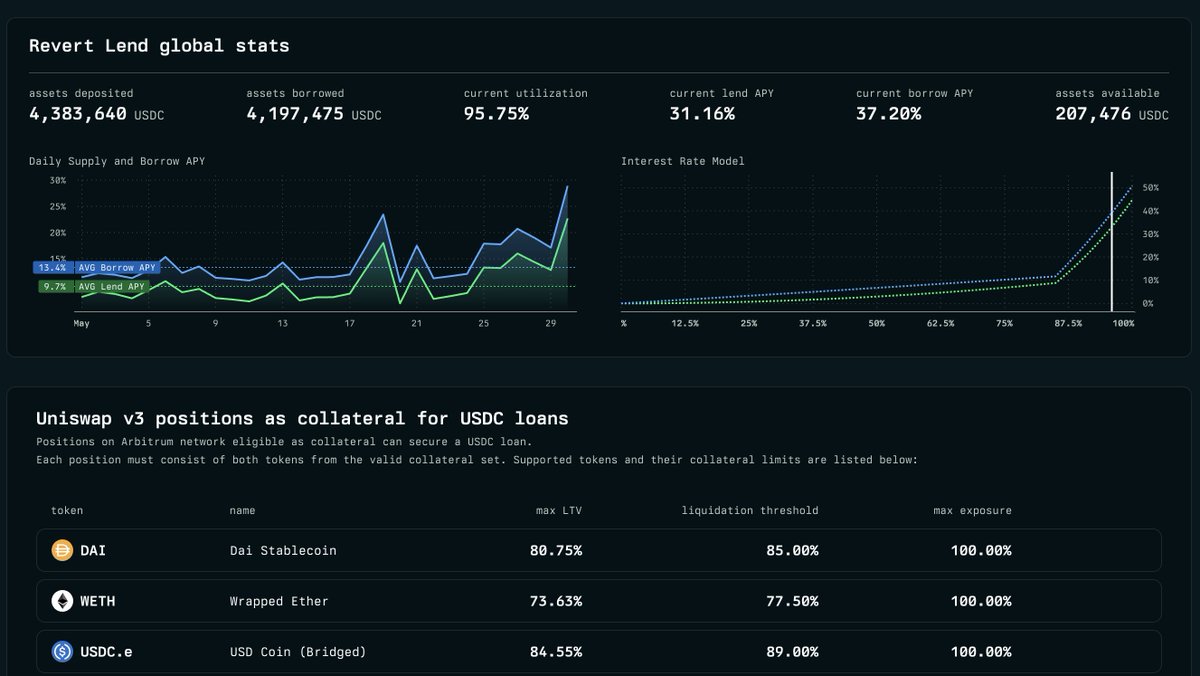

🎉 DefiLlama.com now tracks revert Lend on Arbitrum! 💧 Decentralized lending for Uniswap v3 Liquidity Providers. 💸 Use your Uniswap Labs 🦄 v3 positions as collateral to borrow ERC-20 tokens. 🔽 VISIT revert.finance #ARB_UNIVERSE

🐇 Introducing ChainHopper: A One-Click Cross-Chain Uniswap LP Migration Tool! Move your Uniswap v3/v4 LP positions between EVM chains with a single transaction. No more manual steps, no more waiting. Built with support from Uniswap Foundation 🎉 Let’s dive in ⬇️